Japan’s Gold Market:

A Paradigm Shift

By Bruce Ikemizu, Representative Director, Japan Bullion Market Association

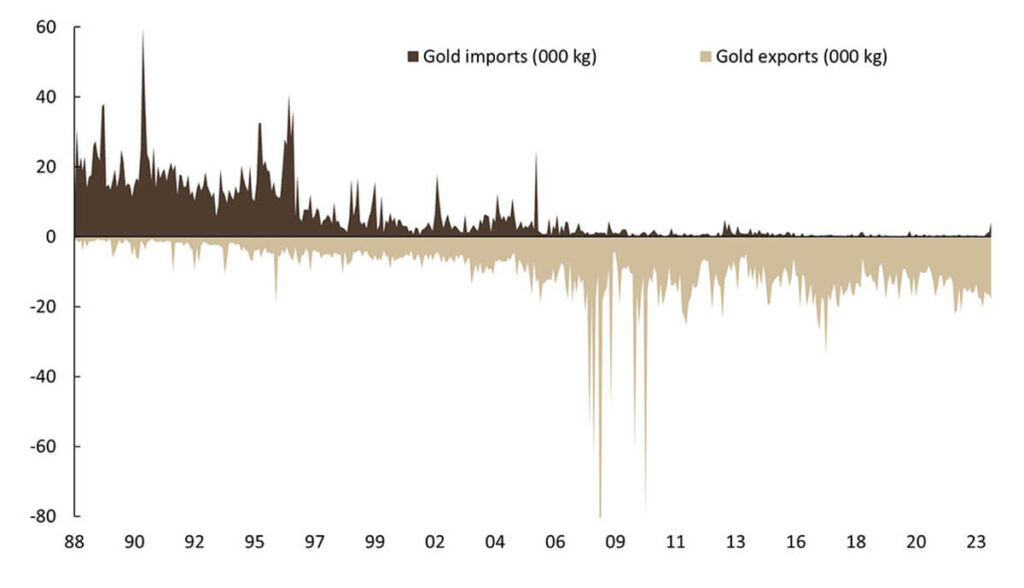

In the past, before China appeared on the world gold market, Japan stood as one of the largest gold importers globally. During the 1980s and 1990s, my primary role in physical gold trading at a trading house involved importing physical gold from Australia, Switzerland, London, South Africa and other sources. However, the dynamics of this business gradually shifted after the introduction of a consumption tax, and more dramatically after the bursting of Japan’s economic bubble after the 2000s, following which the country became a net exporter of the gold, marking a 180-degree turn in our business operations.

During my 14-year tenure at a Tokyo bank branch, we imported gold only once but exported it countless times, mainly to Asia and when demand waned in Asia, to London. The consumption tax, initially introduced in 1989 at 3%, escalated to 5% in 1997, 8% in 2014 and finally 10% in 2019. What does this have to do with gold investment? Well, when you purchase gold in Japan, you have to pay this tax, but you will get it back when you sell it as the tax should be borne by the person who consumes it. In theory, this consumption tax should not have a negative effect on gold investment. Instead, it has its advantages, as you can now receive 10% over the selling price, regardless of whether you paid 0%, 3%, 5%, 8% or 10% tax when you bought it.

However, this consumption tax had significantly different impacts on Japanese gold market. We did not fully comprehend its profound impact it on the market until perhaps the early 2000s. In contrast to the tax treatment of gold in foreign countries, such as Hong Kong, where there is no value-added tax on gold purchases, bringing gold from Hong Kong to Japan without customs declaration and selling it here would allow you to add the consumption tax on top of the price, now at 10%. A 10% profit on gold incentivised extensive smuggling by both individuals and large-scale criminal organisations. Long liquidation of gold at the higher yen price and smuggling were the two primary reasons behind Japan’s gold exports, despite having only one small gold mine that produces just several tonnes annually. The Japanese government eventually took strict measure to combat gold smuggling by customs and instructed business not to buy gold if they could not prove they had officially paid the consumption tax. Although smuggling still persists to some extent, we assume the volume is now lower than it was in the past, and its influence on the Japanese gold market is dinimishing.

Now, gold is garnering more attention in Japan than ever before. In 1971 when US President Nixon announced the detachment of the dollar from gold, the gold price started to float from $35 per troy ounce. 51 years after, gold reached $2,000 per troy ounce, marking a staggering 57-fold increase in value against the US dollar. As of the timing of writing this article, the gold price in US dollars hovers around $1,980 per troy ounce. This trend reflects a natural process, as governments of the world freely print the fiat money as they see fit, while gold supply is limited.

Figure 1: US Money Supply and Gold Price

By and large, the same thing can be said about gold in Japanese yen. However, gold in yen broke its historical high two years after USD gold did. This year, yen gold has broken its historical high multiple times, with the latest price,as I write this article, reaching 9,566 yen per gram. In 1971, gold in yen started around 250 yen per gram, so yen gold has appreciated approximately 38 times over.

Figure 2: Gold in Yen in the Past 54 Years

In the past, we observed significant selling of gold bars and jewellery whenever the price jumped by 500 yen per gram. There were long queues of sellers at the major retail shops. The reverse held true when market declined, with people lining up to buy gold. When I was trading on Tocom at a trading house many years ago, my simple yet consistently profitable trading strategy depended on Japanese investors’ tendency to hunt for bargains, as opposed to the Western investors’ trend-following style. When London and New York sold gold, causing prices to drop, Japanese investors entered the market to snatch up bargains, and vice versa when investors in the West bought and prices rose.

Figure 3: Japanese Gold Import and Export Balance

This bargain-hunting style of Japanese investors has been rapidly changing in recent years, even with the price of gold in yen has reached levels we never saw in the past. One might naturally expect a surge in selling from gold holders, but that is not happening with this sharply higher price level. For example, stronger prices had always attracted sellers at major retail shops, but nowadays, they report that sales and purchases are well balanced at their counters. In the realm of gold ETFs, holdings in the US and Europe had been decreasing, but in stark contrast, Japanese gold ETFs is continuously increasing its holding despite the historically higher prices.

There are couple of reasons for this new attitude toward gold:

- Investors’ generational shift

Older generations were the primary buyers of gold in the 1980s and 1990s, and even until a few years ago. However, now the older generation is exiting the scene, selling their gold, while a younger generation is entering the market. A decade ago, more than 90% of attendees at my investment seminar were older men and women. Especially after Covid, a much younger demographic, both men and women in their 20s and 30s, has become the majority. These younger investors have not witnessed a market where gold was priced around 1,000 yen per gram. Past price levels, which might have deterred older investors from investing at the current gold price, hold little meaning for the younger generation. - Continuing yen depreciation

This year, the Japanese yen began at 131 yen to the dollar and has since depreciated to 150 yen. The yen has devalued by approximately 8.7% against the US dollar. Combined with inflationary pressures, Japanese investors are increasingly concerned about holding yen in their bank accounts. While the safety of bank deposits has traditionally been the preference of older generations, just holding bank deposits is no longer a safeguard against the depreciating value of yen. More investors are now viewing gold as a hedge against inflation and yen depreciation. Investment in gold continues to rise despite higher prices. This new investment purpose effectively explains the trend of Japanese buying gold despite historically high prices.

Figure 4: Gold retail demand is increasing despite sharply higher prices

- Introduction of new NISA account

The NISA (Nippon Investment Saving Account) was introduced in 2014 following the English ISA model. Individuals who use NISA are exempt from paying the 20.315% tax on trading profits. This account, which has a limit of 1.2 million yen and a duration of 5 years, is set to end at the close of this year. The new NISA, which starts in 2024, will allow individuals to invest up to 18 million yen each, with no time limit. This reflects the government’s initiative to move funds from dormant bank deposits into investments. Many people had refrained from opening NISA accounts in the past, considering the limit too small and negligible. I was one of them. However, the new 18-million-yen limit with no time constraint changes the landscape entirely. More and more investors are now opening current NISA accounts as they can have both the 1.2 million and the new 18 million, preparing for the expanded framework starting 4 January 2024. The new NISA will include four gold, three platinum, two silver, one palladium and one precious metals basket funds. In addition to physical gold products, we can naturally expect more investment funds to flow into precious metals from Japanese investors. In fact, this trend is already underway with the Gold ETF, as most new investment in to it is coming from current NISA accounts. This trend is likely to gain momentum next year when the new NISA program launches with a significantly larger framework. The Japanese gold market is undergoing a paradigm shift.

Figure 5: Japanese Gold ETF balance – continuously increasing despite higher prices

MUFJ Gold & Platinum ETF Weight in grams

BRUCE IKEMIZU is the chief director of the Japan Bullion Market Association. He began his career at Sumitomo Corporation as a gold trader after graduating from Sophia University in 1986. He then worked for Credit Suisse and Mitsui & Co. before joining Standard Bank in 1996. He was the head of Tokyo branch of ICBC Standard Bank until leaving the bank in 2019. Bruce is currently using his knowledge and relationships within the sector to develop and grow the newly formed JBMA.