ASIAN INVESTORS BUY INTO THE GOLD RALLY

By NIKOS KAVALIS, Managing Director, Metals Focus Singapore

RETAIL INVESTMENT DEMAND HAS BEEN ROBUST IN SPITE OF RALLYING GOLD PRICES

The past 12-18 months have been a remarkable time for the gold market. A positive macroeconomic backdrop for the metal has come together with heightened geopolitical risks and most recently concerns over US trade policy, to drive gold prices across all currencies through numerous all-time records.

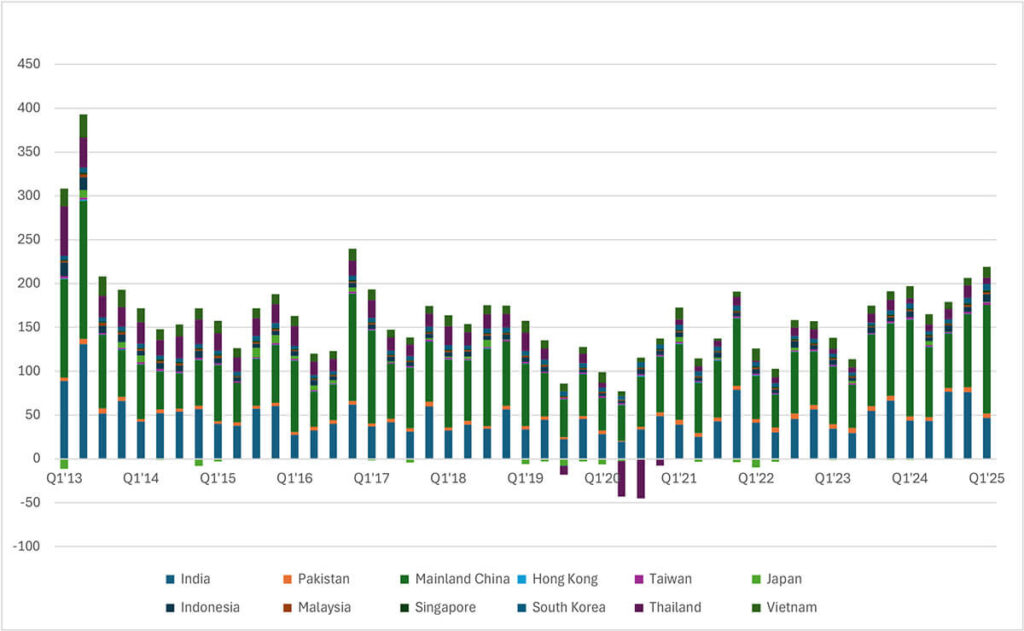

From an Asian perspective, this period has been even more interesting, as retail investor interest in gold bars and coins across most of the key markets in the region have remained robust. This challenges the traditional market perception, that Asian consumers typically buy on price dips and sell on rallies. To be clear, liquidations are clearly also happening and there is a very vibrant two-way market, however on a net basis demand has been healthy and, as one can see from the chart below, trending upwards for the past 12 months.

Chart 1 - Asian Retail Investment Demand - Tonnes

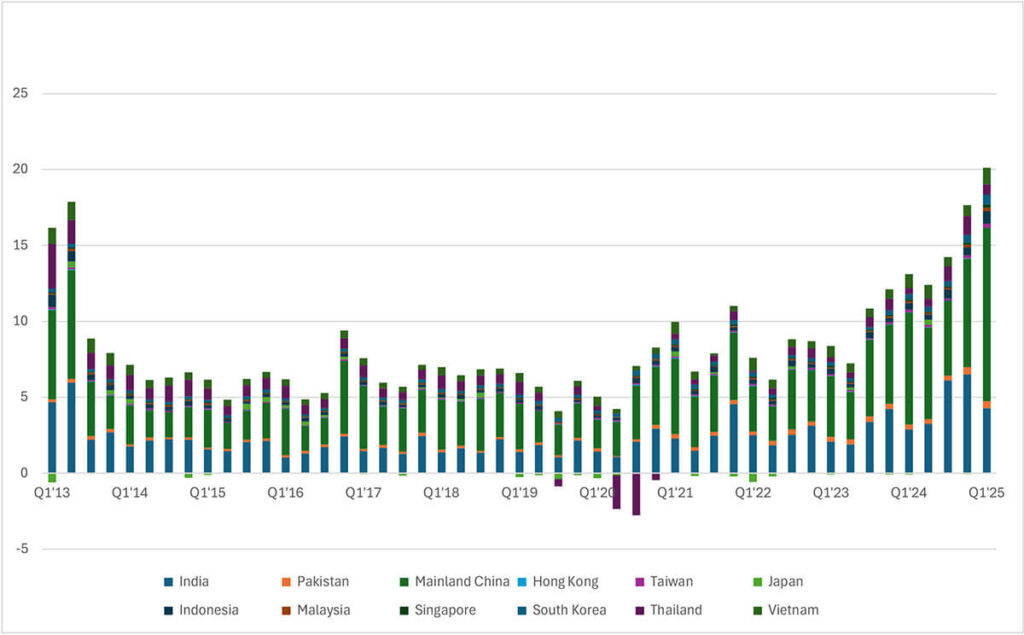

Looking at net investment in value terms, for simplicity simply converting volumes into their US dollar equivalent, paints an even more positive picture. As the second chart on this page illustrates, we have seen a remarkable increase in the amounts Asian consumers have invested in gold bars and coins over the past couple of years, even exceeding 2013 levels, a year when physical demand measured in tonnage terms reached all-time records.

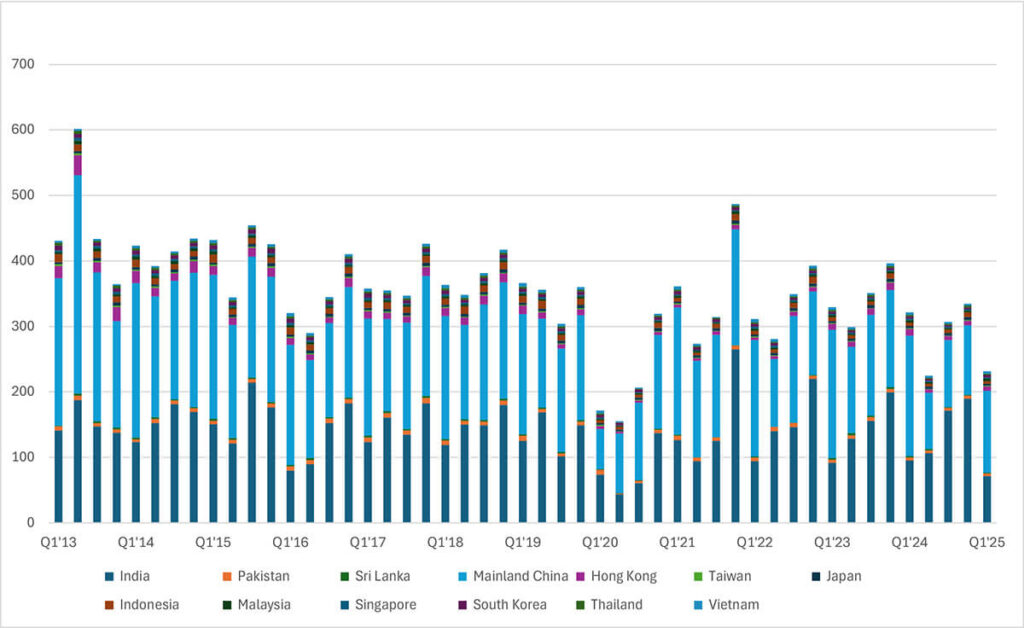

THE PICTURE IS LESS ROSY FOR JEWELLERY CONSUMPTION

Contrary to bar and coin demand from investors, jewellery consumption has come under significant pressure in Asia. This is not surprising – when buying jewellery, consumers tend to have a certain budget and as prices have been rallying this has naturally pushed the weight or volume of jewellery bought down.

Gold jewellery has also had to contend with adverse economic conditions and in some cases structural changes to markets. Global uncertainty and country-specific economic challenges have weighed on discretionary spending more generally and that has also affected gold. Meanwhile, in China, there has been a shift away from quasi-investment jewellery purchases to outright buying of investment products, such as bars and coins.

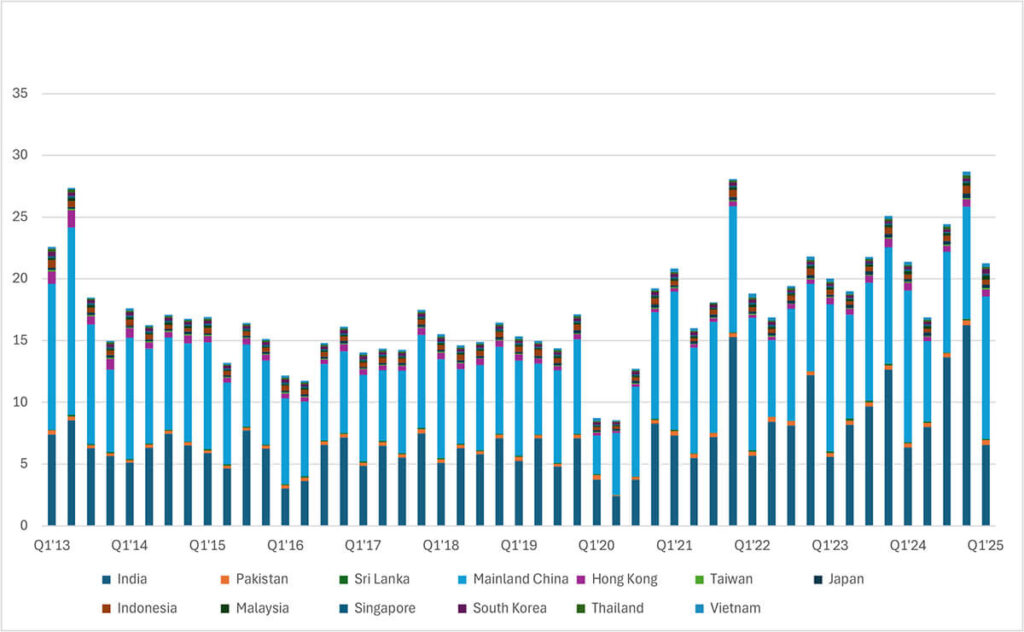

In spite of all this, until recently the decline in jewellery consumption had been contained. In fact, as the accompanying chart illustrates, Asian jewellery consumption in the fourth quarter of last year converted in US dollars was higher than during its peak quarter in 2013. The break-neck rally since the start of 2025 has pushed sales down further, as many consumers have held back purchases, but the amount of money the region spent on gold jewellery during the first quarter was still healthy compared to historical norms.

Chart 2 - Asian Retail Investment Demand - US$ bn

SUSTAINED BULL MARKET EXPECTATIONS GIVE INVESTORS COMFORT

In our view, these trends reflect the market consensus that gold is in a very strong and sustainable bull market. Under such conditions, the behaviour of Asian investors and consumers tends to shift. Instead of the selling into rallies, consumers buy into them, chasing the price higher. In part, this is driven by the comfort that, as the bull market continues, the value of their investments is safe and if anything will rise further. In part it is driven by the fear that they will miss out on the next leg of the rally.

This pattern is not unprecedented. We observed a similar behaviour by Asian investors during the 2010-2011 period, which was also a time when gold prices rallied through multiple, at the time, all time records. Back then, investors in many Asian markets, again bought into the rally, rather than capitalize on the high prices by selling off their holdings.

STRENGTH OF INVESTMENT DEMAND CONSISTENT ACROSS THE REGION

It has been particularly impressive that the health of physical investment discussed above has been noted virtually across all South and East Asian markets Metals Focus collects data for. Starting with the SBMA’s “core” sub-region, four of the five ASEAN markets we monitor have seen year-on-year gains in bar and coin demand for every single one of the previous five quarters. Even within the one that has suffered declines, Vietnam, our field research suggests appetite for gold is robust, however high premiums and limited product availability are an issue.

Chart 3 - Asian Jewellery Consumption - Tonnes

Demand in China, the world’s largest gold consuming market, has been buoyed by a bullish outlook for gold, concerns about the impact of tariffs on the local economy and a questionable outlook for local property and equity markets. In the first quarter of this year, retail investment demand in Mainland China reached its highest level since the all-time record we saw back in 2013. India has also been robust, with year-on-year gains seen in the past seven quarters. In addition to bullish price expectations and concerns about global uncertainties, most recently physical gold investment has benefitted from corrections in local equities and the Indian government having stopped issuing new Sovereign Gold Bonds.

The one market in the region where demand has been weak is Japan, where we have seen a mix of small net investment and disinvestment volumes in recent quarters. Even this, however, compares favourably with past behaviour in that country. It is worth remembering that during the previous bull market and into the 2011 peak, we had seen hefty and consistent liquidations, as investors took profits. Combining Metals Focus data with GFMS ones, there were nearly 270 tonnes of net sales over 2006-2011, averaging nearly 45 tonnes per annum. In contrast, on balance over the past 12-18 months the market has seen some small net buying, as a new generation of gold investors are drawn to its stellar performance.

APPETITE FOR GOLD LIKELY TO REMAIN STRONG IN THE NEAR FUTURE

Looking ahead, we believe retail investment for gold bars and coins in Asia will remain robust in the near-term. This resilience is underpinned by the ongoing positive macroeconomic and geopolitical backdrop, and lingering uncertainty surrounding US trade policy. All these factors, collectively, should contribute to a continued bullish consensus for gold.

Metals Focus’ projections see gains for retail investment across almost all markets in the region. We forecast that handful will enjoy the highest demand levels seen since their 2013 all-time records. This will include China and India, the world’s two largest gold markets. Combined investment demand from these two should exceed 600 tonnes this year, amounting for roughly half of the global total.

Chart 4 - Asian Jewellery Consumption - US$ bn

This forecast is premised on our still optimistic gold price outlook, looking for further price gains and new records being breached within 2025. In essence, we believe Asian investors will continue to buy into gold’s price strength.

However, even if our gold price projections are proven wrong and we instead see corrections, our outlook for Asian retail investment demand is still optimistic, at least in the near term. With macroeconomic, geopolitical and trade policy concerns unlikely to go anywhere, we would expect that lower prices would trigger bargain hunting purchases. We would not even rule out the possibility that demand is even stronger under such a scenario.

Nikos Kavalis is a founding partner of Metals Focus. He has over 20 years of experience in precious metals, having previously worked for the Royal Bank of Scotland and GFMS. Since September 2019, Nikos has been based in Singapore, where he also runs the local subsidiary of Metals Focus.

Read more: