Navigate

Article List

- Editorial

By KL Yap, SBMA

- Metalor Technologies Singapore Pte Ltd – Innovation in Southeast Asia’s Precious Metals Market

By Daryl Low, Founder, CEO, Hydra X

- Singapore-Based Gold Producer Boroo Sets Sights on Growth

By Dulguun Erdenebaatar, Director, CEO, Boroo Pte. Ltd.

- How Long Can The War Support Precious Metals?

By Nikos Kavalis, Managing Director, Metals Focus

- Shanghai Platinum Week: Strengthening China’s Links with the Global PGM Market

By Weibin Deng, Head of Asia Pacific, World Platinum Investment Council

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Editorial

By KL Yap, SBMA

- Metalor Technologies Singapore Pte Ltd – Innovation in Southeast Asia’s Precious Metals Market

By Daryl Low, Founder, CEO, Hydra X

- Singapore-Based Gold Producer Boroo Sets Sights on Growth

By Dulguun Erdenebaatar, Director, CEO, Boroo Pte. Ltd.

- How Long Can The War Support Precious Metals?

By Nikos Kavalis, Managing Director, Metals Focus

- Shanghai Platinum Week: Strengthening China’s Links with the Global PGM Market

By Weibin Deng, Head of Asia Pacific, World Platinum Investment Council

- SBMA News

By Albert Cheng, CEO, SBMA

Asia Pacific Precious Metals Update

By SBMA

The backdrop of increased volatility and uncertainty instability has certainly provided a boost in interest and investment demand for gold, which has seen its safe-haven status reinforced. In a stagflation environment, investors have been looking toward the yellow metal to hedge risk, and the yellow metal has remained near all-time highs.

In his update on the global bullion market, David Tait, World Gold Council (WGC) global Chief Executive Officer (CEO), noted that while gold continues to meet the challenges of an uncertain world, so too must the gold industry. According to Tait, the industry must meet the requirements of modern investors, and there is a need for the industry to adapt to the changing environment and requirements of stakeholders.

“The gold market is not immune to changes in technology. The market should fully grasp opportunities new technologies provide”, Tait said, citing integrity and provenance as issues new technologies can address. He noted climate related risks and opportunities that can impact the gold industry, and highlighted WGC’s efforts to ensure gold is responsibly sourced and produced, and that it meets carbon and environmental, social and governance (ESG) goals.

Tait also said that WGC’s Retail Gold Investment Principles will be formally launched later this year, and a gold investment curriculum will be launched in Singapore before it is rolled out worldwide.

“2022 looks to be another great year for gold in India”, PR Somasundaram, WGC’s regional CEO in India, said in his presentation on the demand for gold in the second largest consumer market globally.

The 85% jump in demand in the fourth quarter of 2021 validated strong socioeconomic role of gold and India’s economic recovery, Somasundaram said, hailing it as an “unprecedented quarter”.

The rebound exceeded expectations, he said, noting that the last time there was such a huge jump was in 2013, on the back of a dropping prices globally. Now, prices are 62% higher than in 2013. The country is seeing continued investment demand among households, with pent-up demand for jewellery, and resumption of festivities, which are typically gold-buying drivers, after almost two years of Covid-related restrictions.

Somasundaram noted that among retail customers, 50,000 rupees per 10g is now an accepted price point – up from 31-32,000 rupees just two years ago. Manufacturing is also “way ahead of demand”, indicating the positive sentiment in the sector, amid an eight-year high in bar and coin demand. The country’s central bank also added 77 tonnes of gold to reserves in 2021 – the largest increase since 2009.

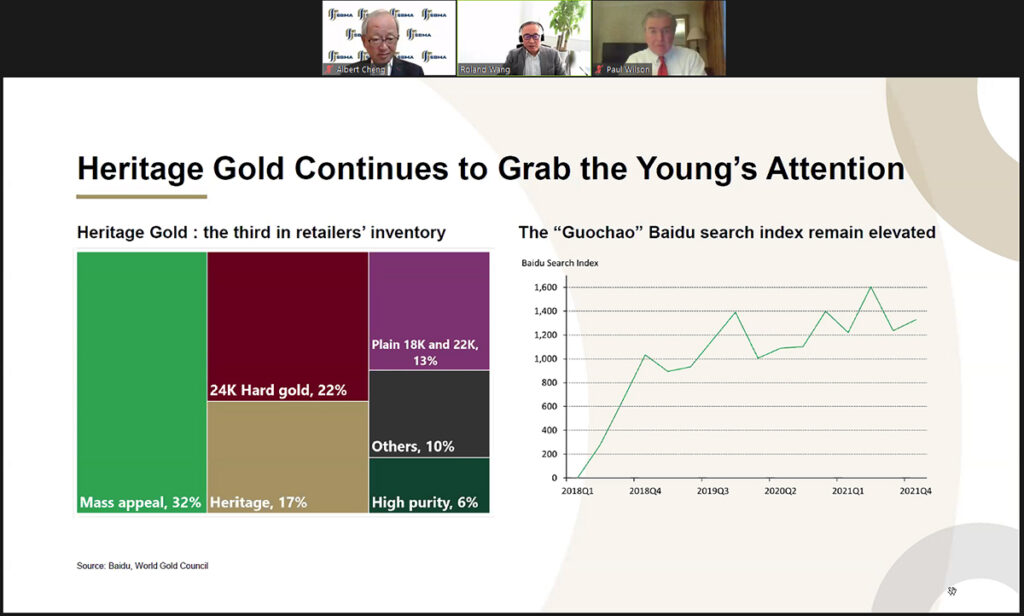

Similarly, Roland Wang, WGC’s regional CEO in China, said physical gold demand remains strong in the Middle Kingdom, despite lower trading volumes. He said demand has not been impacted by trading volume as they are driven by different groups of buyers.

Wang cited several key trends currently driving gold demand in China. First, the surge in popularity of so-called heritage gold, which has gained traction among younger consumers. The per-gram pricing method has helped improve pricing transparency and improved confidence among consumers. Young consumers, who recognise financial and investment value of gold jewellery, are also coming into the market, while strong sales during the Chinese New Year period have boosted industry confidence, Wang said.

In terms of driving investment demand, WGC is working with local stakeholders to improve investment demand and product innovation in the institutional sector. Several drivers exist for retail gold investment, including rising inflationary pressure, lower opportunity costs, increased uncertainties, and growing wealth management awareness among younger consumers, Wang said.

As such, Wang said demand outlook is “well above” pre-pandemic levels, and the industry is headed for a sustainable future. He said he has “full confidence” that there will be healthy demand again this year – likely two-digit growth, given trends seen in the first two months.

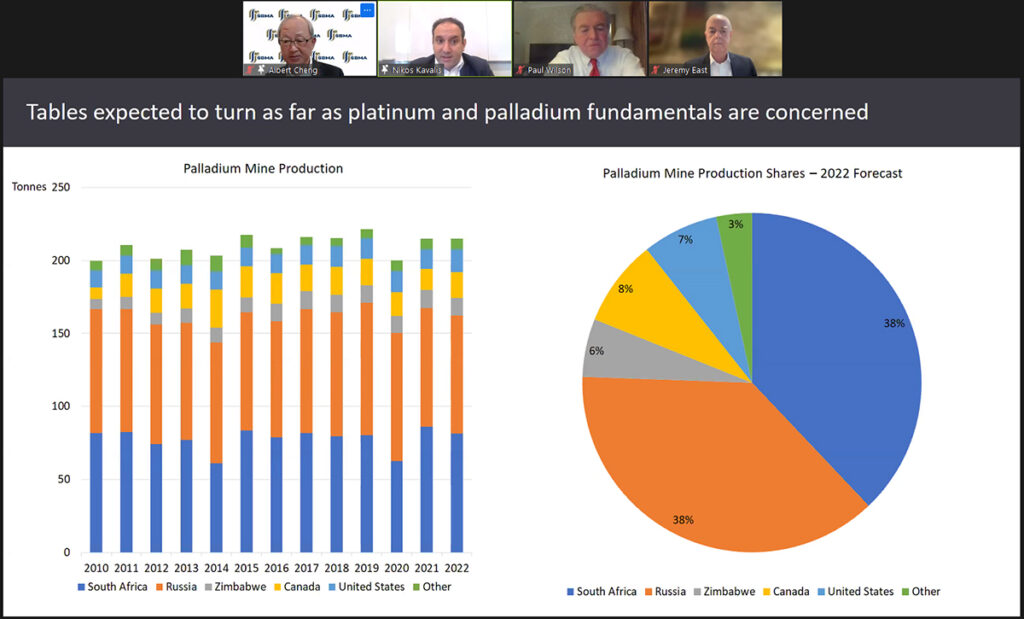

Paul Wilson, CEO World Platinum Investment Council, noted the “unusually higher demand” for investor interest in platinum. While the picture in 2020 was largely one of deficit because investment demand was high, there has been increasing supply over last two years, and mine supply recovered last year along with an increase in production, though supply is not expected to grow too much in 2022, he said.

Despite a chip shortage, there has been continued recovery in automotive market, so demand for catalysts has gone up, Wilson noted. There is “considerable” demand potential for platinum worldwide, including for heavy vehicle platinum loadings in China. Decarbonisation is also driving platinum demand, as the metal is an essential component in producing green hydrogen. “Once the market realises this, there will be booming exchange-traded fund (ETF) demand”, Wilson said

“The reality is that there is a tightness in the platinum market worldwide. Investment demand is expected to soak up excess supply. China is driving massive consumption in platinum. Going forward, times look pretty good”, Wilson said.

Nikos Kavalis, Metals Focus founding partner provided an outlook for the sector against the escalation of hostilities in Ukraine, which has catalysed a rapid rally across all precious metals. According to him, the war will have a short-term impact and the price of gold will eventually will return to hinge on macro factors, meaning liquidation and correction is expected.

Kavalis also pointed out that the rate of inflation, which has risen to multi-decade highs, and levels not seen since the 1980s, has had a muted effect on gold. He explained this to be because gold’s links with inflation is weak and inconsistent over time, and that the link is indirect and mainly seen through real rates and yields.

“The consensus that high inflation is transitory and will not last long. This has capped interest rates in gold”, he said. On the back of macroeconomic developments, robust physical investment expected to remain a theme in 2022, Kavalis added.

For silver, Kavalis said a transition is currently underway in the market – the silver market is moving from structural surplus to structural deficit over the coming decade. This is a result of industrial demand, particularly green energy and technologies, and an increase in the use of silver-bearing components in mobility. All this points to healthy growth in the years ahead and offers silver support going forward, he said.

“Once the dust settles, gold and silver will be supported due to adjustment of interest rate hike adjustments, which we believe has gone too far”, Kavalis said, adding that he will not be surprised if gold drops to less than 1,700 by the end of the year. “But case for diversification remains solid”, he concluded.