Navigate

Article List

- SBMA News

By Albert Cheng, CEO, SBMA

- Gold Market Integrity: Advancing Global Standards

By Sakhila M. Mirza, Executive Board Director and General Counsel, London Bullion Market Association (LBMA)

- Shanghai Gold Exchange: Building a Better Future for the Global Gold Market

By Jiao Jinpu, Chairman, Shanghai Gold Exchange

- Feature | WGC – Year in Review

By Andrew Naylor, Head of ASEAN and Public Policy, World Gold Council

- Gold Investments During a Recession: Be Sure of What Lies Beneath

By Gavin Soon, Senior Sales Manager Asia, Hitachi High-Tech Analytical Science

- The Future of the Gold Investor

By Vikas Shenoy, Head of APAC Origination & Partnerships, InfiniGold

- Platinum Set to Soar

By Weibin Deng, Head, Asia Pacific, World Platinum Investment Council

- Further Upside for Precious Metals Prices in 2021

By Nikos Kavalis, Founding Partner, Metals Focus

- Improving Gold’s Physical and Digital Traceability

By Abhinav Ramesh, Founder, Chainflux

Article List

- SBMA News

By Albert Cheng, CEO, SBMA

- Gold Market Integrity: Advancing Global Standards

By Sakhila M. Mirza, Executive Board Director and General Counsel, London Bullion Market Association (LBMA)

- Shanghai Gold Exchange: Building a Better Future for the Global Gold Market

By Jiao Jinpu, Chairman, Shanghai Gold Exchange

- Feature | WGC – Year in Review

By Andrew Naylor, Head of ASEAN and Public Policy, World Gold Council

- Gold Investments During a Recession: Be Sure of What Lies Beneath

By Gavin Soon, Senior Sales Manager Asia, Hitachi High-Tech Analytical Science

- The Future of the Gold Investor

By Vikas Shenoy, Head of APAC Origination & Partnerships, InfiniGold

- Platinum Set to Soar

By Weibin Deng, Head, Asia Pacific, World Platinum Investment Council

- Further Upside for Precious Metals Prices in 2021

By Nikos Kavalis, Founding Partner, Metals Focus

- Improving Gold’s Physical and Digital Traceability

By Abhinav Ramesh, Founder, Chainflux

Shanghai Gold Exchange: Building a Better Future for the Global Gold Market

By Jiao Jinpu, Chairman, Shanghai Gold Exchange

Published on January 12, 2021

JIAO JINPU, Ph.D and researcher of Economics, is the chairman of Shanghai Gold Exchange and a member of the 13th Shanghai Municipal Committee of the Chinese People’s Political Consultative Conference (CPPCC) and deputy director of its Economy Committee. He previously spent nearly 30 years at the People’s Bank of China in a variety of roles covering research and policy formulation on financial reform, monetary policy, financial regulation, inclusive finance and financial consumer protection. He was also the general director of PBC’s Financial Consumer Protection Bureau, and deputy director of its Research Bureau.

In October 2020, Shanghai Gold Exchange (SGE) celebrated its 18th anniversary. Two decades on, SGE has built itself as the engine of China’s gold market, bringing a wide array of products, improved market structure and further liberalization, while serving as a bridge between the domestic and international markets via its Main Board and International Board.

The exchange currently boasts a multi-tiered, full-fledged market system that trades gold, silver, platinum and gold coins, covering market segments including price matching, benchmark price trading, price asking, quote-driven trading, leasing and gold ETFs. SGE has ranked as the world’s largest exchange for physical gold trading for 14 years straight – in 2020, it recorded RMB 43.32 trillion (US$ 6.71 trillion) in trading revenue, with 58,671.55 tonnes of gold and 4,214,652.42 tonnes of silver traded.

SGE’s track record so far has been impressive, and yet challenges are ubiquitous. The coronavirus pandemic has significantly impacted global politics and trade, and its shockwave to the gold market was unprecedented. Against the backdrop of increasing uncertainty in economies and growing turbulence in the financial market, marketplaces in different time zones and regions are highly correlated, and therefore risks in one market, industry or field can easily be transferred to another. In the face of new risks and challenges, no single market could stand aloof. Quite the contrary – only by addressing challenges together through strengthened cooperation can all stakeholders in the market share opportunities for development and create a future with mutual benefits.

Trading Revenue of Gold and Silver on SGE from 2016 to 2020

BLAZING NEW TRAILS

In recent years, SGE has spared no efforts to promote cooperation and connectivity with the international market, sharing the benefits of China’s gold market reform, and bringing mutual development opportunities.

In September 2014, SGE launched the International Board, which has become a vital channel for international players to access the Chinese market. So far, 89 international members and 87 international institutional clients have contributed a total of RMB 17.4 trillion (US$ 2.7 trillion) in trading revenue.

Meanwhile, SGE has enhanced connectivity with major international financial centers and marketplaces in Belt and Road countries over the past six years, as exemplified by the Shanghai-Hong Kong Gold Connect and the Gold Road Project that aims to tap gold industries in Belt and Road countries.

In April 2016, the world’s first RMB-denominated gold benchmark price made its debut, followed by the first RMB-denominated silver benchmark price three years later. By cross-licensing with the CME Group, SGE has successfully introduced the benchmark price into the world’s largest futures gold market with its listing of Shanghai Gold-based futures contracts. Together with SGE-listed NYAuTN contracts, which are based on the COMEX Gold Futures Asia Spot Price and denominated in CNY, the pair of innovative products have provided investors at home and abroad with a convenient way of accessing both markets. Since October 2019, the two products have respectively seen 243.6 tonnes and 241.18 tonnes in trading volume.

ONGOING INFRASTRUCTURE REINFORCEMENT

In its 18 years of operation, SGE has made it a point to continuously improve its infrastructure and market services. Product innovation is on the right track. Seven gold ETFs have been newly listed, and exchange-traded physical gold options and multilateral price asking products are in development. Trading hours have also been extended to better link international marketplaces, and will be further lengthened to cater to market needs. In terms of infrastructure reinforcement, SGE has initiated the development of the 4th Generation of IT system to build a solid foundation for future growth.

Risk management is also high on the agenda. SGE has been working on improving the central counterparty clearing and risk management system in line with the international Principles for Financial Market Infrastructure, and was accredited by the Chinese central bank as a qualifying central counterparty in 2020. Recognition of a third-country (non-EU) central counterparty is underway.

Meanwhile, the exchange has been proactively participating in global market governance. By holding up to the highest international bars, SGE is committed to building a more regulated and scientific “Chinese Standard” while taking into account domestic needs. SGE has been actively engaged in the kilobar standard initiative to provide a fair, fungible and trustworthy physical gold standard to market players. It will also continue its research and cooperation on responsible sourcing so that China continues to be a responsible country in the gold industry.

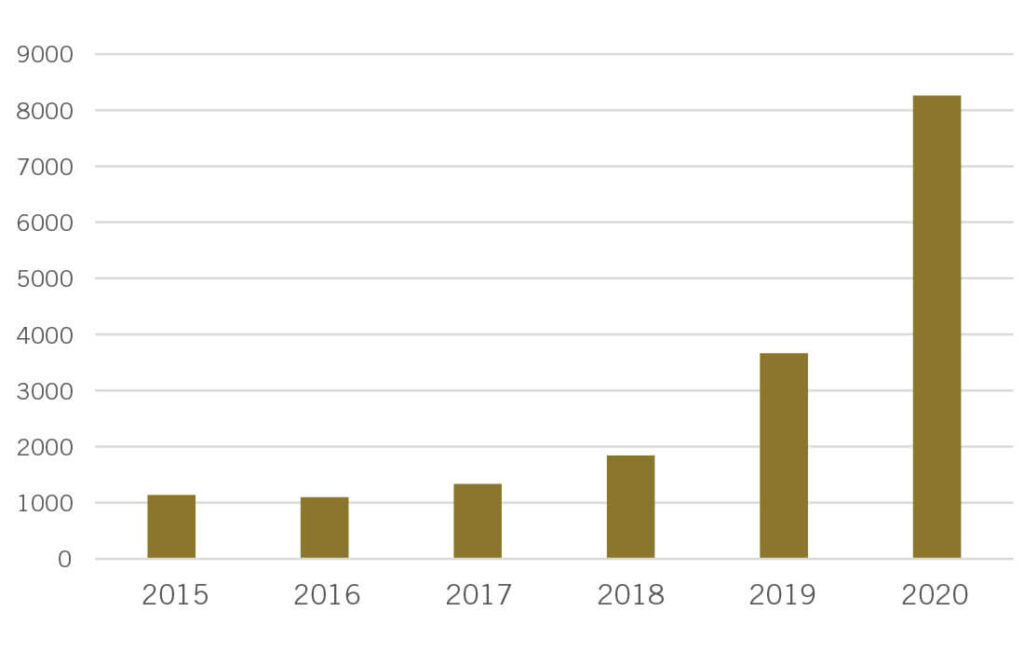

Trading Revenue on SGEI (Unit: Billion RMB)

USHERING IN A NEW CHAPTER

With the pandemic still raging, the international economic and financial situation is even more complicated and volatile with challenges and opportunities ahead. As such, SGE will focus on the following aspects to reinvigorate the market:

- Stick to business innovation. The exchange will offer more choices to the market by stepping up listing innovative products such as price matching options and performance-guarantee price asking contracts, while further exploring more scenarios for the reference of Shanghai Gold and Shanghai Silver benchmark prices.

- Pursue technological advances. SGE is determined to embrace technological innovation in support of technological development in the gold industry. Reinforced IT infrastructure and the application of state-of-the-art digital technology will empower a digitalised and intelligent gold market in the near future.

- Deepen win-win cooperation. China’s 14th Five-Year Plan has proposed the general target of fostering a new development pattern where domestic and international markets can boost each other and building a new economy with a higher level of opening-up. In line with this national strategy, SGE will therefore seek new ways and possibilities to deepen cooperation and dialogue with international marketplaces and institutions in areas of product R&D, business expansion and information sharing.

Today, in the global gold market, all participants are interdependent. We all need to forge stronger communication and cooperation so the industry can collectively tide over challenges, and contribute our wisdom to a better future of the global gold market that will benefit all.

JIAO JINPU, Ph.D and researcher of Economics, is the chairman of Shanghai Gold Exchange and a member of the 13th Shanghai Municipal Committee of the Chinese People’s Political Consultative Conference (CPPCC) and deputy director of its Economy Committee. He previously spent nearly 30 years at the People’s Bank of China in a variety of roles covering research and policy formulation on financial reform, monetary policy, financial regulation, inclusive finance and financial consumer protection. He was also the general director of PBC’s Financial Consumer Protection Bureau, and deputy director of its Research Bureau.