Navigate

Article List

- SBMA at the Bund Summit 2021

By SBMA

- Platinum’s crucial role in global decarbonisation is driving near-term platinum investment demand

By Trevor Raymond, Director of Research, World Platinum Investment Council

- Alex Stewart International Commissions New Precious Metals Laboratory in Liverpool, UK

By Rob Smith, Business Development Executive, Alex Stewart International

- Highlights from the World Gold Council’s Inaugural Investment Summit in Singapore

By World Gold Council

- Hybrid India Gold Conference 2021

By Bullion World

- Gold Still Has Game – Even as Fed Talks Hawkishly

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- Annual General Meeting 2021

By SBMA

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- SBMA at the Bund Summit 2021

By SBMA

- Platinum’s crucial role in global decarbonisation is driving near-term platinum investment demand

By Trevor Raymond, Director of Research, World Platinum Investment Council

- Alex Stewart International Commissions New Precious Metals Laboratory in Liverpool, UK

By Rob Smith, Business Development Executive, Alex Stewart International

- Highlights from the World Gold Council’s Inaugural Investment Summit in Singapore

By World Gold Council

- Hybrid India Gold Conference 2021

By Bullion World

- Gold Still Has Game – Even as Fed Talks Hawkishly

By Bart Melek, Global Head of Commodity Strategy, TD Securities

- Annual General Meeting 2021

By SBMA

- SBMA News

By Albert Cheng, CEO, SBMA

Gold Still Has Game – Even as Fed Talks Hawkishly

By Bart Melek, Global Head of Commodity Strategy, TD Securities

Published on December 10, 2021

BART MELEK has over 20 years of experience analysing precious/base metals, energy, and financial markets, as well as North American and global economies. He has worked closely with commodity, equity and FX trading desks in Toronto, New York, Chicago, London and Singapore, and has numerous forecasting distinctions and top global rankings to his credit. Bart contributes to the TD Securities strategic view and is a commentator for leading media organisations. Before joining TD, Bart was a global commodity strategist and senior economist at another major global financial institution.

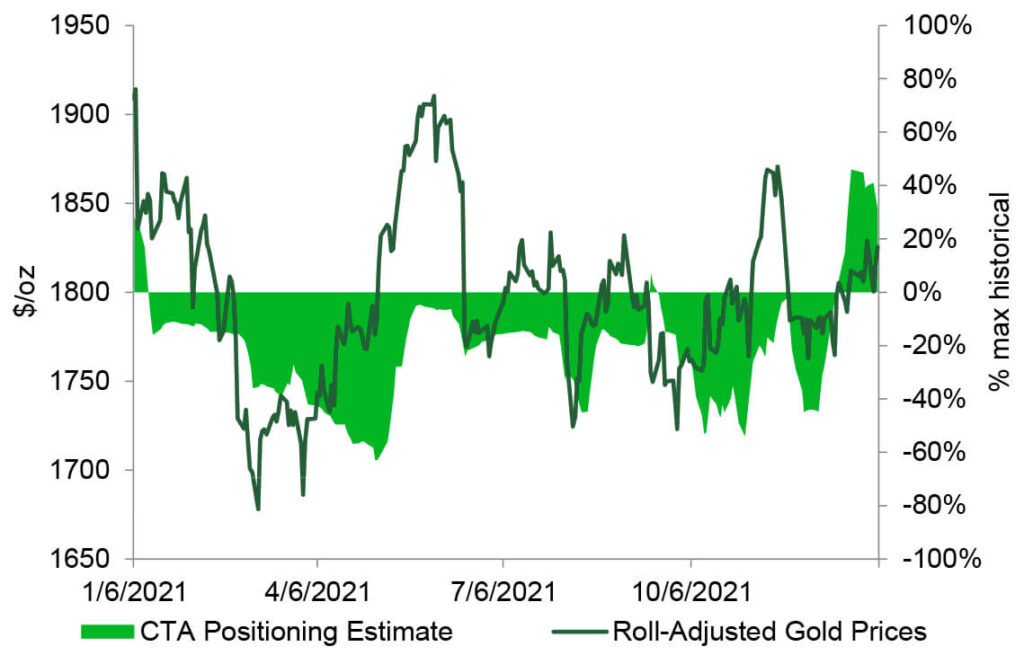

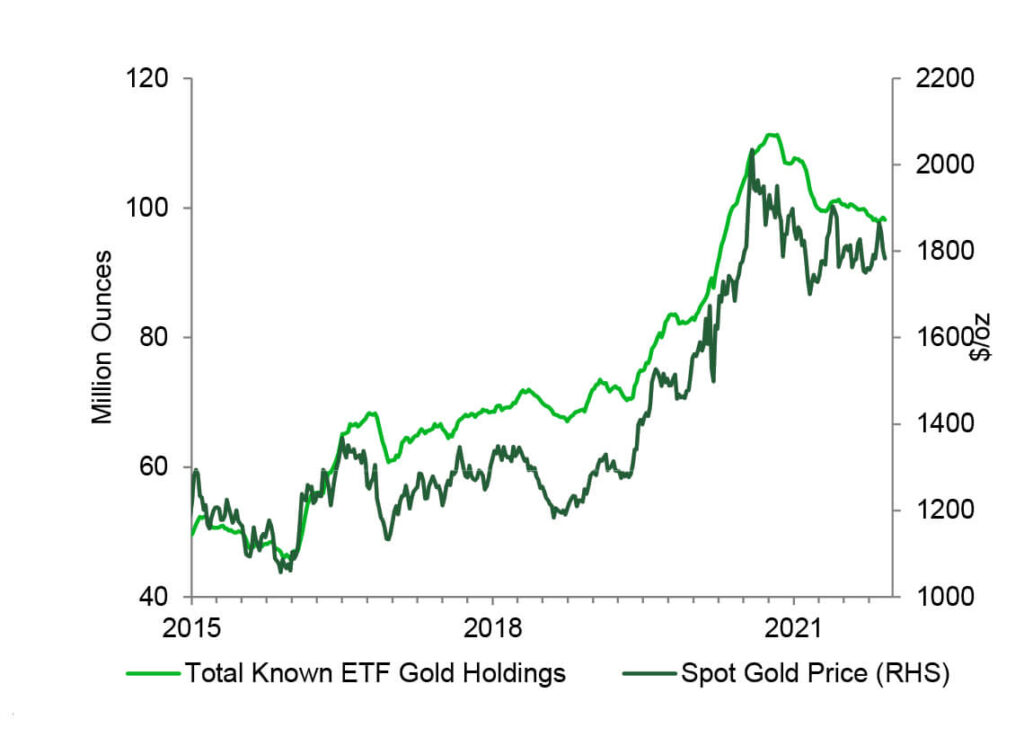

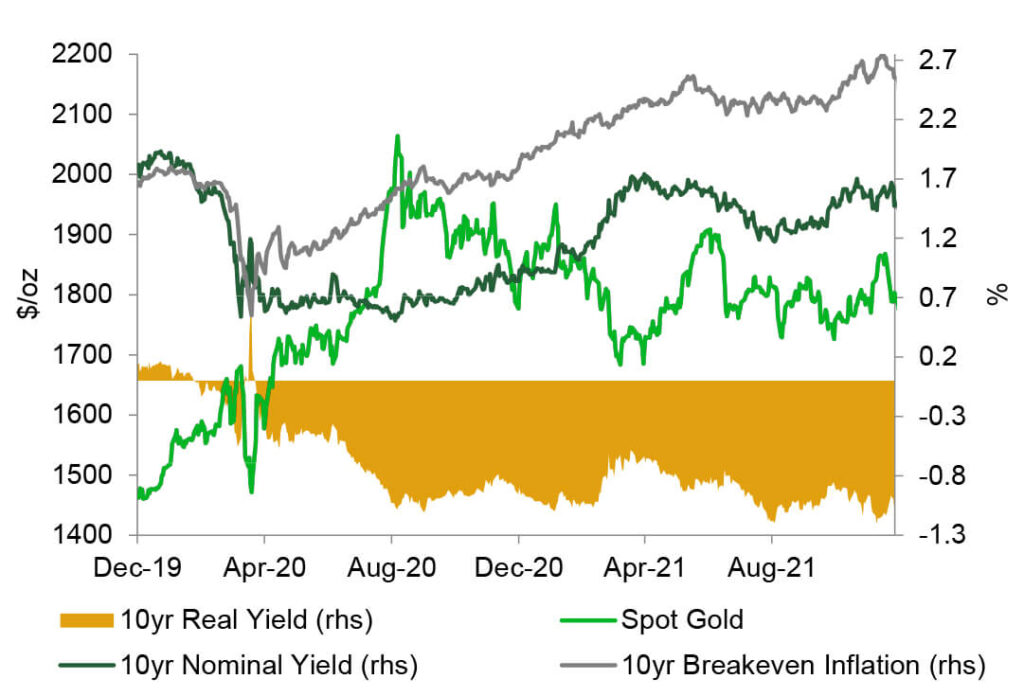

Gold posted a mixed and a very volatile performance in 2021; it moved up to a high of just under $1,960/oz in the early days of 2021, then to a low of $1,677/oz in late-summer, followed by a rally towards nearly $1,875/oz in mid-November, before falling to $1,750s/oz by mid-December. Real interest rate trends, which were driven by inflation expectations, nominal rates and Federal Reserve policy signals, led to this flux. For most of 2021, investor flows in the form of exchange traded fund (ETF) holdings, commodity trading advisor (CTA) and discretionary positioning were very much skewed toward the shortening of exposure, which also helped prices follow a downward trajectory. Indeed, it is expected that the combination of inflation expectations, nominal rates and Federal Reserve policy signals will again determine how gold behaves in 2022.

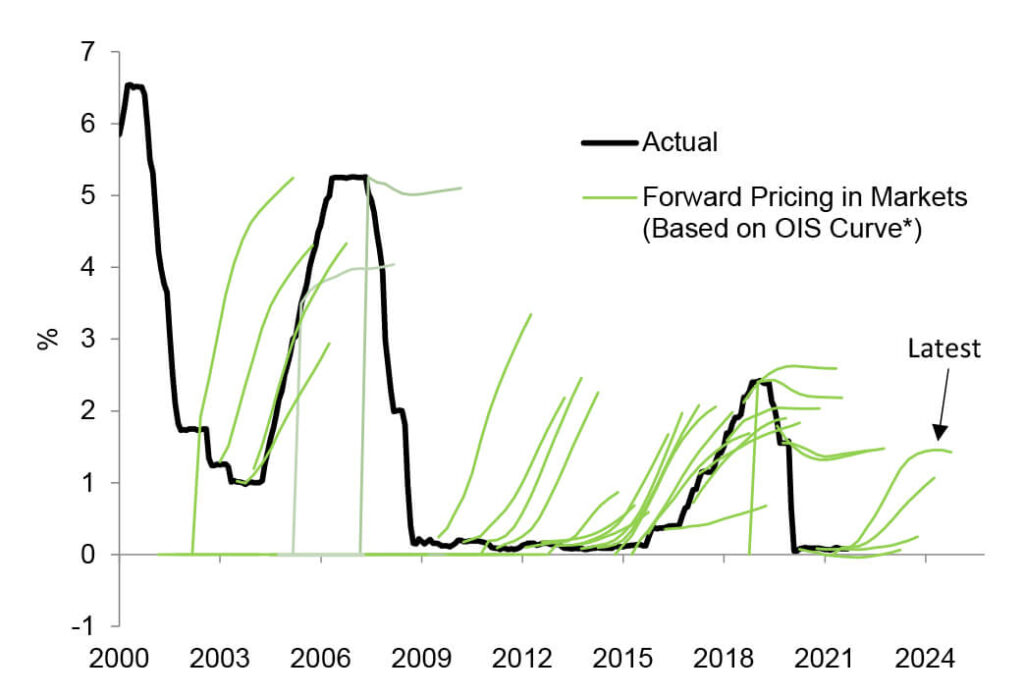

Considering this framework, and the fact that most gold market players are pricing a Fed funds hike as early as March and the possibility of an early balance sheet runoff this year, the current investor bias led to bloated short positions, and has kept prices at around $1,790s/oz. However, while the US central bank may be on track to raise rates, it will still provide an expansionary monetary policy. Central banks continue to buy gold, while investors are looking to diversify given a higher perceived risk of equity market volatility, suggesting that gold speculators’ relative short positioning may still drive the yellow metal materially above the $1,850s/oz in the early months of 2022. But, while negative real rates along the curve should protect gold from a full-blown rout, the yellow metal is projected to trade in the mid $1,600s for parts of H2 2022 as monetary condition keep tightening.

CTA Trend Followers Held Short Tilt on Gold for Much of 2021

While Macro Investors Have Also Shied Away from the Yellow Metal

There is Fed Signalling, Market Perceptions, and Then There are the Facts on the Ground

US President Joe Biden’s announcement that Fed chair Jerome Powell will have his term extended, along with his decision to drop the use of the term “transitory” when speaking about the expected reduction in inflation pressures, are just the most vivid examples of how Fed policy expectations can drive the yellow metal’s price action.

Indeed, prices dropped more than $40/oz on the day, after the news that the more dovishly perceived candidate, Lael Brainard, was not nominated as Fed chair. Also, prices trended lower after the transitory reference received attention, as it was perceived as a hawkish signal. Mr Powell’s decision to speed up the rate of taper from $15 billion to $30 billion and his mention of removing some quantitative stimulus in the latest FOMC Minutes is another case in point on how hawkish policy perceptions worked against gold.

The market is pricing the start of tightening in late Q1, with the dot plots mapping out three 25 bps increases and a balance sheet reduction over the next twelve months. But while Mr Powell recently acknowledge that inflation will stay elevated and pledged to do what’s necessary to contain an inflation surge, he said he will only raise rates over time. This implies that a tightening may start early but be take a gentle form (4 hikes this year), which helped gold to move higher. Policy will respond to data and may turn on a time. Of course, inflationary pressure will need to start slowing down to remove any urgency to control rising prices.

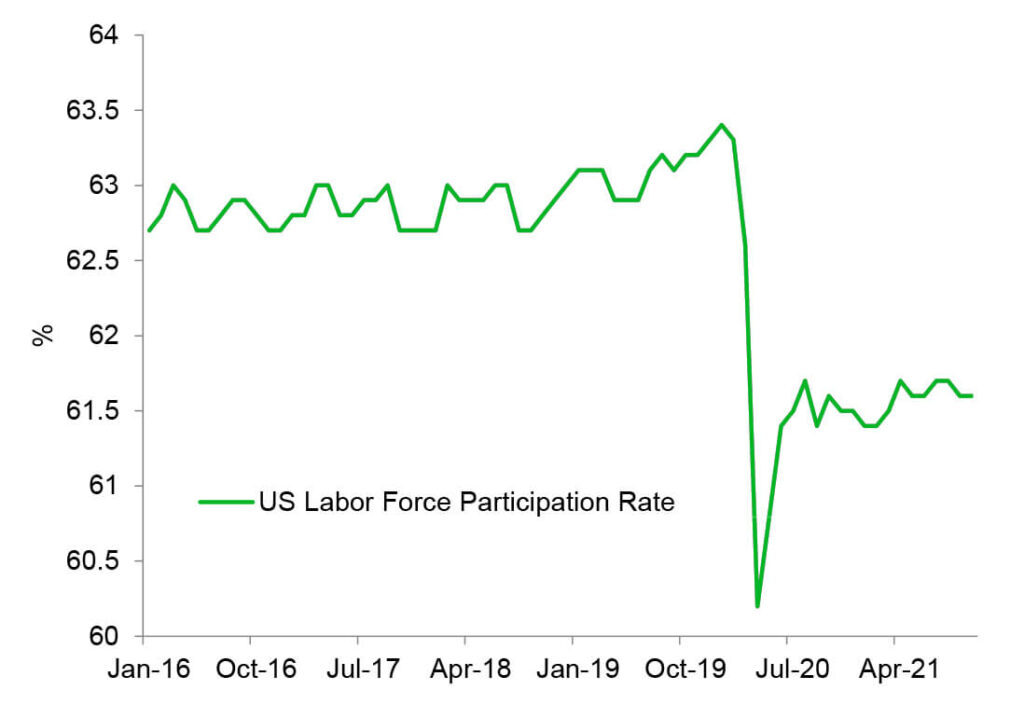

A bonafide restrictive policy may not be in the cards for a while yet. Non-farm payrolls remain some 4 million below pre-Covid levels, participation rates are quite low in the US and the central bank’s policy continues to be skewed toward full employment, despite the hawkish tone. This suggests that the economy may run relatively hot too.

This, the possibility of weakish economic data in the aftermath of the Omicron variant and somewhat less inflationary pressure manifesting deeper into 2022 (as implied by the ISM manufacturing survey recently), along with the lack of strict inflation targeting (an attitude which perceives inflation as transitory, without specifically citing the word), are all factors likely to keep the US central bank from aggressively tightening, as many increasingly expects. This would suggest that there may well be a continuation of the recent short-covering rally in the first few months of the year, alongside long extensions.

Since real rates are likely to say negative despite the “tightening”, gold positioning should tilt in favor of long positions in early-2022, which would be a surprise to many in the market. A CTA fund and technical trader follow up may also materialize, helping this trend. This dynamic is consistent with the precedent for higher prices observed in the immediate pre-Volker era.

Fed Tilt to Full Employment, Need for More Jobs Spells Easy Money for Longer

Are Fixed Income Markets Participants Too Eager to Price In Fed Tightening… Once Again?

Post-Covid Normalisation a Positive

As the economy normalises and moves back to historic consumption patterns, which favour the less inflation-prone commodity-intensive services, the pressure on input costs such as commodities, labor, and logistics, should relax. The base effect is another reason why the transitory argument will remain a reason why the US central bank is unlikely to be in a hurry to get on a restrictive path.

At the same time, post-Covid normalisation may well increase the labor participation rate over time and revere some of the current supply chain problems. The hope is that the resulting higher potential growth may all leave the US central bank comfortable keeping the economy running hot for longer. This would be a gold-accretive real interest rate environment. The best case for gold is elevated, but decelerating inflation, with monetary accommodation removed at only a slow pace.

Remembering that speculative positioning has also been bloated on the short-side of late, and considering that gold has been trading near key technical levels, any delay to the current hike pricing may ignite a short-covering and a technical rally. Political risks associated with the pending US mid-term elections, US fiscal drag, fairly steadfast central bank gold purchases and a significantly slower pace of US and global recovery, are additional factors that may see investors rekindle their interest in gold in early-2022.

In addition, spikes in energy prices this winter may also rekindle yellow metal bulls much sooner than expected, as higher breakevens drive real rates lower, increasing the perception that the US central bank is behind the curve.

Taper Notwithstanding — Gold Can Shine When Rates Don’t Keep Up With Inflation

Fed Behind the Curve a Manna for Gold

Gold is a Unique Asset

Gold is very liquid and scarce, and a luxury good as much as it is an investment. Gold is no one’s liability and carries no counterparty risk. Consequently, it can play a fundamental role in an investment portfolio. It tends to act as a diversifier and a vehicle to mitigate losses in times of market stress. It can also serve as a hedge against inflation and currency risk. Studies (Richard and Robert Michaud) show that a 2-10% allocation in gold can significantly improve portfolio performance.

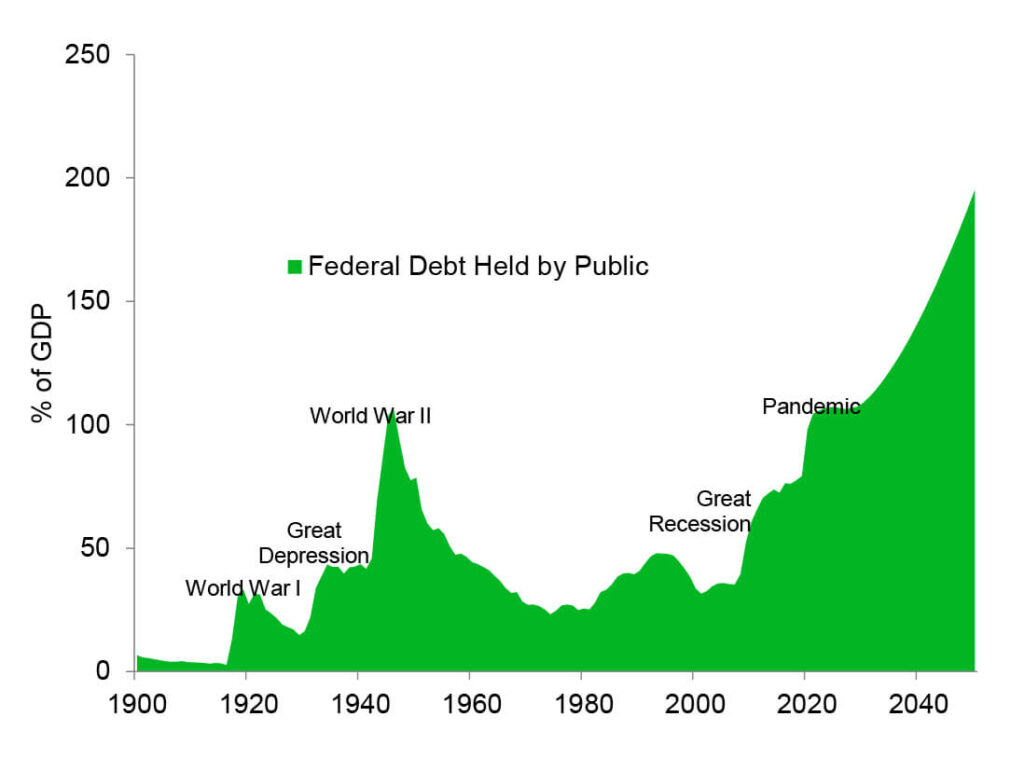

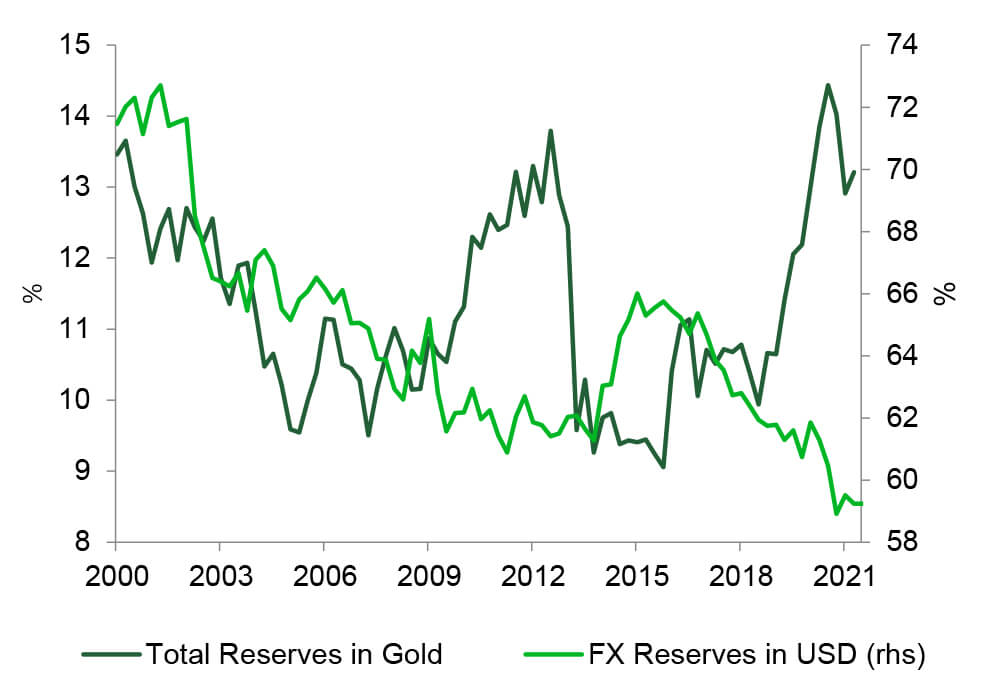

Negative real yields and fear of currency debasement due to sky-high debt and growing central bank balance sheets have prompted central banks around the world to buy record amounts of bullion as a diversifier, which displaces USD holdings in central bank FX reserves. Improving FX reserves along with the post-Covid recovery should also see more gold purchases. Central banks continued to buy gold, and global reserves grew by 69 tonnes in Q3 2021 towards a very large 400 tonnes for the year, by the end of November. We believe this trend will also materialise in the private investment space over time.

However, given that many investors find it difficult to hold long positions in gold (outside ETFs), futures and indexes when monetary conditions are in tightening mode due to higher carry costs and rising opportunity costs, any early-year positives will turn bearish deeper into 2022.

Many gold enthusiasts may turn to mining equity for exposure instead, as these derive most of their value via the long-term expectations of the underlying gold price and have the potential to grow their production. To the extent that the yellow metal will be purchased as protection against fiat currency devaluation and other risks, this implies that USD gold value will rise.

Indeed, it is likely to grow in other currencies as well. Efficient portfolio theory studies suggest that portfolios with gold exposure tend to outperform. While gold has been highly correlated with risk assets such as equities lately, due to the extraordinary monetary policy actions taken by the Fed and other key central banks, over the long-run it has a low or negative correlation to equities, which makes it an attractive hedge. This is the key consideration of why it is a good fit in well diversified and efficiency seeking portfolios.

Pandemic-Fueled Debt Binge Can See Gold Benefit

Dollar Debasement Fears Keep Central Bank Holdings Elevated

Silver’s Industrial and ESG Credentials a Stabilising Force

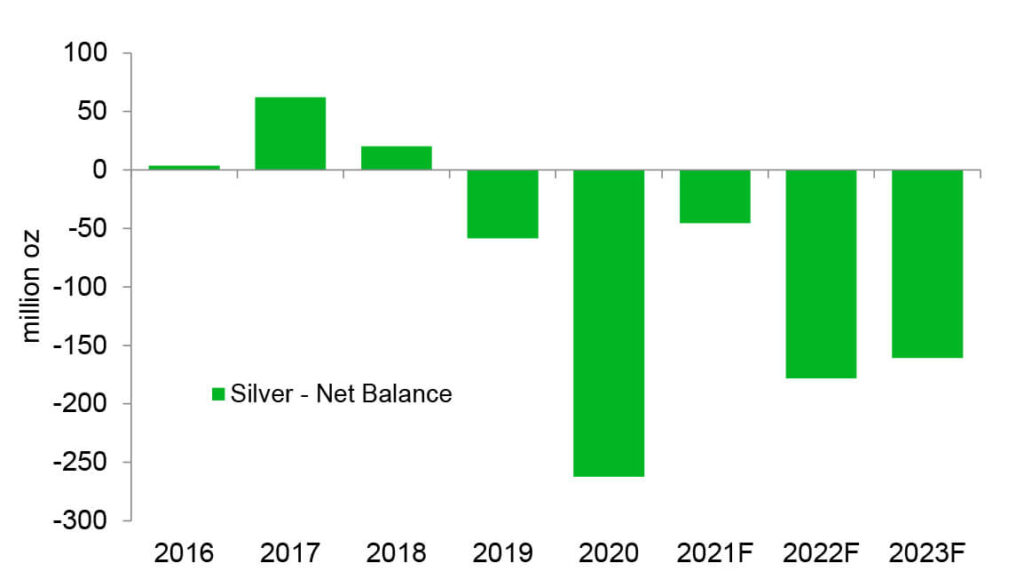

Aside from exchange products, every key area of silver demand is projected to rise this year, with global demand set to surpass the 1 billion ounce mark for the first time since 2015. The recovery in silver industrial demand from the COVID slowdown will see this segment achieve a new high of 530 million oz.

In sharp contrast, following the aggressive social media inspired uptake by ETFs early in 2021, the buying frenzy fizzled as the year unfolded. But the good news is that the enthusiasm spread to more traditional silver investors who continued to build positions through much of 2021.

Despite some weakness on the speculative and derivative investor front, strong industrial demand along with lacklustre supply growth meant that the silver market will once again post a deficit in 2021. With that, silver has been a big outperformer relative to gold over the last year. The 2021 average price of $25.33/oz will be some 24% above the previous year.

The question is: can silver replicate its relative nonperformance in 2022? While we think that silver should be somewhat more insulated from a sharp decline (as has been the case historically), it will likely correct further despite still robust physical investment activity, respectable industrial demand and only moderate supply growth.

An environment which will be dominated by talk of Fed and other central bank tightening, including higher policy rates and possibly QT, it is unlikely there will be sufficient investor confidence to grow long silver exposure needed to generate a sustained rally, negating the upside pressure coming from firm industrial demand and relatively weak supply growth.

Silver Market Set to Post Yet Another Deficit

Investor Appetite Will Play a Key Role for Silver Markets in 2022

H2 2022 Gold Weakness Weighing on Silver Too

As silver has a historical volatility roughly double that of gold, based on historic norms, it should underperform gold when the yellow metal responds to higher real rates in the second half of next year. So, after beating the street in the early months of this year, the white metal may disappoint thereafter. But, the good news is that it will perform better than in previous tightening cycles, as industrial demand will continue to represent an ever-growing proportion of demand into 2023.

At the current 80 gold-to-silver ratio, the white metal is cheap when compared to its relative value to gold over time. In 2022, silver is likely to capitalise on the post-Covid industrial recovery, as over 60% of silver demand comes from industrial sources. Expenditures on photovoltaics used in the production of solar energy, decarbonisation infrastructure, and electrification of vehicles which are more silver-intensive should help demand. The intensity of silver use should continue growing as major global economies’ retooling for net zero is set to be sharply higher over the next decade, starting to materially accelerate into 2022.

Higher Vol Can Harm SIlver When Pecious Metals Environment Turns Bearish

Improved Industrial and ESG Demand Can Insulate Silver from Major Underperformance

Environmental-Driven Silver Demand and Scarcity Some Years Away

Increasing demand for silver in industrial applications, especially those driving the green transformation as the world moves away from CO2 generating fuels, such as photovoltaic cells used in solar panel production, will be something to watch. While still a relatively small share of total demand, representing some 10%, this segment is set to enter an aggressive growth phase in years to come — mainly due to the fact that this energy form is becoming increasingly competitive with traditional CO2 producing energy sources.

Green initiatives under the Biden presidency, the European Green Deal, and China’s 2060 carbon-neutral goal, are all policies which should attract investment ahead of ever tighter conditions and see industrial demand to be well-supported. But that is not a 2022 story for silver.

BART MELEK has over 20 years of experience analysing precious/base metals, energy, and financial markets, as well as North American and global economies. He has worked closely with commodity, equity and FX trading desks in Toronto, New York, Chicago, London and Singapore, and has numerous forecasting distinctions and top global rankings to his credit. Bart contributes to the TD Securities strategic view and is a commentator for leading media organisations. Before joining TD, Bart was a global commodity strategist and senior economist at another major global financial institution.