Navigate

Article List

- SBMA News

By SBMA

- Safe Haven Meets Safe Harbour

By Terry Hanlon, President and CEO, Dillon Gage Metals

- Gold in 2023: Factors Influencing its Performance

By Nicholas Frappell, Global Head Institutional Markets, ABC Refinery

- The Recovery of Thai Gold Demand and its Saving Scheme

By Pawan Nawawattanasub, CEO, YLG Bullion Singapore

- Gold to Shine Again

By Chen Guangzhi, Head of Research, KGI Securities (Singapore)

- The One Bank for ASEAN: Shaping the Gold Landscape from Singapore to China and Beyond

By United Overseas Bank

- The Evolution of Central Bank Gold Buying: Reasons Behind 2022’s Record-Breaking Purchases

By Shaokai Fan, Head of Asia-Pacific (ex-China) and Global Head of Central Banks, World Gold Council

- Metalor Technologies’ Commitment to Responsible Sourcing in Precious Metals Industry

By Jonathan J. Jodry, Business Development Director, Metalor Technologies

- Tokenisation Carries more than its Weight in Gold when it comes to ESG

By Anouska Rayner, Head of Growth Commodities, Paxos

- Using Gold ETFs as a Store of Value

By Geoff Howie, Market Strategist, Singapore Exchange Limited

- The Fed’s Dual Mandate, Strong Physical Markets a Mana for Gold

By Bart Melek, Managing Director & Global Head of Commodity Strategy, TD Securitie

Article List

- SBMA News

By SBMA

- Safe Haven Meets Safe Harbour

By Terry Hanlon, President and CEO, Dillon Gage Metals

- Gold in 2023: Factors Influencing its Performance

By Nicholas Frappell, Global Head Institutional Markets, ABC Refinery

- The Recovery of Thai Gold Demand and its Saving Scheme

By Pawan Nawawattanasub, CEO, YLG Bullion Singapore

- Gold to Shine Again

By Chen Guangzhi, Head of Research, KGI Securities (Singapore)

- The One Bank for ASEAN: Shaping the Gold Landscape from Singapore to China and Beyond

By United Overseas Bank

- The Evolution of Central Bank Gold Buying: Reasons Behind 2022’s Record-Breaking Purchases

By Shaokai Fan, Head of Asia-Pacific (ex-China) and Global Head of Central Banks, World Gold Council

- Metalor Technologies’ Commitment to Responsible Sourcing in Precious Metals Industry

By Jonathan J. Jodry, Business Development Director, Metalor Technologies

- Tokenisation Carries more than its Weight in Gold when it comes to ESG

By Anouska Rayner, Head of Growth Commodities, Paxos

- Using Gold ETFs as a Store of Value

By Geoff Howie, Market Strategist, Singapore Exchange Limited

- The Fed’s Dual Mandate, Strong Physical Markets a Mana for Gold

By Bart Melek, Managing Director & Global Head of Commodity Strategy, TD Securitie

Gold in 2023: Factors Influencing its Performance

By Nicholas Frappell, Global Head Institutional Markets, ABC Refinery

Gold in 2023

Gold made a strong start to 2023, making gains of US$220 before reaching a high – as of late April – of US$2,048/oz. This strength took place against a background of tightening central bank policy that might otherwise be expected to drag on gold prices.

The Dollar and Gold

Instead, a secular decline on the dollar that peaked in Dollar Index terms in September 2022 drove a substantial rise in the USD gold price. That Dollar weakness is – in very broad terms – expected to continue through the rest of this year and into next year as markets work on the expectation that US rates have peaked and that the US will be the first major economy to ease. In addition, the broad Dollar cycle pointed to a peak in the latter half of 2022, followed by an extended move lower. So far, the Dollar Index or DXY, has fallen by almost 14% from the September 2022 high. This should provide a solid underpinning to gold’s performance this year.

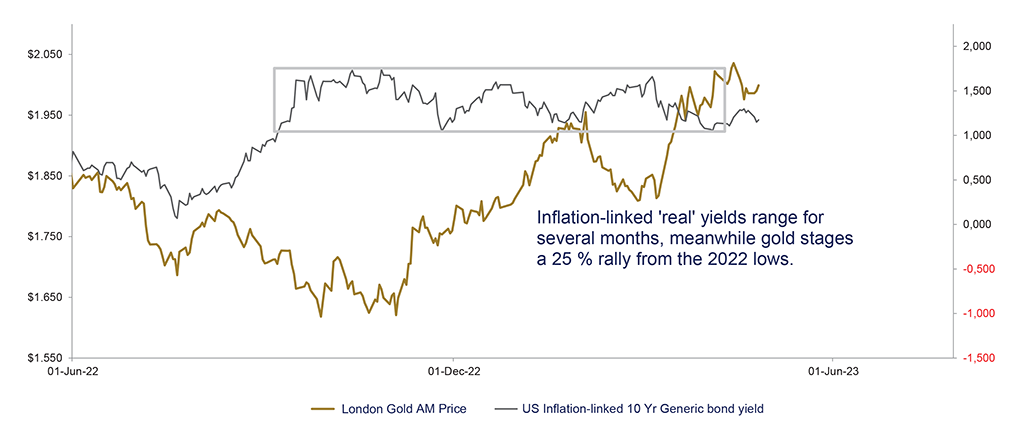

Real Rates and Gold

In contrast to previous years, real rates – or approximations of them – have not been as significant a driving force in gold’s price behaviour or as an explanatory variable for changes in the price. Real yields are significantly higher, yet gold too has risen, and recent range-bound yields have borne less of a relationship with the rising gold price.

Spot gold and 10 year inflation-linked US yields

What might explain this? A plausible answer is that official sector buying took place during a period of rising real rates, which tend to de-couple the long standing and robust relationship between gold price changes and real rates, as modelled via Inflation-linked Treasury notes.

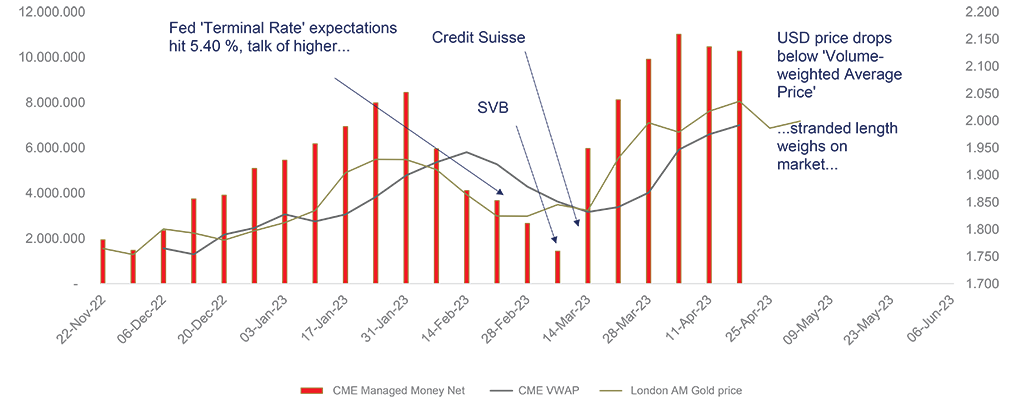

The Banking Sector and Gold

A run on a hitherto not very well-known US bank in Santa Clara led to significant volatility in fixed income combined with fears of systemic risk to the financial system both within America and the Eurozone. The takeover of Silicon Valley Bank (SVB) by US authorities on March 10 led to a substantial downgrading of the expected pathway of policy rates, helping gold rally hard from US$1,810 to US$2,048 in little over a month.

The demise of SVB and a small number of other US banks was followed by real fear over the financial stability of Credit Suisse, a G-SIB or “Global Systemically Important Bank” whose resolution by Swiss authorities has created a postmerger UBS with a balance sheet double the size of Swiss GDP, and perhaps a lifetime of litigation over the treatment of junior bondholders.

CME Net Managed Money position, VWAP and USD price

The fundamental arguments of whether rates have risen far enough to tame inflation and whether Terminal Rates can and should go lower, or whether rapidly rising rates have affected bank stability and financial conditions and need to pause or turn lower, should be one of the defining issues of mid-2023.

THE FED FACES A POTENTIAL TRAP WHEREBY TIGHTENING REMAINS NECESSARY, BUT AT THE RISK OF THE STABILITY OF THE BANKING SYSTEM.

These arguments matter because they drive rates markets and ultimately all asset markets, including gold. The Fed faces a potential trap whereby tightening remains necessary, but at the risk of the stability of the banking system. Or it may face a more benign outcome whereby financial conditions tighten as banks seek to bid for deposits in competition with short-term bills, and this tightening does some of the Fed’s work for it, allowing the FOMC to steer a less restrictive and less risky pathway forward.

We will all know a good deal more about this by the time of publication as the Fed has stated that the impact of interest rate rises on banking stability and financial conditions will be analysed even more closely in May this year.

What can be said is that the round of banking instability that we witnessed in March cannot be said to be over, with some medium and smaller banks facing outflows of depositor funds in the US and similar headwinds in other major economies.

Gold and the official sector

A second question begging for an answer in 2023 is this: how will the official sector act towards gold?

Last year was an astonishing performance as the official sector purchased 1,136 tonnes of gold, with about 850 tonnes falling in the last half of the year alone (WGC, Metals Focus).

As the World Gold Council has pointed out, this figure is an outlier compared with historic data that it is sensible to think that a repeat in a subsequent year is highly unlikely. However, it is worth bearing in mind that all institutions have the capacity for herd-like behaviour, and just as the 1990s demonstrated the extent to which reducing official holdings of gold became entrenched among many central banks, the notable increase in buying in 2022 may herald a trend change in the willingness of the official sector to diversify into gold, particularly as rates pivot and the official sector collectively rebalances their portfolios. Official sector buying in January and February 2023 totalled 158 tonnes, which exceeds the Q1 number for last year.

The two important points here are firstly the importance of the official sector as an important factor contributing to gold demand (24% of total demand last year, according to WGC data) and less importantly perhaps, that for those trying to map out the price of gold, the impact of real rates on the gold price may continue to be somewhat muted, with the dollar and perhaps Crude being more reliable factors in determining gold’s path.

Central bank gold purchases – quarterly, versus daily US 10 yr TIPs yield

Gliding Towards Grey Swans…

In 2023, there are at least two economic “grey swan” – events that are visible to observers and not completely unexpected, but whose timing and impact are difficult to predict. Japan’s exit from Yield Curve Control (YCC) is one such event that “may” be handled smoothly but is more likely to drop another large stone into the world pond of rates and FX, with the potential to affect Japan’s banks and reverberate through both developed and emerging markets.

The second event is the US debt ceiling. The partisan nature of domestic US politics and divided control over both the Lower and Upper Houses are likely to make resolving the ceiling a difficult task. Any delay in resolving the issue will create uncertainty. Currently, 1-month Treasury bills are heavily in demand relative to 3-month bills as money managers fret over bills maturing during the “peak debt ceiling” period.

Importantly for gold, a delay will lead to an increase in the supportive policy measures undertaken by the Federal Reserve. These measures*, such as increasing liquidity, injecting reserves, and possibly ending quantitative tightening (QT) and swinging back to quantitative easing (QE), should be positive for gold.

The paradox for gold and other assets in 2023 may prove to be the disconnect between the overt tightening of policy rates and the provision of substantial amounts of liquidity that act in opposition to one another, with the latter being harder to trace in real-time.

Summary

The expected relative weakness of the US dollar and the possibility of an economic slow-down as both policy and bank conditions tighten suggest a strongly supportive environment for gold.

AT THE TIME OF WRITING, GOLD IS IN A BULLISH TREND ACROSS MEDIUM AND LONGER-TERM TIME FRAMES.

At the time of writing, gold is in a bullish trend across medium and longer-term time frames. Everyone will be acutely aware of the “double top” at US$2,075. A break above that level opens the way for gold to extend (in the longer-term) towards the US$2,400~2,500 levels.

The tense geopolitical backdrop plays to gold’s strengths as a risk diversifier; however, the impact of ongoing tensions is even harder to predict, let alone measure, than all the many other influences on gold.

ABC remains a constant in these challenging markets, with ABC Bullion supplying bars to customers from the LBMA, SGE and CME-accredited ABC Refinery, a cornerstone of the refining sector in Australasia. ABC provides internationally accredited bars, refining services and information on precious metals markets to clients and the rest of the world.

(* minutes of the FOMC Conference Call, October 16, 2013)

Please be advised that this article reflects information as of 28 April 2023, and circumstances may have changed since its writing.