PLATINUM CORNER

Platinum Essentials

Latest Update

November 2025

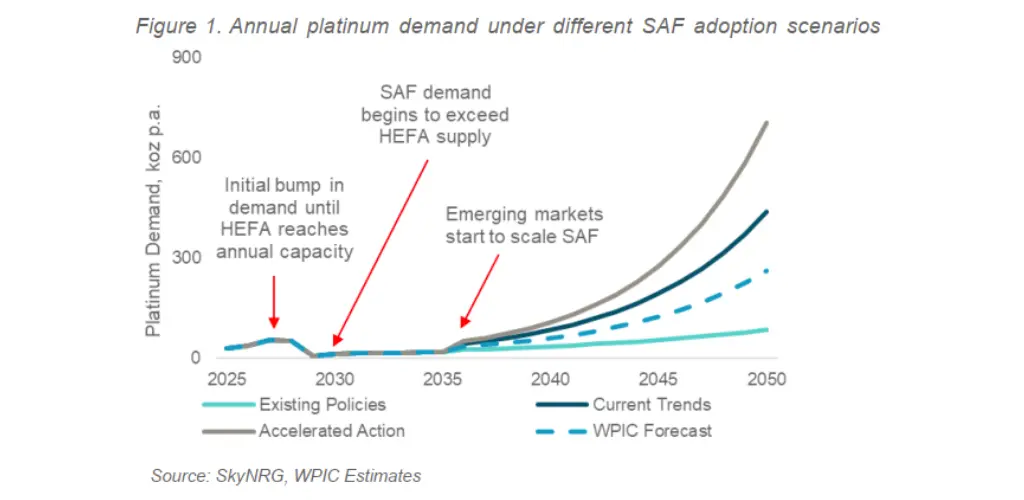

Sustainable Aviation Fuel (SAF) growth positions platinum as a key driver of the aviation energy transition

Aviation is a hard-to-abate sector, posing one of the biggest challenges to achieving net zero.