Navigate

Article List

- Editorial

By Albert Cheng, CEO, SBMA

- SBMA News

By Albert Cheng, CEO, SBMA

- India’s Surge in Gold Imports: Optimism or Speculation?

By Srivatsava Ganapathy, CEO, Eventell Global Advisory

- India to See Strong Uptick in Jewellery Demand

By Chirag Sheth, Principal Consultant, Metals Focus

- Renminbi Internationalisation and its Effects on Gold

By Chinese Gold and Silver Exchange

- Thailand’s Gold Market: An Introduction

By SBMA, with contributions by Ross Andrew Friedman

- Thailand’s Crucial Role in the ASEAN Gold Market

By Nuttapong Hirunyasiri, CEO, MTS Gold Group

- Thailand: Gold Provides Liquidity Amid Pandemic

By Pawan Nawawattanasub, CEO, YLG Bullion International

- #SilverSqueeze – What Actually Happened and Why it Didn’t Work Out as Planned

By Brian Lan, Managing Director, GoldSilver Central

- Japan Exchange Group: Reinventing Japan’s Precious Metals Derivatives Market

By Ryoichi Seki, General Manager, Business Development, Osaka Exchange

- Gold Investing in a Digital World

By Kerry Stevenson, Founder, Gold & Alternative Investments Conference

Article List

- Editorial

By Albert Cheng, CEO, SBMA

- SBMA News

By Albert Cheng, CEO, SBMA

- India’s Surge in Gold Imports: Optimism or Speculation?

By Srivatsava Ganapathy, CEO, Eventell Global Advisory

- India to See Strong Uptick in Jewellery Demand

By Chirag Sheth, Principal Consultant, Metals Focus

- Renminbi Internationalisation and its Effects on Gold

By Chinese Gold and Silver Exchange

- Thailand’s Gold Market: An Introduction

By SBMA, with contributions by Ross Andrew Friedman

- Thailand’s Crucial Role in the ASEAN Gold Market

By Nuttapong Hirunyasiri, CEO, MTS Gold Group

- Thailand: Gold Provides Liquidity Amid Pandemic

By Pawan Nawawattanasub, CEO, YLG Bullion International

- #SilverSqueeze – What Actually Happened and Why it Didn’t Work Out as Planned

By Brian Lan, Managing Director, GoldSilver Central

- Japan Exchange Group: Reinventing Japan’s Precious Metals Derivatives Market

By Ryoichi Seki, General Manager, Business Development, Osaka Exchange

- Gold Investing in a Digital World

By Kerry Stevenson, Founder, Gold & Alternative Investments Conference

India’s Surge in Gold Imports: Optimism or Speculation?

By Srivatsava Ganapathy, CEO, Eventell Global Advisory

Published on April 10, 2021

SRIVATSAVA GANAPATHY (VATSA) is the CEO of Eventell Global Advisory, which creates industry platforms (physical, digital and hybrid versions) for the commodity sector through path-breaking conferences and industry-relevant research and insights. Eventell provides insights on the global bullion market and industry through its web portal, www.bullionworld.in, and a monthly magazine of the same name.

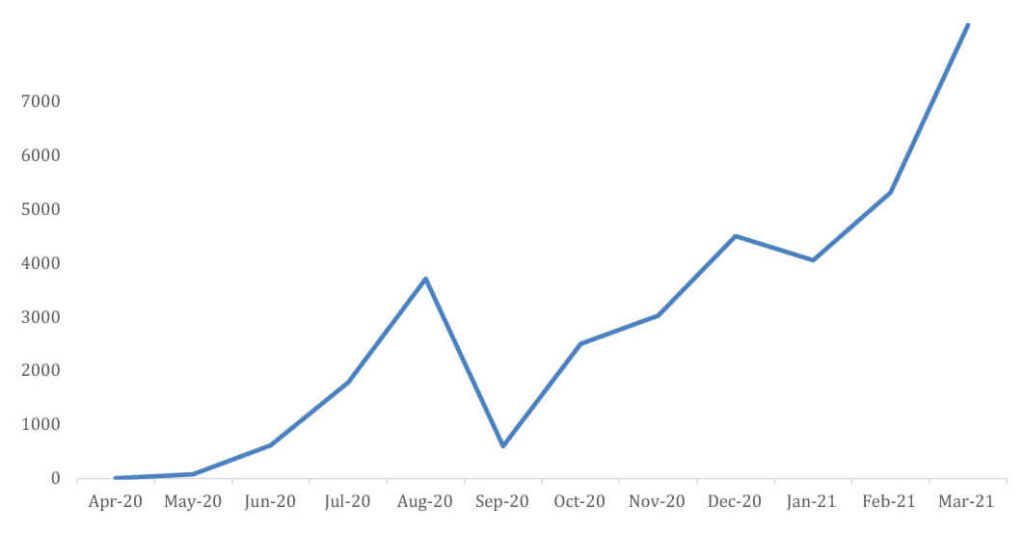

Gold imports into India during March 2021 surged to 160 tonnes*, reaching US$8.4 billion. Between January and March 2021, the country imported 321 tonnes of gold against an import of 115.4 tonnes during the same period in 2020.

Gold imports into India since October 2020 have been on the rise, running up to U$27.7 billion, against a total gold import of US$34.5 billion during FY 2020-21. What are the reasons for the recent spike in gold import? Is it backed by demand revival for gold jewellery or is it a mere speculative build-up?

Low real interest rates

The Reserve Bank of India (RBI) has been following an accommodative monetary policy to facilitate economic growth. This is clear from observing the trends in some of the key rates. For instance, the repurchase rate (also called the repo rate, the rate at which a commercial bank borrows money from RBI against government securities), has been on the decline, from 8% in 2014 to 4% currently. Likewise, the reverse repo rate (the rate at which RBI borrows from banks) and the bank rate (the rate at which banks can borrow from RBI without security) have also been lowered to the current levels of 3.35% and 4.25% respectively. The yield on 10-year Indian government bonds (Chart 2) clearly captures the changes in repo and reverse repo rates. The yield on 10-year bonds touched a low of 5.78% in July 2020, before recovering to the current level of 6.16%. Yields on other Indian government bonds have also fallen.

Demand for physical assets

While inflation based on wholesale price index (WPI) has been kept well under control at less than 2% in recent times (notwithstanding a spike to 4.7% in January 2021), the retail price based inflation numbers have been volatile, moving between 7.5% and 5% during 2020. As a result, real interest rates in India, based on retail inflation rates, were very low for most of 2020. Investors moved away from traditional financial assets such as fixed deposits to physical assets, mainly gold. A steep increase in subscriptions to sovereign gold bonds, assets under management of gold exchange-traded funds, and digital gold during 2020 are proofs of the trend.

Customs Duty Cut

The industry was pleasantly surprised when customs duty on precious metals (both bullion bars and dore) was reduced on February 1, 2021. Accordingly, the effective import duty on gold, silver, platinum and palladium bullion bars was reduced from 12.875% (basic customs duty/BCD of 12.5% + higher education cess/SWS of 3% on BCD) to 10.75% (7.5% BCD + 10% SWS on BCD + 2.5% Agricultural Infrastructure Development Cess/AIDC) of the assessable value. In order to maintain the differential between standard bullion and dore, the customs duty for gold dore bar and silver dore bar was cut to 6.9% from 11.85% and to 6.1% from 11% respectively. It is widely believed that lower import duties will make illegal imports less attractive and promote organised business.

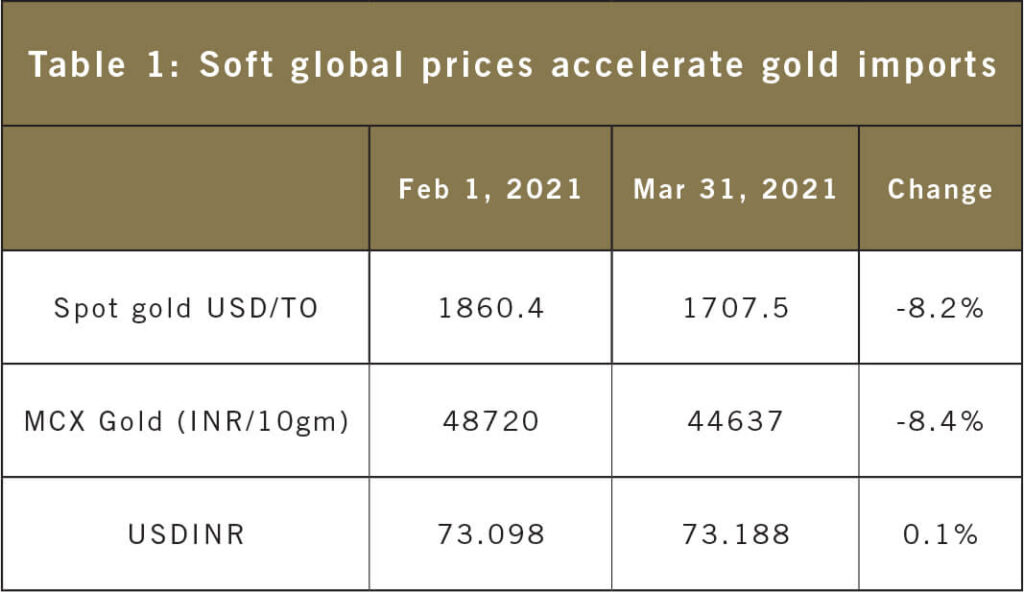

Gold Import Boost

Between February 1 and March 31, 2021 global gold prices slid by 8.2%. Thanks to the stable currency, the price of gold in Indian rupee terms too fell by the same share during the same period. Lower prices accelerated gold imports during the period.

Why is India importing gold now?

India is one of the largest markets for gold jewellery. World Gold Council, India estimates that 55% of the country’s gold jewellery demand is driven by marriage-related purchases. While marriages are held throughout the year, their number increases steeply during certain periods. For the current year, the first marriage season starts in mid-April, and will last for about two-and-a-half months. As such, the upcoming marriage season and the likely increase in marriage-related gold jewellery purchases is one of the reasons for the increase in gold imports.

Second, Akshaya Tritiya is considered as an auspicious occasion for purchasing or gifting gold. The festival, slated for mid-May 2021, is expected to provide another boost to the demand for gold jewellery. The festival is quite a significant demand driver – during pre-covid times, Akshaya Tritiya related gold jewellery sales reached up to 50 tonnes. Besides, the holy month of Ramadan is an important demand driver for gold jewellery.

Third, the conviction that gold is an enduring asset class and valuable is well-entrenched across India, especially among women. Gold and silver jewellery is the only asset that is widely owned by women in India. The sharp decline in gold prices from its peak of 56,000 rupees (US$753) per 10 g in August 2020 to the current level of around 44,000 rupees per 10 g is an excellent opportunity for the public to convert a part of their savings to gold/silver jewellery purchases.

In summary, imports of gold have risen in anticipation of expected increase in marriage-related demand and festival-related purchases of gold jewellery, as well as the decline in the price of gold.

Chart 1: India’s gold import (USD billion) in FY2021

Potential risks

Covid-19 is the most visible risk to gold demand as cases surge across the country, particularly if restrictions on social gathering and non-essential gatherings are reintroduced. Should the second wave of Covid-19 escalate, it could lead to a delay in economic recovery, which in turn would lead to a loss of income. As highlighted by the World Gold Council, demand for gold in India is mainly driven by growth in incomes. So, for demand of gold to grow and sustain, income growth is a pre-requisite.

Policy change is always a risk in the Indian context. Although the current account balance of the government is comfortable at present, a sharp reversal to current account deficit might force the government to review its policies. However, the probability of such an event in the near-term is low.

Chart-2: Government of India 10-year bond yield: Bottomed out?

Summary

A combination of favourable factors – low real interest rates, falling gold prices and a drop in customs duty – has led to an increase in gold imports since October 2020. The annual marriage and festival season is also expected to drive demand for the previous metal. A second wave of Covid-19 is a serious risk, even as the country is accelerating its vaccination drive and hoping to control its spread. The coming two quarters are going to be crucial for the recovery of the Indian economy. Gold’s fortune is closely linked to the growth of Indian economy as bulk of the demand for gold jewellery is linked to income growth. If one assumes stable gold prices and acceleration in economic growth, then one should see continued growth in gold demand doing forward.

SRIVATSAVA GANAPATHY (VATSA) is the CEO of Eventell Global Advisory, which creates industry platforms (physical, digital and hybrid versions) for the commodity sector through path-breaking conferences and industry-relevant research and insights. Eventell provides insights on the global bullion market and industry through its web portal, www.bullionworld.in, and a monthly magazine of the same name.