Navigate

Article List

- Vietnam’s Gold Market

By SBMA

- What is Hallmarking and Why is it Important?

By Ng Siew Hua, Chief Assayer, Singapore Assay Office

- Bullion’s Appeal to Singapore’s Mass Market

By Ernest Kwek, Executive Director, SK Bullion

- Meeting the Needs of Gold Investors Today

By Ryoichi Seki, General Manager, Global Business Development, TOCOM

- Demystifying London’s Gold & Silver Vault Holdings

By Neil Harby, Chief Technical Officer, London Bullion Market Association

- Modernising Gold & Silver Markets with LMEprecious

By William Fyfe, Head of Singapore, London Metal Exchange

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Vietnam’s Gold Market

By SBMA

- What is Hallmarking and Why is it Important?

By Ng Siew Hua, Chief Assayer, Singapore Assay Office

- Bullion’s Appeal to Singapore’s Mass Market

By Ernest Kwek, Executive Director, SK Bullion

- Meeting the Needs of Gold Investors Today

By Ryoichi Seki, General Manager, Global Business Development, TOCOM

- Demystifying London’s Gold & Silver Vault Holdings

By Neil Harby, Chief Technical Officer, London Bullion Market Association

- Modernising Gold & Silver Markets with LMEprecious

By William Fyfe, Head of Singapore, London Metal Exchange

- SBMA News

By Albert Cheng, CEO, SBMA

Vietnam’s Gold Market

By SBMA

Published on September 25, 2017

Vietnam, a country of 93 million, is one of Asia’s fastest growing economies. In the past few decades, a shift to a mixed economy and a construction boom has contributed to rapid economic growth, though the Vietnamese government still holds a tight rein over major state sectors, including the gold market.

Background

Gold has played a historically important role in Vietnamese life and the country’s economy. In the 20th century, Vietnam experienced war, high inflation, economic instability and currency devaluation. As a result, Vietnamese gold still has the status of a physical currency to a certain extent, and it the preferred investment asset class among the population.

Before 1975, gold was used as a medium of exchange and a unit of measurement. In the 1960s, a Honda Cub motorbike was priced to 3 taels of gold, and the monthly salary of senior government official was pegged to 2 taels of gold (1 tael = 37.5 grams).

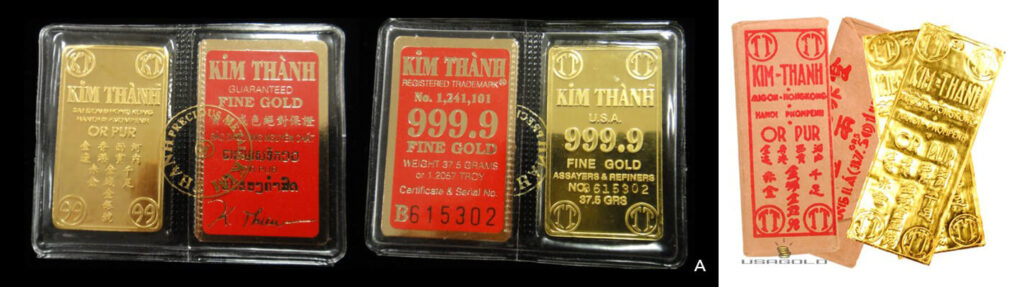

Kim Thanh was a famous refiner and bullion deader in Southeast Asia before and during the Vietnam War (1 Nov 1955 to 30 April 1975). Its gold bars (1 tael, with 99.99% purity) were used as a means of exchange and a store of value. After the Vietnam War, Kim Thanh gold bars, or Swiss bars, were portable assets for the Vietnamese boat people and other refugees.

The period after the Vietnam War was a time of hyperinflation, and double-digit inflation was common from 1975 to the early 1990s, reaching its peak in 1986 (875%). In the late 1980s to the early 1990s, real estate, motorcycles, televisions, livestock and even agricultural products were priced and traded in gold. However, as inflation eased in the early 2000s, gold’s exchange and price measurement functions gradually decreased, alongside the use and exchange of the Kim Thanh gold bar.

Currently, SJC gold bars dominate the market in Vietnam. According to Vietnam Gold Consultants Vice Chairman Mr Huynh Trung Khanh, SJC has produced 20 million gold bars to date.1

Development of the gold market since 1986

The development of the Vietnamese economy began with the introduction of Doi Moi, or “Renovation”, in December 1986. The set of economic reforms aimed at transforming Vietnam’s centrally planned economy into a market-driven one with a socialist orientation.

The early 1990s witnessed the first wave of foreign direct investment (FDI) into Vietnam, which pushed its GDP to 8-9% by the mid-1990s. In 1997, the currency crisis hit Asia hard, particularly Thailand and Indonesia. Vietnam suffered less than its neighbours as the country’s financial market was not open to foreign countries. The damage in Vietnam was limited to a 4% fall in GDP in 1999.

In the 2000s, FDI flowed back into Vietnam. This pushed GDP growth above 8% in 2005, a level that was maintained for three years, while FDI grew by 8.5%, exceeding US$20 billion in 2007. Economic growth created a new-found appetite for investment among the Vietnamese. Gold, real estate and stocks became popular asset classes for investments.

In relation to the regulation of gold, the government abolished all administrative licensing for the management of gold trading activities in 1999, and the following year, the State Bank of Vietnam, the country’s central bank, allowed credit institutions to mobilise gold in term deposits along with Vietnamese dong deposits guaranteed by gold. Besides that, the import of gold was permitted in 2001.

In 2005, the Finance Ministry reduced the import tax on gold bars from 1% to 0.5%, and the following year, the Central Bank approved margin trading on domestic and foreign gold.

In 2007, the Asian Commercial Bank opened leveraged gold trading facilities, and many banks followed suit in opening similar trading facilities. However, while this increased gold imports, it also increased the country’s trade deficit.

In June 2008, the government decided to stop the import of gold. However, this created a surge in gold prices and resulted in more parallel imports. In November 2009, the government resumed gold imports, which resulted in a sharp drop in reserves.

The gold market today

After years of active and free trading, particularly from 2008 to 2010, the central bank decided to take actions to cool the gold market. It issued control measures, which included the closure of more than 20 gold trading floors.

The market has been stable since the Vietnamese government issued a decree in 2012 to enable the central bank to directly intervene in the gold market, effectively making the State Bank of Vietnam the sole controller of gold trading in the country. The new rules meant that only companies with a minimum capital of 100 billion Vietnamese dong, annual tax payments of 500 million dong, and branches in a minimum of three provinces would be allowed to trade gold and import gold bars. However, this put many small gold traders out of business. The number of gold traders fell from over 10,000 to around 2,500.

Some credit institutions and jewellery manufacturers had to close as a result of the new rules, which stated that a credit institution must have a charter capital of at least 3 trillion dong, be registered for gold bar trading, and be based in at least five provinces and municipalities. In order to qualify as a gold jewellery manufacturer, the company must be lawfully established, possess a business registration certificate to make gold jewellery, and have the necessary production facilities and equipment.

According to information found at the State Bank of Vietnam website, the gold market is still tightly controlled, and there is not much freedom to import and export gold.1 The Vietnamese government is solely authorised to produce gold bullion, and it is also the only entity authorised to import and export raw gold for bullion production. Companies can import raw materials used in gold jewellery production, but this requires a license from the central bank, which is also required for trading gold bullion in Vietnam.

The following list of prohibited acts was published in Vietnam Law & Legal Forum magazine on 27 April 2012:

Prohibited acts in gold trading under Decree No. 24/2012/ND-CP of April 3, 2012

- Producing gold jewellery and art craft without a certificate of business legibility granted by the State Bank;

- Trading in gold bars; or importing or exporting gold material without a State Bank license;

- Individuals bringing gold upon entry or exit in excess of prescribed limit without a State Bank license;

- Using gold as a means of payment;

- Producing gold bars in contravention of this Decree;

- Engaged in other gold trading activities without the Prime Minister’s permission and a State Bank license;

- Violating this Decree and other related laws.

The decree created problems for local gold jewellery manufacturers as they could no longer import gold. The central bank later permitted a few firms to import gold materials under their strict supervision, but as yet no gold import quota has been granted.

Despite the strict rules governing the gold trade, there is no shortage of imported gold bars in the market as there is a “healthy underground market” for gold from Cambodia, Laos and China, with a higher premium of US$40/troy oz. Additionally, while the gold retail distribution network has changed superficially on the surface, the core business remains strong – 10,000 gold shops operate in the country, selling gold chi rings over the counter and gold tael bars under the counter.

Summary

On the surface, the gold market in Vietnam is highly regulated, with the State Bank of Vietnam controlling nearly all aspects of gold trading and manufacturing. However, the market is still strong, with a physical demand of 85 tonnes of gold per year, and a potential Gold Mobilisation Plan of 500 tonnes minimum in the pipeline. Additionally, the future Vietnam Gold Exchange has a large trading potential, seeing that daily margin trading volume already reached 2 million ounces in 2008.2

Sample SJC bars

Sample SBC bar

Sample SJC bars

Economic data (2015)

Population: 92 million

GDP Growth: 6.7%

GDP/P: US$2,036

CPI: 0.6%

Exports: US$162 billion

Imports: US$166 billion

Foreign Reserves: US$34 billion

Foreign Debt: US$39 billion

Units of gold trading in Vietnam

10 chi = 37.5 grams = 1 tael

5 chi = 18.8 grams

2 chi = 7.5 grams

1 chi = 3.8 grams

½ chi = 1.9 grams

Notes

- Current regulation on gold can be found at the State Bank of Vietnam website (www.sbv.gov.vn/webcenter/portal/en.home)

- http://asiapacificpmc.com/presentation/10_khanh.pdf