Navigate

Article List

- Launch of Metals Focus’ Gold Focus 2018

By Nikos Kavalis, Director, Metals Focus

- Myanmar: Gold’s Last Frontier

By Khin Maung Han, Chairman, Myanmar Gold Development Public Company

- Will Bitcoin Replace Gold as a Modern-Day Safe Haven?

By Avtar Sandu, Senior Commodities Manager, Phillip Futures

- Why Gold is More than an Insurance Asset

By Wayne Gordon, Executive Director, Chief Investment Office, Wealth Management, UBS

- The Economics of Bitcoin and Gold

By Jan Kursawe, Crypto Economist and Financial Analyst, Vaultoro.com

- Democratising Access to Gold

By Robin Lee, CEO, HelloGold

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Launch of Metals Focus’ Gold Focus 2018

By Nikos Kavalis, Director, Metals Focus

- Myanmar: Gold’s Last Frontier

By Khin Maung Han, Chairman, Myanmar Gold Development Public Company

- Will Bitcoin Replace Gold as a Modern-Day Safe Haven?

By Avtar Sandu, Senior Commodities Manager, Phillip Futures

- Why Gold is More than an Insurance Asset

By Wayne Gordon, Executive Director, Chief Investment Office, Wealth Management, UBS

- The Economics of Bitcoin and Gold

By Jan Kursawe, Crypto Economist and Financial Analyst, Vaultoro.com

- Democratising Access to Gold

By Robin Lee, CEO, HelloGold

- SBMA News

By Albert Cheng, CEO, SBMA

Launch of Metals Focus’ Gold Focus 2018

By Nikos Kavalis, Director, Metals Focus

Published on April 17, 2018

Nikos Kavalis is a founding partner of Metals Focus. He has over 14 years of experience working as a metals analyst/strategist for the Royal Bank of Scotland in London and as a metals analyst for GFMS. Nikos holds a BSc in Econometrics and Economics from the University of York and MSc in Econometrics and Mathematical Economics from the London School of Economics.

In early April, Metals Focus launched Gold Focus 2018, its flagship annual publication on the gold market. The report features comprehensive historical supply and demand statistics and a detailed 2018 forecast. It was launched at four events, in London, Toronto, Dubai and Mumbai; a follow-up event is scheduled in Singapore on 25 April.

Looking at some of the main findings of the publication, following a good December run, the gold price has moved broadly sideways since the start of 2018. This lack of direction can in turn be blamed on a lack of decisive triggers in the market. Metals Focus believes such range-bound conditions will probably persist over the second quarter of 2018, as conflicting drivers are at play. However, Metals Focus expects gold prices to break higher in the second half of the year, testing $1,450 before the end of 2018.

The range trading that gold is currently facing reflects number of challenges, some of which were also present throughout 2017. First, the vast majority of professional investors are continuing to focus on equity markets, despite the volatility spikes we have seen at times this year. Second, rising bond yields are pushing up the opportunity cost of holding gold. Third, after trending down for much of last year, the US dollar has recently been more resilient. Lastly, ongoing rate hikes by the US Federal Reserve Bank remain a negative factor for gold. Together, these factors are likely to limit gold’s upside in the near term.

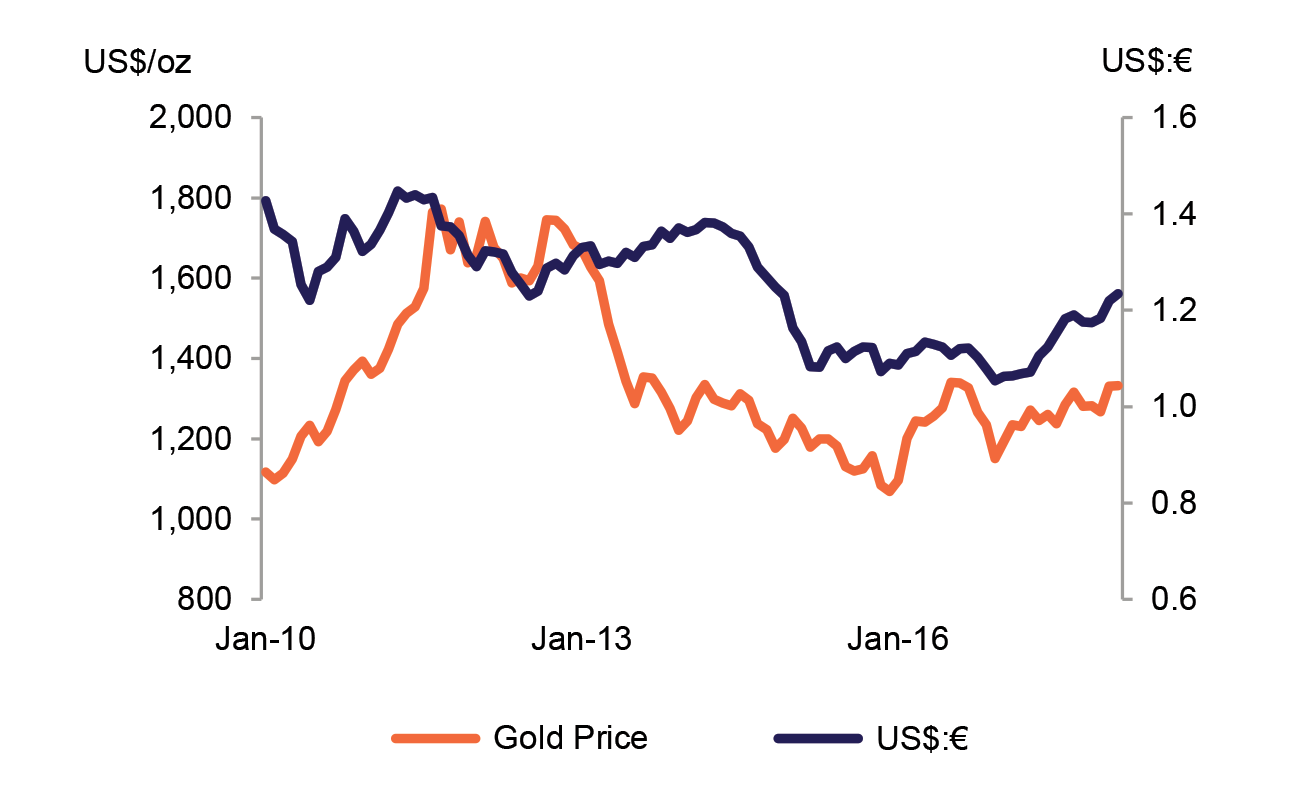

Looking further ahead this year, however, Metals Focus expects that global market conditions will become more positive for the gold price. In part, this is premised on our expectation that the dollar will resume its secular downtrend. Concerns about the ballooning US government debt, the possibility of a further flattening of the US yield curve and expectations of monetary policy tightening in Europe should sooner or later weigh on the US currency. Meanwhile, we believe that the volatility that equity markets experienced in the first few months this year will be an ongoing theme over the rest of 2018, which would eventually also benefit gold. Although at times US interest rate increases may act as a headwind, their impact on the gold price will be limited as they are largely priced in.

In addition to the above, tail-risks will underpin gold, even if they do not actually crystallise. Among these, rising trade protectionism and the possibility of outright trade wars stand out. Geopolitical risks have apparently dissipated, given the recent thawing in North Korea’s relationships with South Korea and the US. However we caution that it is still too early to predict the outcome of Korean talks. Meanwhile, the recent appointment of Mike Pompeo and John Bolton as Secretary of State and National Security Advisor, respectively, point to a growing likelihood that the US will pull out of the Iran nuclear deal, which could unsettle markets.

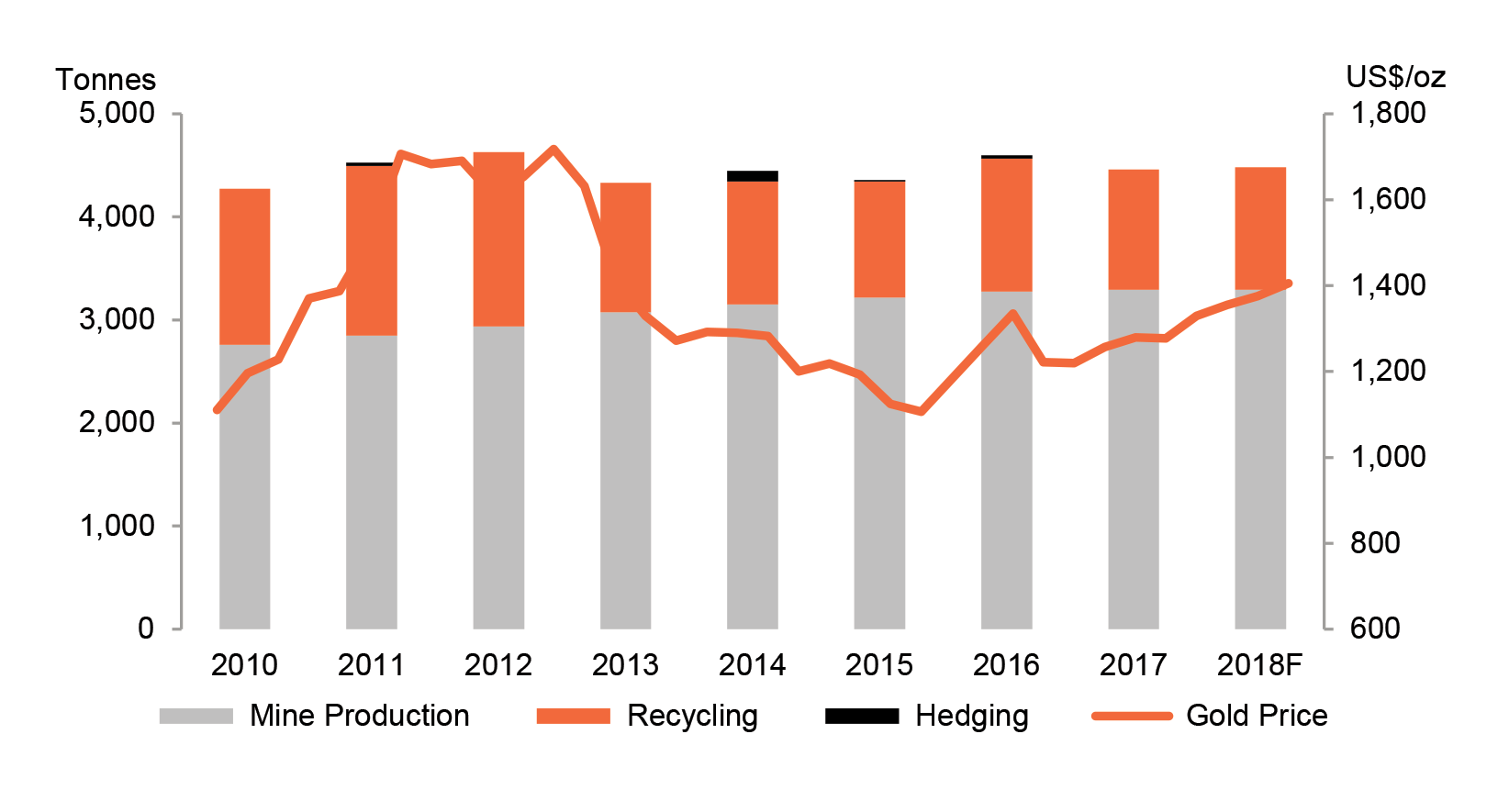

In terms of gold’s fundamentals, Metals Focus expects jewellery fabrication to touch a three-year high in 2018, rising by 2%. Physical investment is also expected to improve, by 4%, while net official sector purchases are projected to decline marginally. Gold mine supply, on the other hand, will mark a decade of growth, edging higher in 2018, albeit by just 0.1%, to a new peak.

Looking at the demand side in more detail, Asia, driven by India and China, is expected to provide much of the fuel for the increase in the global total. The outlook for Indian jewellery and investment remains positive and we expect both to increase by around 3% year-on-year. The former should be boosted by the Indian government’s focus on lifting farm incomes, while the latter should profit from growing risk aversion in the face of the recent correction in local equities. Both should also benefit from a positive outlook towards the rupee gold price.

Moving to China, a healthy outlook for the country’s economy and continued structural changes in the local jewellery industry should result in a further, albeit modest, increase in jewellery fabrication. Premium 999-purity products, 22-carat and 18-carat pieces will continue to spearhead this trend, gaining further market share from conventional products. Meanwhile, we forecast a 7% increase in physical investment, as a result of ongoing portfolio diversification against the backdrop of a limited range of locally available investment opportunities.

Elsewhere across much of Southeast Asia, the outlook for gold demand in 2018 also looks positive. We expect to see gains in jewellery demand in most countries, including Malaysia, Indonesia, Thailand and Vietnam, which all enjoy year-on-year gains within a 3-6% range. Improving economies in local and key export markets underpin these gains and, in some cases, also encouragement from local policy changes. Similar factors should also drive regional physical investment demand, for which we forecast virtually all countries we cover in Southeast Asia to experience gains or at least stability.

Nikos Kavalis is a founding partner of Metals Focus. He has over 14 years of experience working as a metals analyst/strategist for the Royal Bank of Scotland in London and as a metals analyst for GFMS. Nikos holds a BSc in Econometrics and Economics from the University of York and MSc in Econometrics and Mathematical Economics from the London School of Economics.