Navigate

Article List

- Editorial

By Gordon Cheung, Deputy Chief Executive, SBMA

- The Australian Gold Industry, Trade, and Markets

By Thuong Nguyen, Economist, Australian Government Department of Industry, Innovation and Science

- Platinum & Palladium Outlook

By Bruce Ikemizu, Head of Commodities Trading, ICBC Standard Bank, Tokyo Branch

- Our Journey – SBMA’s Humble Beginnings To Our Silver Jubilee And Beyond

By Albert Cheng, CEO, SBMA

- Global Technology With Local Service

By ECO-Mastermelt

- Percolating Market, Policy Risks Point To Weightier Gold Allocations

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- Economic Jitters Fuel Gold Rush

By Finews Asia

- Safeguarding Singapore’s Precious Metals Industry

By Paramjit Singh, Registrar of Regulated Dealers, Director, Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) division, Ministry of Law

- The Added Value

By Jacek Baranowski, International Sales Manager, Metal Market Asia

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Editorial

By Gordon Cheung, Deputy Chief Executive, SBMA

- The Australian Gold Industry, Trade, and Markets

By Thuong Nguyen, Economist, Australian Government Department of Industry, Innovation and Science

- Platinum & Palladium Outlook

By Bruce Ikemizu, Head of Commodities Trading, ICBC Standard Bank, Tokyo Branch

- Our Journey – SBMA’s Humble Beginnings To Our Silver Jubilee And Beyond

By Albert Cheng, CEO, SBMA

- Global Technology With Local Service

By ECO-Mastermelt

- Percolating Market, Policy Risks Point To Weightier Gold Allocations

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- Economic Jitters Fuel Gold Rush

By Finews Asia

- Safeguarding Singapore’s Precious Metals Industry

By Paramjit Singh, Registrar of Regulated Dealers, Director, Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) division, Ministry of Law

- The Added Value

By Jacek Baranowski, International Sales Manager, Metal Market Asia

- SBMA News

By Albert Cheng, CEO, SBMA

Percolating Market, Policy Risks Point To Weightier Gold Allocations

By Bart Melek, Global Head of Commodity Strategy, TD Securities

Published on June 5, 2019

BART MELEK has over 20 years of experience analysing precious/base metals, energy, and financial markets, as well as North American and global economies. He has worked closely with commodity, equity and FX trading desks in Toronto, New York, Chicago, London and Singapore, and has numerous forecasting distinctions and top global rankings to his credit. Bart contributes to the TD Securities strategic view and is a commentator for leading media organizations. Previous to joining TD, Bart was a global commodity strategist and senior economist at another major Canadian bank.

The US Federal Reserve’s recent tilt toward a well-defined dovish monetary policy stance, which pulled rates lower across the yield curve, along with a spike in growth uncertainty and equity market volatility, managed to boost gold prices into a significantly higher trading range in the early part of 2019. But there was no breakout toward $1,400+/oz. The yellow metal hit a high of nearly $1,347/oz in late February and has since been trading in a narrow band either side of $1,300/oz. As such, many in the market are quite dismayed and ponder what it would take to move gold past $1,350/oz in a meaningful way, if a dovish Fed can’t do the job.

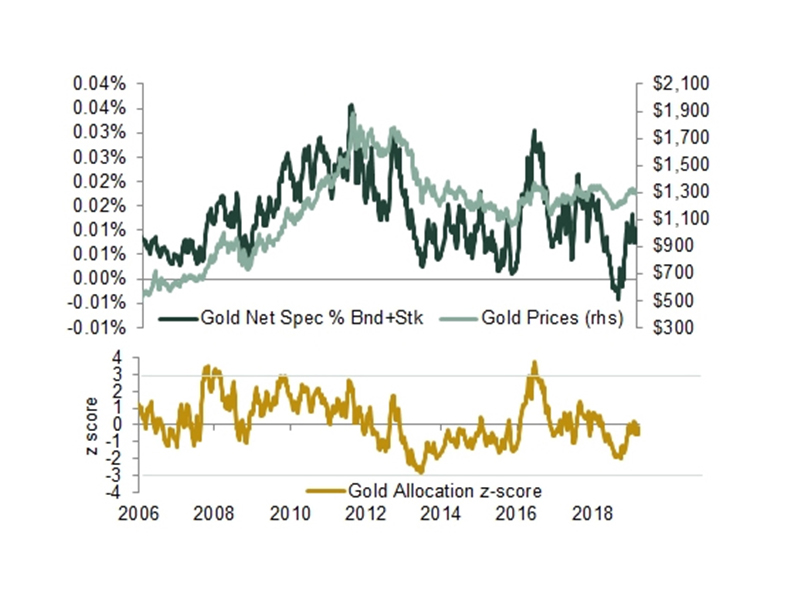

Gold alocations tend to spike as Real rates decline

Current allocations below average for late cycle economy

Despite views that the global economy will trend lower into 2020 and that rates will remain quite low, prices are unlikely to break out higher until there is a meaningful asset allocation rotation into gold by money managers. And for now, a strong dollar and noteworthy opportunity costs of holding zero-yielding assets such as gold, relative to expected equity market returns, serve as meaningful barriers to prevent the required capital inflows that would give gold prices a boost. It can be argued that a lower US rate environment and robust central bank purchases are necessary to support the yellow metal, but are not sufficient to incentivise broad asset allocation changes from the status quo. Before gold reaches escape velocity, which would take prices closer to cyclical highs, investors would need to increase their allocation in portfolios, which remains low relative to historic norms for this point in the economic cycle.

The gold bugs looking for prices to rally will need to be patient and should know it likely won’t take too long for portfolio weightings to start to tilt into gold again, as the pieces necessary for a sustained gold bull run are indeed slowly falling into place. The good news, at least for gold, is that public, private and corporate debt around the world has skyrocketed, the business cycle is maturing, and equity market risks and higher volatility are also in the cards. And, since gold is very much a diversifier and a traditional portfolio hedge, money managers will allocate more gold to their asset mix when opportunity costs relative to dollar-denominated equities fall, correction risks increase and the demand for insurance assets grows.

The increasing market conviction that central banks around the world may again need to take extraordinary measures, such as quantitative easing, when the economy heads south again is more fodder for the view that asset allocations would benefit from a tilt toward hedge assets. The growing idea within political circles that central bank policy has a role to play in developing solutions to social problems, such as income and wealth inequality, also raises concerns surrounding the dollar’s long-term status as a strong reserve currency, especially as Modern Monetary Theory is being discussed in polite society. These are reasons, in addition to equity market performance, which no doubt should prompt investors to show interest in gold as a hedge once risk appetite turns south.

To the extent that gold is a form of portfolio insurance, a higher probability of negative event risk increases insurance premiums, which is typically why asset volatilities may be a signal. Food for thought: the “barbarous relic” is no one’s liability and central banks are already buying it at a rate not seen in five decades, with China disclosing substantial purchases for four months in a row.

TIME FOR GOLD NOT YET RIPE

The same set of factors that have kept investors from loading up on gold over the past several months should serve to keep it in a range-bound trading pattern for now. From our vantage point, much of the lackluster performance has been sentiment and capital flow driven.

This is a trend that is unlikely to be materially reversed in the near-term, now that US equity markets have caught a bid and as recent data points to the US and China’s continued strength.

However, as markets become convinced that the Fed is ready to ease, an expected weaker dollar and a materially slower US growth profile in the latter part of 2019, which should also raise equity correction risks, will also likely skew portfolio allocations away from risk and toward safe havens. This has historically meant a higher gold price as well.

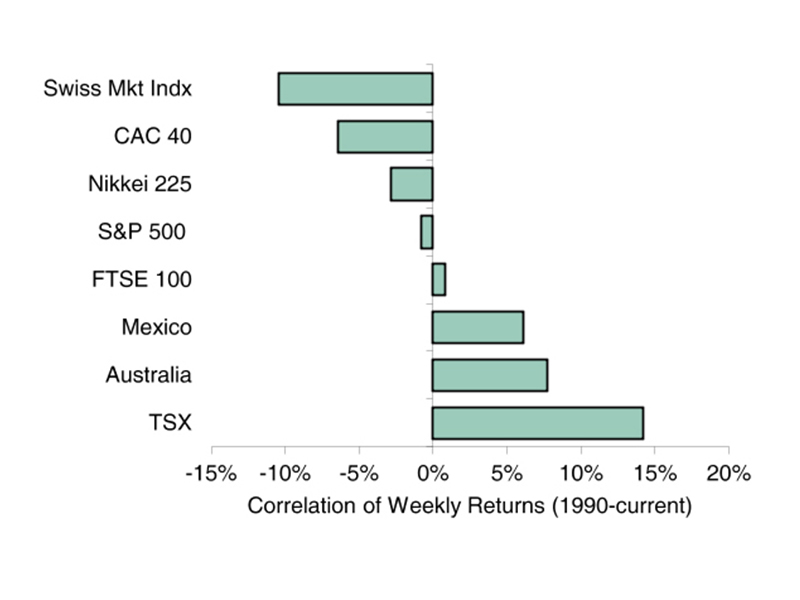

As equity volatility picks up-gold becomes more attractive diversifier

Gold tends to perform well amid equity weakness

Despite views that the global economy will trend lower into 2020 and that rates will remain quite low, prices are unlikely to break out higher until there is a meaningful asset allocation rotation into gold by money managers. And for now, a strong dollar and noteworthy opportunity costs of holding zero-yielding assets such as gold, relative to expected equity market returns, serve as meaningful barriers to prevent the required capital inflows that would give gold prices a boost. It can be argued that a lower US rate environment and robust central bank purchases are necessary to support the yellow metal, but are not sufficient to incentivise broad asset allocation changes from the status quo. Before gold reaches escape velocity, which would take prices closer to cyclical highs, investors would need to increase their allocation in portfolios, which remains low relative to historic norms for this point in the economic cycle.

The gold bugs looking for prices to rally will need to be patient and should know it likely won’t take too long for portfolio weightings to start to tilt into gold again, as the pieces necessary for a sustained gold bull run are indeed slowly falling into place. The good news, at least for gold, is that public, private and corporate debt around the world has skyrocketed, the business cycle is maturing, and equity market risks and higher volatility are also in the cards. And, since gold is very much a diversifier and a traditional portfolio hedge, money managers will allocate more gold to their asset mix when opportunity costs relative to dollar-denominated equities fall, correction risks increase and the demand for insurance assets grows.

The increasing market conviction that central banks around the world may again need to take extraordinary measures, such as quantitative easing, when the economy heads south again is more fodder for the view that asset allocations would benefit from a tilt toward hedge assets. The growing idea within political circles that central bank policy has a role to play in developing solutions to social problems, such as income and wealth inequality, also raises concerns surrounding the dollar’s long-term status as a strong reserve currency, especially as Modern Monetary Theory is being discussed in polite society. These are reasons, in addition to equity market performance, which no doubt should prompt investors to show interest in gold as a hedge once risk appetite turns south.

To the extent that gold is a form of portfolio insurance, a higher probability of negative event risk increases insurance premiums, which is typically why asset volatilities may be a signal. Food for thought: the “barbarous relic” is no one’s liability and central banks are already buying it at a rate not seen in five decades, with China disclosing substantial purchases for four months in a row.

CENTRAL BANKS A PRELUDE TO ASSET MANAGER BUYING

The same set of factors that have kept investors from loading up on gold over the past several months should serve to keep it in a range-bound trading pattern for now. From our vantage point, much of the lackluster performance has been sentiment and capital flow driven.

This is a trend that is unlikely to be materially reversed in the near-term, now that US equity markets have caught a bid and as recent data points to the US and China’s continued strength.

However, as markets become convinced that the Fed is ready to ease, an expected weaker dollar and a materially slower US growth profile in the latter part of 2019, which should also raise equity correction risks, will also likely skew portfolio allocations away from risk and toward safe havens. This has historically meant a higher gold price as well.

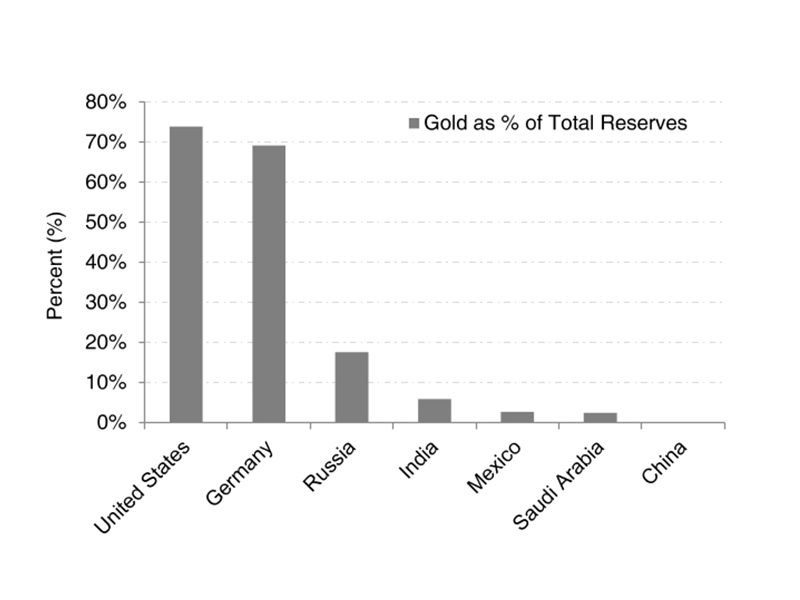

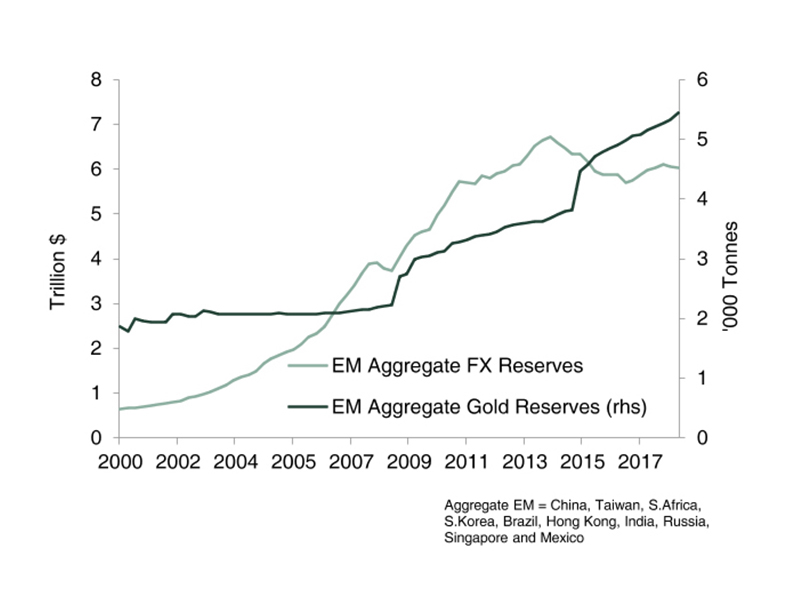

Emerging markets have room to grow gold reserves

Room to increase gold % reserves as central banks move away from dollar

As the world drifts into a multipolar power structure with the US likely sharing its superpower status with China (and possibly with India over the longer term), gold’s reliability, time-tested ability to preserve wealth, and almost universal acceptance makes it a good reserve asset.

After all, unlike all other assets classes, gold is nobody’s liability. The yellow metal is typically considered a hedge against currency chaos, a store of value in a negative real interest rate environment, a robust portfolio diversifier and a hedge against a weaker dollar resulting from excessive fiscal deficits and the potential use of monetary policy to address social goals such as income and wealth inequality.

Overall, given that gold currently makes up roughly 10% of total global reserves, there is plenty of room for it to grow to levels seen prior to the big central bank sales. China, Russia, India, Mexico and other key emerging nations hold only a fraction of their reserves in gold – certainly a much lower proportion than the US, Germany, Italy and France. Since 2014, global central banks have also very likely been reducing their holdings of US Treasuries, diversifying their reserves away from the greenback in favor of gold, euro, yen, and other currencies.

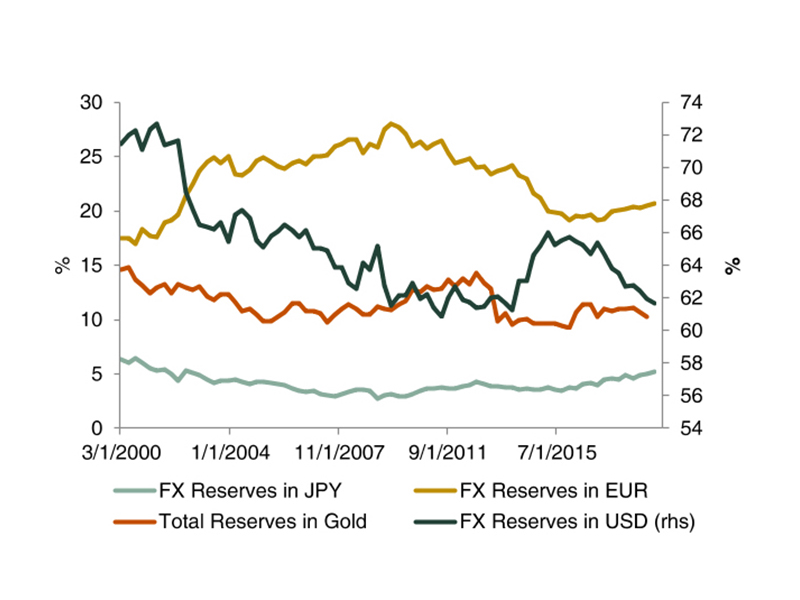

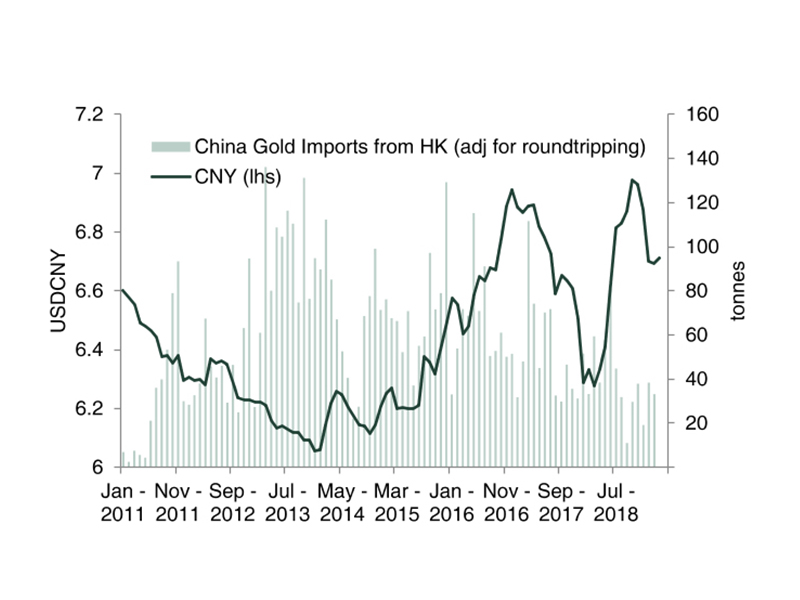

Steadying yuan to see gold purchases recover

As EM reserves recover more gold will be needed

This has occurred in conjunction with a number of bilateral agreements between various nations to carry on conducting trade in currencies other than the dollar, which implies the need for a lower ratio of dollars held by central banks. Based on statements by Germany’s foreign minister, this trend will like be re-enforced going forward as the EU works to free itself from dependence on the US and as it works on developing its own international payments channels, after repeated American weaponisation of the payment system for political ends. The slow shift towards commodity transactions and pricing in other currencies, such as the yuan, along with the increase in global trade outside of the US, are also factors that are likely to hasten the shift away from the greenback in central bank portfolios. Gold could very well benefit from such a shift.

Following numerous critical statements about Fed policy from the White House, many observers are concerned that there will be pressure to make the Fed and other central banks less independent, and that it would potentially become a tool for the Treasury. Colossal US annual deficits, which are quickly approaching $1 trillion, and talk of massive new social, environmental and educational spending programs to address inequality by politicians make this a growing risk. This, of course, would imply low real rates and a lesser appetite for the greenback.

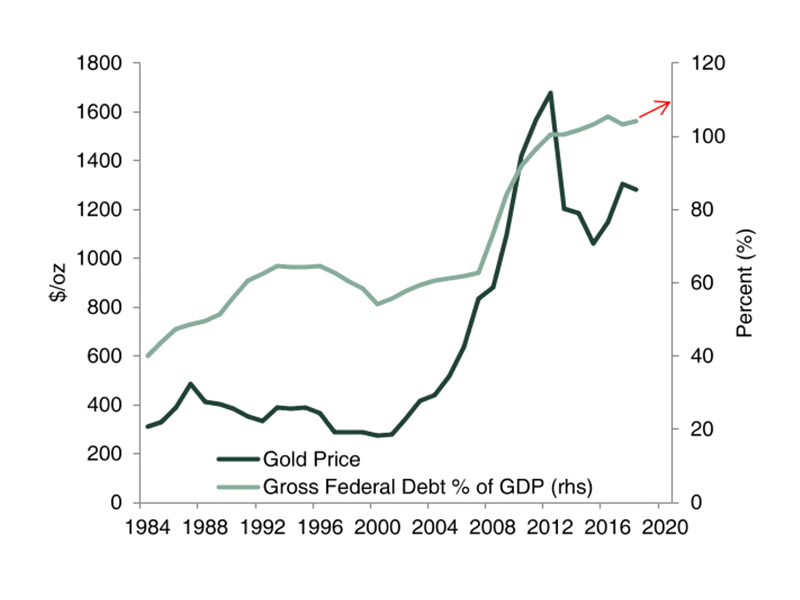

As corporated debt surges central banks exercise caution on rate hikes

US debt growth profile supports gold prices in longer term

PRIVATE PORTFOLIO ALLOCATION TRENDS TO FOLLOW CB LOGIC – BUT EQUITY TRENDS A MORE IMPORTANT DRIVER

The factors that are driving central banks to move away from the dollar and see more gold exposure are also likely to drive asset allocation decisions in the private and pension sectors. The difference between the official sector and other portfolio managers is that equity market performance is very likely to be a determinant for asset managers, while it is not for central banks.

While the potential for a reduced role of the dollar as the world’s primary reserve currency increases the risk for any dollar-denominated investment assets, equity market performance and yields seem to be even more important drivers. The return on stocks and bonds drive the opportunity cost of holding a zero-yielding asset such as gold – the higher the returns from stock and bond portfolios the less appetite for gold there seems to be.

Since the yellow metal has historically been a hedge against currency upheaval, a store of value in a negative real interest rate environment and an effective portfolio diversifier, we are quite certain that investor interest will grow when bond yields slide and equity valuations are perceived to be risky. We expect that all these factors will materialise into 2020.

Given that gold is an effective hedge against the fallout of global currency reshuffling, more demand for the metal as protection has been the case historically – money manager positioning in gold increases during times of crisis. There is a very well defined inverse gold-dollar relationship, suggesting the yellow metal can also serve as a hedge against a dollar decline.

As the current expansionary cycle grows increasingly long in the tooth and the flat yield curve looks ripe for inversion at any time, the significant risk of a sharp slowdown or recession will no doubt drive real rates lower. Central banks tend to drive rates into negative territory to simulate aggregate demand when the expansion becomes weak and at risk of turning over.

Given that the US economy is running out of its trillion dollars’ worth of fiscal fuel into 2020, the world is carrying record debt levels and with the global economy growing at lower rates, interest rates are not likely to increase much. This, in addition to a very high debt-carry ratio in the corporate sector, suggests the economy has a large degree of interest rate elasticity. As such, when easing becomes necessary again, and given the fact that rates are already low, the Fed may need to go to the zero bound and QE quicker than the last time around.

During periods when real interest rates are low or negative, owning bonds to maturity can lead to long-term value destruction, as nominal rates are insufficient to compensate for inflation. Historically, gold, which is a zero-coupon asset, has been a good store of value during such times – the opportunity cost drops and value of insurance assets rises given the disruption in financial markets when growth slows.

Following the Great Recession, the Fed and other central banks around the world engaged in an effort to reflate the global economy by pushing interest rates below the rate of inflation. The goal was to stimulate nominal GDP growth to the point that it exceeds the growth in debt, driving the total debt/GDP ratio lower by eroding purchasing power.

Gold should provide investors with a means of maintaining purchasing power as nominal rates are kept below inflation. Our analysis shows that the price of gold has been inversely correlated with the dollar and largely negatively correlated with stocks and interest rates. This makes gold an accretive addition to a portfolio of stocks and bonds as it may help lower overall portfolio volatility and increase returns.

As such, a higher weighting of the yellow metal in a portfolio can help to buoy a portfolio’s value during bear markets. Conversely, the downside is that it may attenuate portfolio returns during bull markets, explaining why current allocations are low and why performance has been lackluster at best. The recent strength in equities makes it expensive to hold gold in terms of opportunity cost.

The metal has in the past proved to be a highly effective portfolio diversifier that helps reduce volatility when added to a portfolio of stocks and bonds. Money manager positioning data supports this hypothesis. Considering the balance of risks for equity markets is tilting towards a correction and away from another substantial bull run, with some market participants arguing that stocks are grossly overvalued in many markets and that the dollar is poised to weaken going forward, there will be increasing motivation to increase gold’s relative weighting in order to outperform.

BART MELEK has over 20 years of experience analysing precious/base metals, energy, and financial markets, as well as North American and global economies. He has worked closely with commodity, equity and FX trading desks in Toronto, New York, Chicago, London and Singapore, and has numerous forecasting distinctions and top global rankings to his credit. Bart contributes to the TD Securities strategic view and is a commentator for leading media organizations. Previous to joining TD, Bart was a global commodity strategist and senior economist at another major Canadian bank.