Navigate

Article List

- Chairman’s Foreword – A look back at 2016 and what’s ahead

By Sunil Kashyap, Chairman, SBMA

- Gold Market Outlook for 2017

By Nikos Kavalis, Director, Metals Focus

- Advancing Islamic Finance Through Gold

By Shaokai Fan, Director, Central Banks and Public Policy, World Gold Council

- Expanding Access to Physical Gold

By Martin Huxley, Managing Director, INTL FCStone

- Feature: Metalor Technologies Singapore Pte Ltd – Meeting Asia’s Precious Metals Demand

By Metalor Technologies Singapore Pte Ltd

- Singapore’s Listed Gold Plays

By Geoff Howie, Market Strategist, Singapore Exchange

- Creating New Markets, Enabling Accessibility: From Traditional to Digital

By Loh Mun Chun, Director, GoldSilver Central

- A Golden Resurgence: Re-establishing Singapore as Asia’s Precious Metals Hub

By Lester Lu, Divisional Director, Metals & Minerals, IE Singapore

- Developments in the LBMA Gold Price

By Matthew Glenville, COO, ICE Benchmark Administration

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Chairman’s Foreword – A look back at 2016 and what’s ahead

By Sunil Kashyap, Chairman, SBMA

- Gold Market Outlook for 2017

By Nikos Kavalis, Director, Metals Focus

- Advancing Islamic Finance Through Gold

By Shaokai Fan, Director, Central Banks and Public Policy, World Gold Council

- Expanding Access to Physical Gold

By Martin Huxley, Managing Director, INTL FCStone

- Feature: Metalor Technologies Singapore Pte Ltd – Meeting Asia’s Precious Metals Demand

By Metalor Technologies Singapore Pte Ltd

- Singapore’s Listed Gold Plays

By Geoff Howie, Market Strategist, Singapore Exchange

- Creating New Markets, Enabling Accessibility: From Traditional to Digital

By Loh Mun Chun, Director, GoldSilver Central

- A Golden Resurgence: Re-establishing Singapore as Asia’s Precious Metals Hub

By Lester Lu, Divisional Director, Metals & Minerals, IE Singapore

- Developments in the LBMA Gold Price

By Matthew Glenville, COO, ICE Benchmark Administration

- SBMA News

By Albert Cheng, CEO, SBMA

Metalor Technologies Singapore Pte Ltd – Meeting Asia’s Precious Metals Demand

By Metalor Technologies Singapore Pte Ltd

Published on March 9, 2017

The infrastructure for gold trading in Singapore has grown tremendously in recent years thanks to efforts by International Enterprise (IE) Singapore and SBMA. The establishment of Metalor’s fifth refinery in Singapore in 2013 has been crucial to the country’s ambitions of becoming a global precious metals trade hub. Crucible takes a look at the Swiss refiner’s operations here and speaks to its Refining Business Unit manager, KL Yap, to get an idea of Metalor’s role in the gold industry and the refining sector in Singapore.

Metalor Singapore, a 100% subsidiary of Metalor Technologies International SA, was established in 2013 as part of efforts by the Swiss refiner to supply precious metals to the burgeoning Southeast Asian market.

Founded in 1852, the private-equity controlled diversified industrial group in the precious metals sector is headquartered in Neuchatel, Switzerland and employs 1,500 people around the world. Its core businesses are recovery and refining, manufacturing electrical contacts, and manufacturing plating solutions and plating equipment. The group is present in 17 countries and operates 12 production facilities globally.

It chose Singapore to construct a gold refinery and bullion product manufacturing plant to meet the regional demand for gold, following efforts by the Singapore government and IE Singapore to position the country as a global trading hub for the physical trading of precious metals. Crucial in boosting trading was the Singapore government’s decision to remove the 7% Goods and Services Tax (GST) on Investment Precious Metals (IPM) in 2012.

As the only major gold refiner in the country, Metalor Singapore has a pivotal role to play in the city-state’s bid to become a precious metals hub for the region.

In June 2013, the Inland Revenue Authority of Singapore (IRAS) certified Metalor Singapore as an approved IPM refiner and producer. The same month, the new refinery cast its first kilo 99.99 bar.

Metalor is a Swiss-headquartered precious metals refining and speciality products group, with precious metals refinery facilities in Europe, United States, Hong Kong and Singapore.

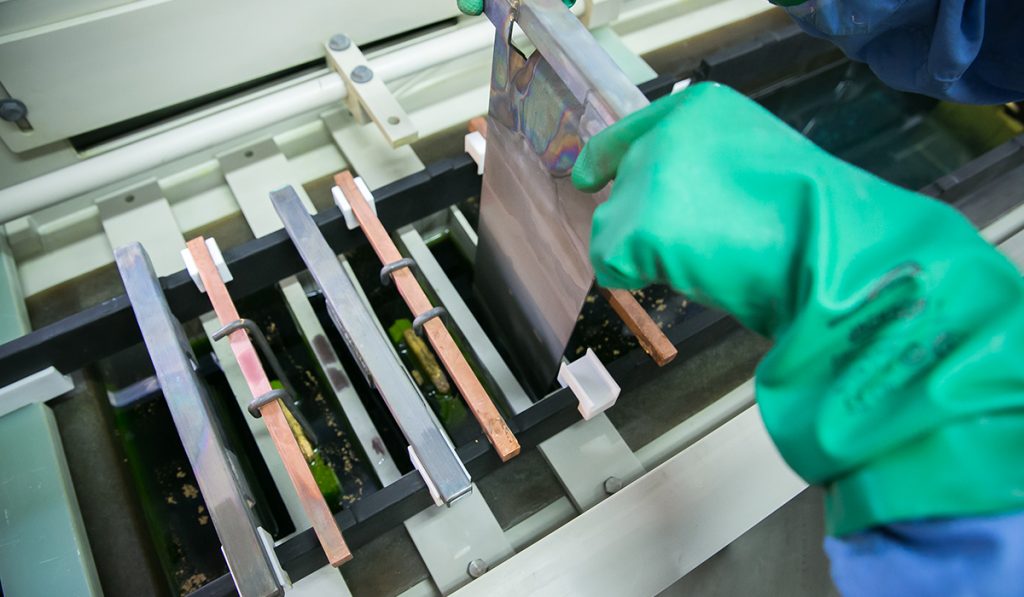

Metalor’s Operations in Singapore

Metalor Singapore focuses on gold refining of mine doré and the recycling of precious metal bearing scraps; recycling and upgrade of gold bullion; gold products for the jewellery, electronics and metal surface finishing industries; and gold bars. Its customers are mainly banks, bullion traders, scrap collectors and mines in Southeast Asia.

Metalor’s refineries worldwide have an annual gold refining capacity of over 800 tonnes.

Metalor’s gold refining methods include chemical and electrochemical refining processes. The company normally accepts the following goldbearing materials for refining to specified purities up to 999.9: semi-refined bullion, mine doré, old jewellery and industrial waste, jewellery manufacturers’ scrap and old coins and medals.

Metalor Singapore was added to Good Delivery List, a quality certification of the London Bullion Market Association (LBMA), for gold in July 2014, making it the largest LBMA-accredited refinery in Southeast Asia.

Takeover by Tanaka Kikinzoku Kyogo K.K.

In July 2016, Metalor announced that Japanese industrial group Tanaka Kikinzoku Kyogo K.K. was acquiring 100% of the shares of Metalor Technologies International SA.

The precious metals manufacturer develops and sells products containing precious metals materials for the electronics, semi conductor and automotive industries.

The acquisition will allow Metalor to enlarge its product and service offerings to customers globally. For Tanaka Kikinzoku Kyogo K.K., combining the operations of both companies will allow it to expand its recovery and refining business into new geographic regions in which it has not established a base, including North America, Europe and Asia. This will also increase the sales of its products and services to Metalor’s blue-chip customers.

“The synergy behind the takeover of Tanaka is the complementary nature of both companies in terms of geographical fit and complementary business. Tanaka Group is a reputable player in Asia whilst Metalor has a strong presence in Europe and the Americas. Together with Metalor, The Tanaka Group will become one of the Tier One precious metals companies in the World. Metalor will continue to operate under its own brand name and the management of Metalor will continue to run the company”, Metalor Group director Frank Tanaka and CEO Philippe Royer said in a joint statement.

Refineries on the LBMA Good Delivery List have to be financially viable and meet rigorous production standards of refining and assaying.

Metalor Singapore: Quick Facts

All gold and silver bullion products, all mining dorés, all jewelry scraps, all fusible industrial scraps.

3.0 tonnes/week.

4.0 tonnes/week.

Electro-refining

Hydro-metallurgical refining

Silver doré refining

Fire assay below 99.5%

ICP assay above 99.5%

1kg bar 99.99

100g bar 99.99

400oz London Good Delivery bar

Responsible Jewelry Council – Certificate of Conformity

LBMA Good Delivery status

Metalor Technologies Singapore Pte Ltd

Surface Engineering Hub

8 Buroh Street #01-06

Singapore 627563

Tel: +65 6586 3333

Email: sales.sg@metalor.com

Web: www.metalor.com

Why did Metalor choose to set up its fifth gold refinery in Singapore?

The country is strategically situated in Southeast Asia and is between the gold trading supply chain of India and China; hence our Singapore refinery enables bullion traders in Asia to be more cost efficient.

How does Metalor Singapore see its role in building the country’s role as a precious metals trading hub?

It is vital for IE Singapore to continue its lobbying and close collaboration with SBMA to identify and implement initiatives toward achieving this goal. One of them might be spearheading discussions with Singapore’s national airline to be competitive in terms of freight rates for the import and export of bullion products, which will significantly improve the overall cost efficiency in the current gold ecosystem.

How do you see regional demand and Metalor’s operations in Singapore evolving in the next few years?

Gold is a safe haven and relatively stable investment, so the demand coming from Asia, with an expanding middle class, will also grow. With our current annual gold refining and production capacity of about 150 tonnes to 200 tonnes, Metalor will continue to serve as one of the key precious metals solution providers in Southeast Asia for many years to come.

— KL Yap, Refining Business Unit Manager, Metalor Technologies

* This article was published in partnership with Metalor Technologies Singapore Pte Ltd

Nikos Kavalis is a founding partner of Metals Focus. He has over 13 years of experience working as a metals analyst/strategist for the Royal Bank of Scotland in London and as a metals analyst for GFMS. Nikos holds a BSc in Econometrics and Economics from the University of York and MSc in Econometrics and Mathematical Economics from the London School of Economics.