Navigate

Article List

- Chairman’s Foreword – A look back at 2016 and what’s ahead

By Sunil Kashyap, Chairman, SBMA

- Gold Market Outlook for 2017

By Nikos Kavalis, Director, Metals Focus

- Advancing Islamic Finance Through Gold

By Shaokai Fan, Director, Central Banks and Public Policy, World Gold Council

- Expanding Access to Physical Gold

By Martin Huxley, Managing Director, INTL FCStone

- Feature: Metalor Technologies Singapore Pte Ltd – Meeting Asia’s Precious Metals Demand

By Metalor Technologies Singapore Pte Ltd

- Singapore’s Listed Gold Plays

By Geoff Howie, Market Strategist, Singapore Exchange

- Creating New Markets, Enabling Accessibility: From Traditional to Digital

By Loh Mun Chun, Director, GoldSilver Central

- A Golden Resurgence: Re-establishing Singapore as Asia’s Precious Metals Hub

By Lester Lu, Divisional Director, Metals & Minerals, IE Singapore

- Developments in the LBMA Gold Price

By Matthew Glenville, COO, ICE Benchmark Administration

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Chairman’s Foreword – A look back at 2016 and what’s ahead

By Sunil Kashyap, Chairman, SBMA

- Gold Market Outlook for 2017

By Nikos Kavalis, Director, Metals Focus

- Advancing Islamic Finance Through Gold

By Shaokai Fan, Director, Central Banks and Public Policy, World Gold Council

- Expanding Access to Physical Gold

By Martin Huxley, Managing Director, INTL FCStone

- Feature: Metalor Technologies Singapore Pte Ltd – Meeting Asia’s Precious Metals Demand

By Metalor Technologies Singapore Pte Ltd

- Singapore’s Listed Gold Plays

By Geoff Howie, Market Strategist, Singapore Exchange

- Creating New Markets, Enabling Accessibility: From Traditional to Digital

By Loh Mun Chun, Director, GoldSilver Central

- A Golden Resurgence: Re-establishing Singapore as Asia’s Precious Metals Hub

By Lester Lu, Divisional Director, Metals & Minerals, IE Singapore

- Developments in the LBMA Gold Price

By Matthew Glenville, COO, ICE Benchmark Administration

- SBMA News

By Albert Cheng, CEO, SBMA

Gold Market Outlook for 2017

By Nikos Kavalis, Director, Metals Focus

Published on March 9, 2017

Nikos Kavalis is a founding partner of Metals Focus. He has over 13 years of experience working as a metals analyst/strategist for the Royal Bank of Scotland in London and as a metals analyst for GFMS. Nikos holds a BSc in Econometrics and Economics from the University of York and MSc in Econometrics and Mathematical Economics from the London School of Economics.

Gold prices saw a challenging last few months of 2016, but the first few weeks of 2017 have lent some optimism to the gold bulls. Is the recovery merely a blip, or will gold continue on its upwards trend throughout the year?

Introduction

The dollar price for gold has risen by nearly 7% over the first six weeks of 2017, regaining most of the losses it suffered after the U.S. presidential election. This strong performance partly reflects the simple fact that gold by year-end had been oversold. It has also been driven by some investors that have become more positive towards gold against the backdrop of renewed concerns about the many uncertainties that persist across global markets.

At this juncture, one may wonder if we are in the early stages of a repeat of 2016, when gold rallied over the first six months of the year, following a poor end to 2015. Or is the recent recovery merely a “dead-cat bounce”, as growth accelerates in the U.S. and monetary policy tightens, resulting in renewed weakness for the metal? Metals Focus’ house view favours the former scenario; we see gold trending upwards throughout the rest of this year.

Macro backdrop remains positive towards gold

The reasoning behind this constructive stance towards gold rests on our view that most of the positive factors that helped its price in 2016 should continue to prevail through to the end of 2017 and likely beyond.

Most of the positive factors that helped gold’s price in 2016 should continue to prevail through to the end of 2017 and likely beyond.

First and foremost, we believe that real shortterm U.S. interest rates will remain negative for some time to come. Whether there are two or three policy rate hikes this year by the Federal Reserve, when adjusted for inflation, they will almost certainly still be negative throughout, given current levels of inflation and their likely, albeit modest, increases in the months ahead. Looking at longer-term yields, we believe that any further increase will be modest and will fall short of investors’ expectations. Elsewhere, real, and in some cases even nominal, rates are negative across most reserve currencies.

Meanwhile we are not convinced about the optimism that has emerged towards the Trump administration’s fiscal aspirations. While a combination of lower taxes and higher spending on infrastructure and military would no doubt be beneficial to the U.S. economy, the only way to achieve this would be through higher deficits. Debt levels in the U.S. are already elevated, and according to Congressional Budget Office projections, are likely to continue rising even without any new legislation being introduced. Furthermore, any fiscal loosening would accelerate the increase in debt, which we suspect would meet some resistance from the traditionally fiscally prudent core of the Republican congress.

With this in mind, we are also not convinced that the recent uptrend in U.S. equity prices is sustainable over the medium-term. Specifically, as we doubt the ability of fiscal policy to fuel an acceleration of U.S. growth, we similarly doubt the ability of earnings to increase sufficiently to justify current or even higher valuations. The risk for a correction, which seems significant, would be beneficial for gold.

Political uncertainty to encourage safe haven interest

2017 also looks set to be a year of heightened political uncertainties. This should also encourage investors to look to gold’s safe haven attributes. U.S. President Donald Trump’s unpredictable and firebrand approach to foreign, trade, as well as internal security policy is a major wildcard. Across the Atlantic, Brexit negotiations, the rise of populism, forthcoming elections across a handful of key eurozone members and the resurfacing of sovereign debt concerns and frictions across the monetary union are all factors contributing to fattening tail risks. Russia’s position in the international arena also continues to be troubling, particularly following the recent escalation of tensions in eastern Ukraine. Finally, ongoing unrest across a number of Middle Eastern countries also continues to pose threats to global geopolitical stability.

2017 also looks set to be a year of heightened political uncertainties. This should also encourage investors to look to gold’s safe haven attributes.

Lacklustre jewellery demand in China and India

While we expect macroeconomic and geopolitical conditions to be supportive of gold this year, the same cannot quite be said of the physical markets (Figure 1). This is due to our expectation that jewellery demand in gold’s two biggest consuming countries, China and India, will continue to face challenges.

Figure 1: Quarterly Global Jewellery Consumption – tonnes

Chinese jewellery demand has been under pressure for some time now. In part this has been due to the country’s economic slowdown and the impact this has had on income growth and, more importantly, consumer confidence. The effect of dramatic gains in property prices on disposable incomes is also partly to blame. In addition, structural changes in Chinese consumer preferences continue to negatively impact gold jewellery.

These include a growing appetite for consumer electronics, preference of brand over material value and changing fashion trends favouring lower cost accessories that can be replaced more frequently and a growing appetite for experiences rather than material items, in particular travel. We believe that these challenges will persist in 2017. Although the scope for further decline is now limited, another year-on-year fall in consumption seems likely.

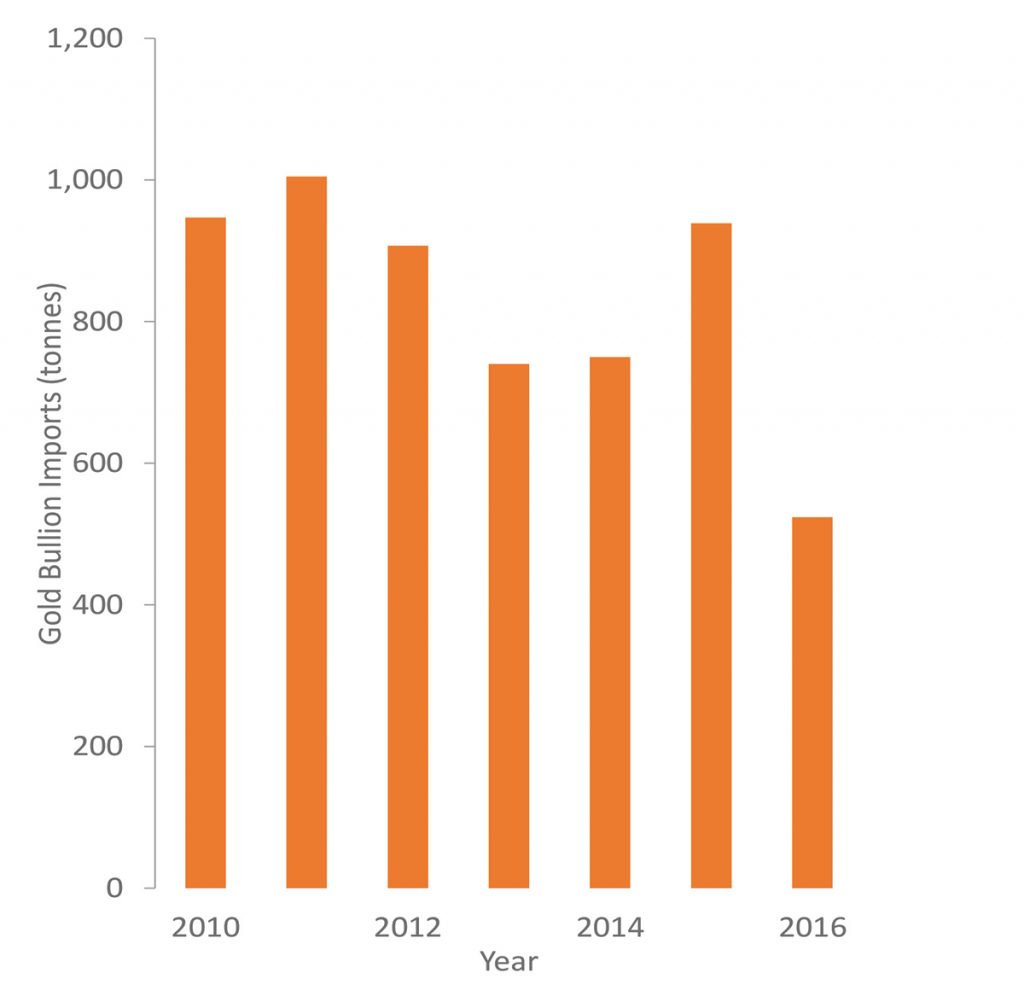

In India, new regulations introduced to clamp down on the country’s black economy weighed on jewellery demand in 2016 (Figure 2). It is unlikely that the exceptional challenges that we saw over part of last year, for instance around the time of the strikes or shortly after the demonetisation, will be repeated.

Figure 2: Indian Bullion Imports

On this basis, we are predicting a recovery in consumption. Having said this, the ongoing regulatory burden on the industry should limit the extent of this recovery.

Mixed outlook across key Southeast Asian markets

Physical demand for jewellery and investment products should fare better as a whole across Southeast Asia. However, this hides mixed results that we forecast for different countries in the region.

Starting with Thailand, the domestic economy experienced a temporary slowdown during the period of mourning for the death of King Bhumibol Adulyadej, but quickly recovered after November. The outlook for this year seems positive, which should support domestic gold investment and jewellery demand (Figure 3). However, local jewellery manufacturers are facing headwinds relating to external uncertainties affecting exports, particularly U.S. trade policy towards Asia Pacific countries and the upcoming elections in Europe.

Figure 3: Thai Gold Bullion Import/Export Volume

It is worth also adding that Thailand Futures Exchange (TFEX) is set to roll out a new physical gold exchange contract in 2017. This is the country’s first spot gold contract quoted in U.S. dollars, aimed at local investors and dealers, as well as potentially those from nearby countries.

Vietnam enjoyed healthy economic growth in 2016 and there are no signs of a slowdown this year. The growing middle class is expected to continue supporting the domestic economy, which should translate into robust growth for gold demand. Demand should also receive a boost from the anticipated easing of gold import restrictions by the country’s central bank and the gradual opening of the market.

In Indonesia, the tax amnesty programme will continue until 31 March and should continue to boost local demand as capital returns to the country. Meanwhile, the government plans to use taxes collected from the programme to boost the domestic economy through an ambitious infrastructure agenda, which in turn should also benefit gold demand. However, the challenges facing Chinese consumption may affect Indonesia jewellery exporters. Elsewhere, the government recently partially lifted the ban on unprocessed ore and semi-processed material shipments.

Singaporean jewellery demand is forecast to see another year of broadly flat performance in 2017. In contrast, given the macroeconomic conditions discussed earlier, bar and coin investment demand should see a healthy increase. Meanwhile, the Singapore Exchange’s Kilobar Gold Contract has recently been designated to be compliant with the newly established Shari’ah Standard for Gold. This potentially opens up the opportunity for interest into the contract from Islamic finance institutions and their clients in the region, particularly given Singapore’s proximity to sizeable Muslim-majority nations.

Singaporean jewellery demand is forecast to see another year of broadly flat performance in 2017. In contrast, given the macroeconomic conditions discussed earlier, bar and coin investment demand should see a healthy increase.

Conditions will be challenging for Malaysian jewellery manufacturers this year, who are suffering from the implementation of a 5% import duty in Dubai, a key export destination. Some offset should emerge from the local currency’s weakness, which should boost the country’s competitiveness. Moving to the domestic market, consumers are now generally used to the GST, implemented on 1 April 2015, and it seems that wholesalers and retailers have been gradually regaining their customers. Both jewellery and investment demand are expected to recover, albeit at a moderate pace in 2017, following post-GST implementation declines.

Nikos Kavalis is a founding partner of Metals Focus. He has over 13 years of experience working as a metals analyst/strategist for the Royal Bank of Scotland in London and as a metals analyst for GFMS. Nikos holds a BSc in Econometrics and Economics from the University of York and MSc in Econometrics and Mathematical Economics from the London School of Economics.