Navigate

Article List

- Editorial

By Albert Cheng, CEO, SBMA

- Hong Kong & China Q1 Market Update

By Jeremy East, Senior Representative for the Asia Region, London Bullion Market Association

- Gold in the Time of Coronavirus

By Nikos Kavalis, Founding Partner, Metals Focus

- Covid-19: Potential Impacts on China’s Economy and Gold Market

By Ray Jia, Research Manager, World Gold Council

- Protecting Your Portfolio Against Covid-19

By Joshua Rotbart, Founder and Managing Partner, J. Rotbart & Co.

- Covid-19’s Impact on Singapore’s Physical Retail Gold Market

By Loh Mun Chun, Director, GoldSilver Central

- A Snapshot of the Indian Gold Market Amid Covid-19

By Prithviraj Kothari, National President, India Bullion and Jewellers Association

- Gold: The Collateral of Last Resort

By Emil Kalinowski, Manager, Metals Market Research, Wheaton Precious Metals International

- Why Investors Should Always Hold a Position in Gold

By Nicolas Mathier, Founder, Global Precious Metals

- Bringing About Traceability to the Gold Industry

By Abhinav Ramesh, Director, Chainflux

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Editorial

By Albert Cheng, CEO, SBMA

- Hong Kong & China Q1 Market Update

By Jeremy East, Senior Representative for the Asia Region, London Bullion Market Association

- Gold in the Time of Coronavirus

By Nikos Kavalis, Founding Partner, Metals Focus

- Covid-19: Potential Impacts on China’s Economy and Gold Market

By Ray Jia, Research Manager, World Gold Council

- Protecting Your Portfolio Against Covid-19

By Joshua Rotbart, Founder and Managing Partner, J. Rotbart & Co.

- Covid-19’s Impact on Singapore’s Physical Retail Gold Market

By Loh Mun Chun, Director, GoldSilver Central

- A Snapshot of the Indian Gold Market Amid Covid-19

By Prithviraj Kothari, National President, India Bullion and Jewellers Association

- Gold: The Collateral of Last Resort

By Emil Kalinowski, Manager, Metals Market Research, Wheaton Precious Metals International

- Why Investors Should Always Hold a Position in Gold

By Nicolas Mathier, Founder, Global Precious Metals

- Bringing About Traceability to the Gold Industry

By Abhinav Ramesh, Director, Chainflux

- SBMA News

By Albert Cheng, CEO, SBMA

Protecting Your Portfolio Against Covid-19

By Joshua Rotbart, Founder and Managing Partner, J. Rotbart & Co.

Published on March 20, 2020

JOSHUA ROTBART is the founder and managing partner of J. Rotbart & Co. Originally from Israel, Joshua joined Malca-Amit in 2010 and led the business development of the logistics group’s flagship vault at Singapore Freeport. In 2013, he moved to the company’s global head office in Hong Kong to develop Malca-Amit Precious Metals, its bullion procurement subsidiary. He left in 2016 to start J. Rotbart & Co.

We are only two-and-a-half months into the coronavirus (Covid-19) crisis, but its economic repercussions are already starting to be felt. As we look to the future, what steps should be taken to ensure financial stability? Gold and precious metals have long been a safe harbor during times of uncertainty like this.

ALTHOUGH COVID-19 HAS NOT BEEN DEEMED A GLOBAL PANDEMIC, THIS DOESN’T MEAN YOU SHOULDN’T START TAKING PRECAUTIONS.

To paraphrase an old saying, when China sneezes, the world catches a cold. And unfortunately, this is turning out to be literally true with the Covid-19 outbreak. Even with quarantines ranging from entire cities to at-risk individuals, we are seeing more and more cases reported worldwide. And while urgent efforts are being made to develop a vaccine and contain the disease’s spread, the impact of this crisis is being felt everywhere.

Even if you live somewhere far removed from Covid-19 patients, it is likely you are also feeling the effects of the virus – at least in your wallet. The Global Preparedness Monitoring Board, comprised of the World Bank and the World Health Organization, estimated that the 2003 SARS epidemic caused a loss in productivity of more than US$40 billion and that a moderate global pandemic could affect GDP by 2.2%, or around US$1.5 trillion. And although Covid-19 has not been deemed a global pandemic, this doesn’t mean you shouldn’t start taking precautions. JP Morgan has already adjusted its forecast for China’s first-quarter growth from an impressive 6.3% down to 1%.

WE DON’T THINK THERE IS AN END TO THE COVID-19 SITUATION THAT WON’T BE WITHOUT SOME FINANCIAL AND ECONOMIC DISCOMFORT.

CHINA’S ECONOMY IS THE WORLD’S ECONOMY

As the world’s second-largest economy, China affects every portfolio, including yours. The situation in China has slowed manufacturing across multiple industries around the world. From automotive to tech, deliveries have decreased or ceased, which will show in bottom lines everywhere. Apple and other companies have already warned about their earnings. This, in turn, may wreak havoc on stock exchanges as other related companies feel the pain.

As companies need to tighten their belts during and after a crisis like this, investors must look to safe havens to protect their portfolios. Gold and other precious metals, such as silver and palladium, are often looked to as a hedge against financial downturns elsewhere.

The local gold market in Hong Kong is quiet and local activity has decreased as consumers prefer to stay home and wait. Same for China – currently demand is not there for gold, or any related products. Having said that, our clients in Singapore and North America are quite active and either increase their exposure to gold or liquidate some of their holdings to materialize profits.

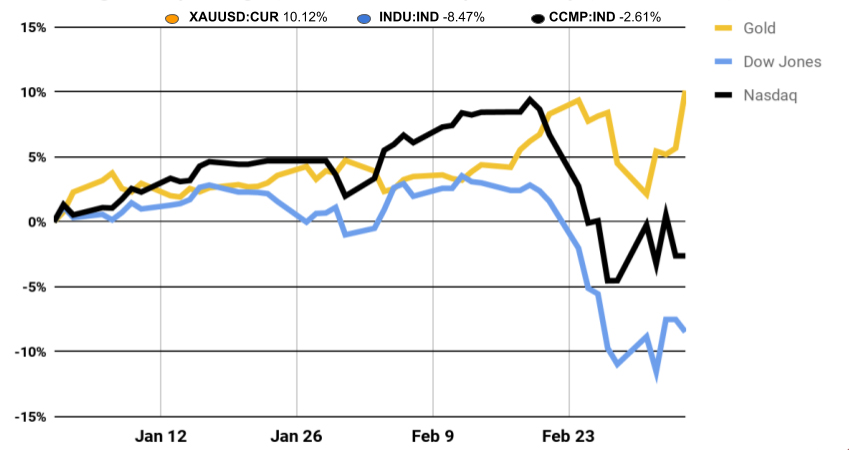

Changes in the price of gold, Dow Jones and Nasdaq from January 1, 2020 to March 6, 2020

PROTECTING YOUR PORTFOLIO AGAINST COVID-19 WITH GOLD

One can see the security of gold from the SARS crisis – gold prices gained 27% at the height of the epidemic, from March 2003 to March 2004. And gold has continued gaining value to this day. As Covid-19 picks up pace, investors have been flocking to this and other precious metals as they try to protect their portfolios, with gold prices reaching record highs in the last few weeks.

Since the first recorded incidents of Covid-19 on December 12, 2019, to March 6, 2020, gold prices have increased 10% from US$1,467 to US$1,681. Comparatively, major equity markets are slipping (see the graph above). This again proves gold’s importance as a hedge against falling financial markets.

If gold prices are so high, why should you buy it? We believe that gold is a safe, long-term investment, during good times and bad. And we don’t think there is an end to the Covid-19 situation that won’t be without some financial and economic discomfort. And we’re not alone. Other analysts believe gold prices may reach as high as US$2,000 or even higher. Nevertheless, with global efforts in place to address Covid-19, we look forward to this health crisis being resolved safely and soon with no lasting negative impacts.

JOSHUA ROTBART is the founder and managing partner of J. Rotbart & Co. Originally from Israel, Joshua joined Malca-Amit in 2010 and led the business development of the logistics group’s flagship vault at Singapore Freeport. In 2013, he moved to the company’s global head office in Hong Kong to develop Malca-Amit Precious Metals, its bullion procurement subsidiary. He left in 2016 to start J. Rotbart & Co.