Navigate

Article List

- SBMA News

By Albert Cheng, CEO, SBMA

- Gold Market Integrity: Advancing Global Standards

By Sakhila M. Mirza, Executive Board Director and General Counsel, London Bullion Market Association (LBMA)

- Shanghai Gold Exchange: Building a Better Future for the Global Gold Market

By Jiao Jinpu, Chairman, Shanghai Gold Exchange

- Feature | WGC – Year in Review

By Andrew Naylor, Head of ASEAN and Public Policy, World Gold Council

- Gold Investments During a Recession: Be Sure of What Lies Beneath

By Gavin Soon, Senior Sales Manager Asia, Hitachi High-Tech Analytical Science

- The Future of the Gold Investor

By Vikas Shenoy, Head of APAC Origination & Partnerships, InfiniGold

- Platinum Set to Soar

By Weibin Deng, Head, Asia Pacific, World Platinum Investment Council

- Further Upside for Precious Metals Prices in 2021

By Nikos Kavalis, Founding Partner, Metals Focus

- Improving Gold’s Physical and Digital Traceability

By Abhinav Ramesh, Founder, Chainflux

Article List

- SBMA News

By Albert Cheng, CEO, SBMA

- Gold Market Integrity: Advancing Global Standards

By Sakhila M. Mirza, Executive Board Director and General Counsel, London Bullion Market Association (LBMA)

- Shanghai Gold Exchange: Building a Better Future for the Global Gold Market

By Jiao Jinpu, Chairman, Shanghai Gold Exchange

- Feature | WGC – Year in Review

By Andrew Naylor, Head of ASEAN and Public Policy, World Gold Council

- Gold Investments During a Recession: Be Sure of What Lies Beneath

By Gavin Soon, Senior Sales Manager Asia, Hitachi High-Tech Analytical Science

- The Future of the Gold Investor

By Vikas Shenoy, Head of APAC Origination & Partnerships, InfiniGold

- Platinum Set to Soar

By Weibin Deng, Head, Asia Pacific, World Platinum Investment Council

- Further Upside for Precious Metals Prices in 2021

By Nikos Kavalis, Founding Partner, Metals Focus

- Improving Gold’s Physical and Digital Traceability

By Abhinav Ramesh, Founder, Chainflux

Further Upside for Precious Metals Prices in 2021

By Nikos Kavalis, Founding Partner, Metals Focus

Published on January 12, 2021

NIKOS KAVALIS is a founding partner of Metals Focus. He has over 17 years of experience in precious metals, having previously worked for the Royal Bank of Scotland and GFMS. Since September 2019, Nikos has been based in Singapore, where he also runs the local subsidiary of Metals Focus.

The outbreak of Covid-19 that shook the world in 2020 also had a dramatic impact on precious metals markets. Lockdowns around the globe hit key end-use sectors directly. The impact of the crisis on incomes and consumer sentiment further suppressed demand, especially for discretionary segments such as jewellery. Yet perhaps most importantly, the unprecedented fiscal and monetary policy response by authorities around the world fuelled price rallies.

As 2021 begins, it is clear that the pandemic will remain a problem to varying extents for much of the year. Even under the most optimistic projections for vaccine development and, more crucially, production, it will take months before a critical mass of the world’s population is vaccinated. Policy accommodation will also no doubt continue, providing much-needed support to troubled economies around the world.

GOLD

Last year, gold rallied to a new all-time high of $2,075 in early August and although the metal has since suffered liquidations, its price at the beginning of 2021 stood at over $1,900. Gold’s price strength was the result of strong buying by institutional investors over much of the year. This was in turn fuelled by safe haven interest and an increasingly bullish outlook for gold, owing to fiscal and monetary policy stimulus.

The jewellery industry was, in contrast, in dire straits for much of 2020. Retail demand was hit hard by lockdowns, reduced discretionary spending as a result of economic uncertainty, and rising gold prices. This was particularly true in Asia. Metals Focus’ full-year figures have not yet been finalised, however in the November edition of our Five-Year Forecast, we expected Asian jewellery consumption to fall by 35% in 2020. China and India, which historically accounted for as much as 60% of global consumption, were both forecast to decline by around 37%. Stronger physical investment (covering bar and coin demand) was expected to provide a small offset. This was centred on Western markets, where investor appetite was very strong, and in fact, volumes would have been even higher, were it not for restrictions and, at times, product shortages. East and South Asian countries were instead expected to suffer declines.

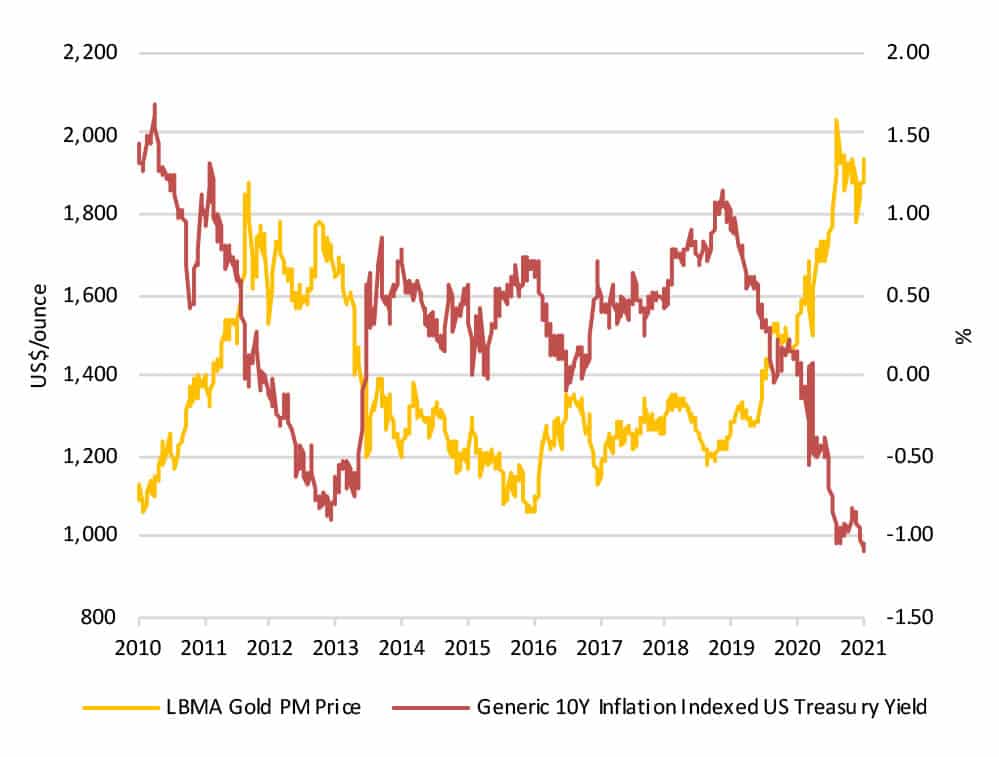

Turning to 2021, Metals Focus remains bullish towards gold. We are confident that as policy rates remain low and fiscal spending persists, inflows of institutional money into the yellow metal will continue. Low rates and yields are typically positive for gold, as they minimise the opportunity cost of holding the zero-yielding metal. Moreover, given exceptionally low yields (or, in other words, high bond prices), the effectiveness of bonds as a hedge against market turmoil, and in particular equity market corrections, is hampered as it becomes harder to see yields fall much more. This forces investors towards other portfolio diversifiers, something that should continue to benefit gold. Related to this point, policy accommodation has resulted in exceptionally strong equity market performance. While this has been a boon for investors, it also amplifies their need to diversify portfolios and gold will remain an instrument to do so.

Loose fiscal and monetary policy also creates future inflation risks. It is worth remembering here that this argument was instrumental in fuelling the gold price rally that followed the 2008 global financial crisis, only to be proven wrong later. In spite of this precedent, many investors feel that given the far more extensive stimulus provided during the Covid-19 crisis, the likelihood of inflationary pressures is much higher. As such, even though Metals Focus’ house view is that high inflation seems unlikely, we believe that the fear of it will continue to benefit gold over the next 12 months or so. Last but not least, we believe that the dollar will likely remain weak for some time, adding further price support. We therefore see gold once again breaking the $2,000 mark in the next few months and reaching new all-time highs later in the year.

Gold and Real US Treasury Yields

SILVER

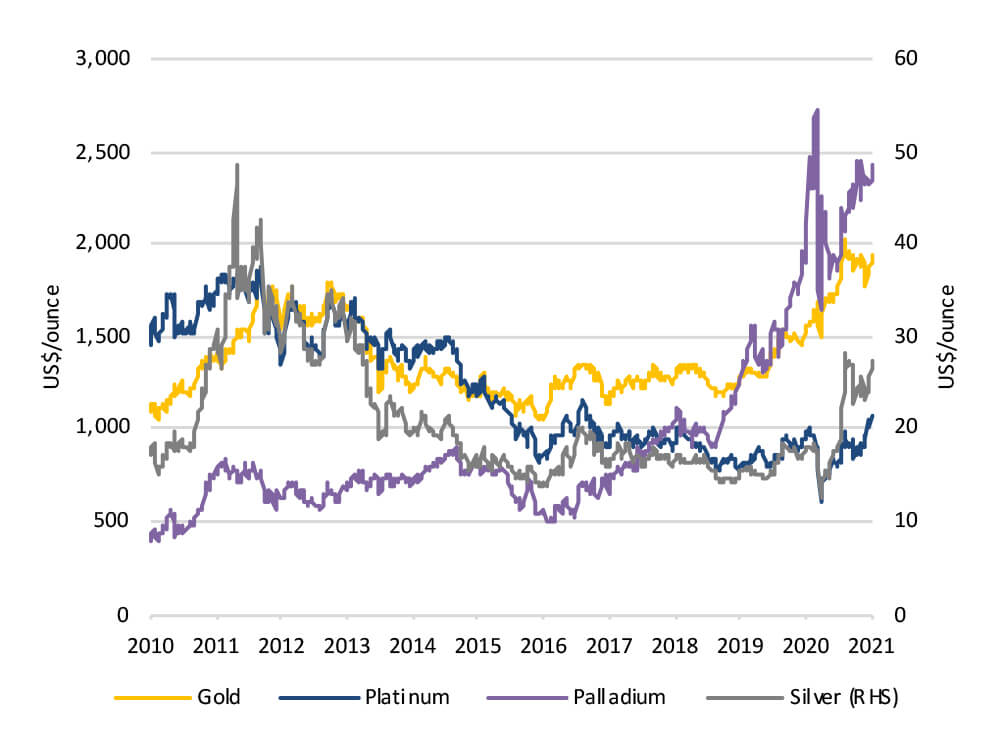

Over the first few months of the crisis, silver underperformed compared to gold. It was only during the summer, when gold’s rally gathered enough momentum to partially catch up. Investors became comfortable that the precious metals bull market was here to stay and thus moved into this more volatile metal. Stronger base metals prices and optimism towards silver’s use in green technologies also played a part in this.

Although the crisis did weigh on silver demand, it was less pronounced than for gold. This reflects silver’s lower reliance on price elastic and discretionary demand segments, being a largely industrial metal and with some offset from rising bar and coin demand in the West. Moreover, as Covid-related disruptions affected mine production, silver’s overall supply surplus in 2020 was little changed from the previous year. Having said this, looking at Asia in particular, the declines seen in Indian demand were material and often resulted in oversupplied market conditions during the year.

Looking ahead, we have little doubt that the drivers of gold demand will also boost silver’s appeal to investors. In addition, owing to its typically more volatile nature, we would expect silver to outperform gold overall in 2021, peaking in the high $30s before year-end. This is expected to drive the gold-silver ratio lower, from current levels around the 70 mark to the mid to low 60s. As far as the metal’s fundamentals are concerned, although an effectively full recovery for industrial demand and further growth in physical investment are expected, they will be largely offset by a rebound in mine supply, leaving the market with a significant physical surplus.

Precious Metals Prices*

PLATINUM AND PALLADIUM

In addition to the indirect impact of macro factors discussed earlier, platinum and palladium prices were impacted by dramatic swings in the two metals’ fundamentals in 2020. Both suffered heavy losses during the March economic meltdown and subsequently experienced sharp rebounds as news of supply disruptions emerged. From then on, platinum moved broadly in line with gold, until its recent decoupling when platinum avoided the investor liquidations that hit gold. Palladium meanwhile drifted modestly upwards, helped by improving demand conditions.

In addition to the Covid-19 crisis, platinum and palladium supply were impacted by disruptions to Amplats’ processing capacity. Coupled with Covid-related interruptions to South African mining operations, these resulted in double-digit declines across both metals’ mine production last year.

Demand was also hit by the pandemic. Platinum and palladium autocatalyst fabrication suffered double-digit losses due to the crisis’ impact on incomes and consumer confidence. For platinum, diesel’s market share losses, especially in Europe, added extra pressure. Higher PGM loadings in the automotive sector, due to tightening emissions standards, particularly in Asia, provided an offset.

Platinum jewellery demand fell by 13% in 2020, a far smaller decline than the one gold suffered. This partly reflected market share gains within China at the expense of the yellow metal. Except glass, all industrial demand segments for platinum suffered declines. Investment in contrast more than doubled, fuelled by lower prices. Demand for palladium from non-autocatalyst applications was also weaker.

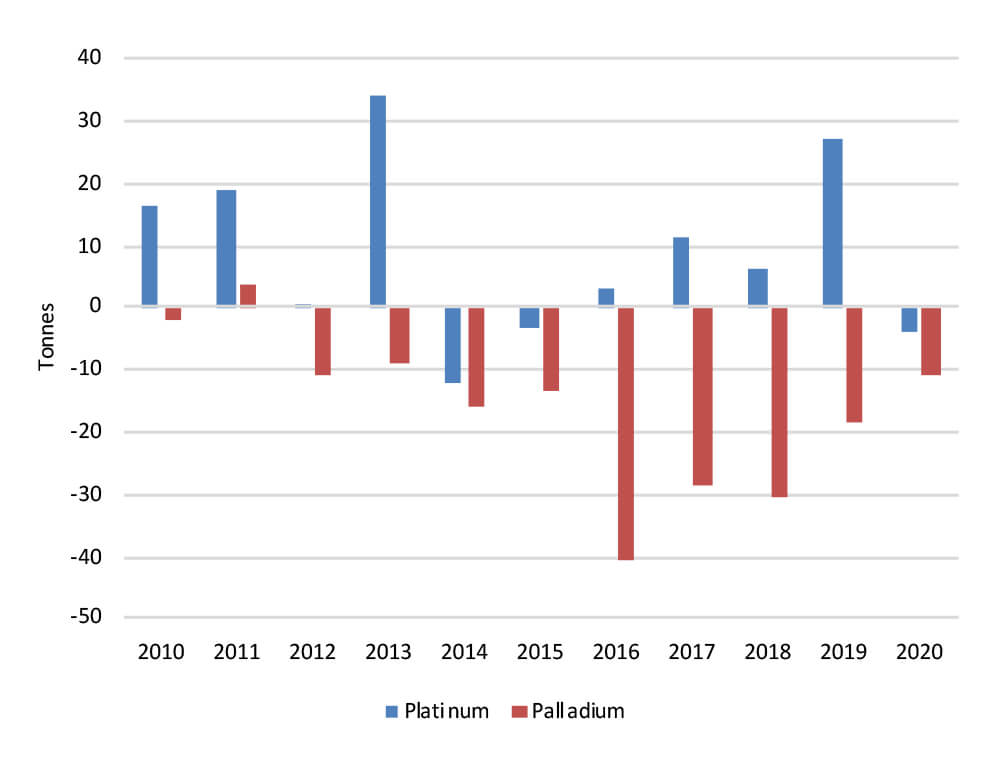

As a result of these forces, the platinum market moved into a deficit last year – its first since 2015. Palladium was also in deficit for the ninth consecutive year.

Platinum & Palladium Supply-Demand Balance

Looking ahead, while we forecast a recovery for mine production this year, we do not expect supply to return to 2019 levels for either metal. Moreover, South African production continues to face challenges, including risk of further disruptions to processing capacity and uncertainties over energy supply. As a result, there are downside risks to this forecast. Autocatalyst demand, meanwhile, is expected to reach a three-year high for platinum and a new all-time peak for palladium, as the impact of recovering vehicle sales is amplified by ongoing increases in PGM loadings. With a few exceptions, most other areas of platinum and palladium demand are expected to increase. Overall, we expect the platinum market to be almost balanced, while palladium will see its deficit grow.

Turning to prices, while we are generally constructive towards platinum for 2021 overall, we believe that a correction is likely in the near term. With Amplats’ Anglo Converter Plant partly operational, the recent market tightness should dissipate, and this is likely to weigh on the price. Later this year, however, tailwinds from a stronger gold price, supply concerns and stronger evidence of improving demand conditions should help platinum rally. Our bullish outlook for palladium is based on more traditional fundamental considerations. Limited above-ground inventories, coupled with a growing deficit, should see the physical market tighten, taking the metal’s price to new all-time highs.

NIKOS KAVALIS is a founding partner of Metals Focus. He has over 17 years of experience in precious metals, having previously worked for the Royal Bank of Scotland and GFMS. Since September 2019, Nikos has been based in Singapore, where he also runs the local subsidiary of Metals Focus.