HISTORY OF GOLD IN AUSTRALIA & FUTURE TRENDS

By Nicholas Frappell, Global Head Institutional Markets, ABC Refinery

Australia’s relationship with gold began in the mid-19th century, marked by a monumental gold rush centered in the Victorian gold fields. This event fundamentally altered Australian society – an impact later historians deemed revolutionary.

The magnitude of this gold rush was only surpassed by California’s gold rush, which occurred roughly three years earlier. Economists, including British economist William Stanley Jevons, were skeptical about the value of gold-digging, viewing it as “almost a dead loss of labor as regards the world in general – a wrong against the human race”.

SOCIAL CHANGE

The gold rush not only brought prosperity but also ignited a rebellion among miners against British rule, an event commemorated by ABC Bullion’s “Eureka” minted coins and tablets. This period also catalyzed significant social changes that led to enhanced parliamentary democracy in Australia.

Additionally, this era marked the first significant collaboration between Australia and China in the gold sector, with over 30,000 Chinese miners participating in the rush. Some of their distinctive mineshafts are still visible in the countryside today, notable for being cylindrical, so that evil spirits would not be able to find a convenient corner to lurk in and then leap out to snare an unwary miner.

Gold production decreased after the fervor of the 19th-century gold rush subsided.

THE TWENTIETH-CENTURY BOOM

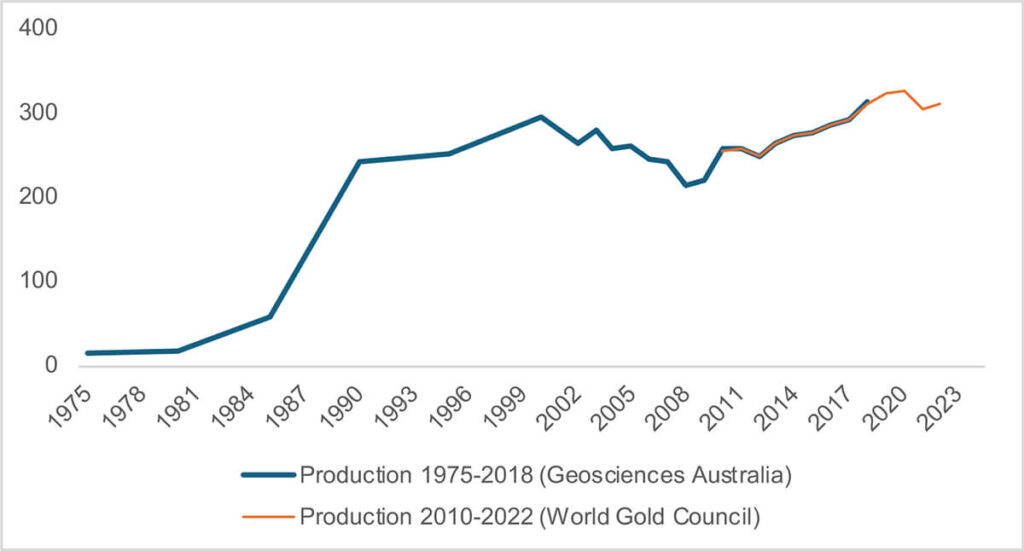

Australian Gold Production 1975-2022

The boom in gold production that began in the late 1980s continues to this day in Australia. This surge was accompanied by innovations in banking and risk management that allowed producers to secure capital through associated hedging. The 1990s are often seen as a golden era for banks providing facilities to miners, enabling them to sell their future production forward. This was encouraged by high nominal Australian yields, creating a favorable environment for selling forward production into a contango.

This period of innovation sometimes led to unforeseen financial exposures. As spot gold prices rose towards the end of the 1990s, some producers were harshly exposed, leading to a more cautious approach to hedging among producers seen today. Additionally, the belief that the bear market, which began in 1980, and ended with the start of the new century, influenced the industry’s strategies.

Australia now ranks as the third-largest gold producer globally, producing well over 300 tonnes annually, as per the latest World Gold Council data. Australian gold producers benefit from robust environmental protections, strong workplace and investor safeguards, and competitive all-in-sustaining costs (AISC). Geological surveys indicate substantial undeveloped gold reserves, suggesting a sustained future for the industry.

In an era where consumers are increasingly conscious of the impacts of extractive industries, Australia stands out for adhering to best practices in mining and processing ores. This, combined with positive domestic public sentiment towards gold mining and its benefits to local communities, positions Australia favorably compared to its global peers. The industry’s public support is crucial, as opposition can hinder the granting of new permits and the expansion of existing or development of new projects.

RETAIL INVESTMENT

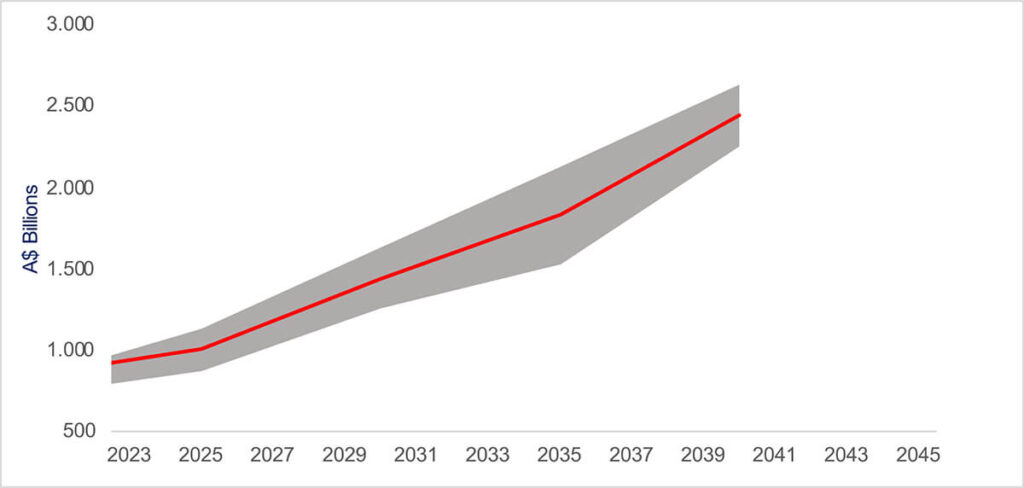

Projected Growth Self-Managed Funds 2023-40 in A$ Billions

FUTURE TRENDS

NICHOLAS FRAPPELL is the Global Head of Institutional Markets at ABC Refinery. He has extensive experience in precious metals trading, having worked in London, Tokyo, Singapore, Hong Kong, and Sydney. Nick holds a Master’s in Finance from the University of London and is the Chair of the LBMA membership sub-committee. He also co-hosts the ABC Refinery “Pod of Gold” podcast.

Read more: