Navigate

Article List

- Asia, Australia and Gold

By Nicholas Frappell, General Manager, ABC Bullion

- LMEprecious – New Opportunities for the Asia Pacific Precious Metals Market

By David Mears, Assistant Vice-President, Precious Metals Market Development, London Metal Exchange

- Building a Belt and Road Gold Corridor in Asia

By The Chinese Gold & Silver Exchange Society

- Working Together to Achieve the Mutual Benefits in the Golden Era

By Wang Zhenying, President, Shanghai Gold Exchange

- INTL FCStone – Supporting the Bullion Market’s Growth in Asia

Feature: INTL FCStone

- Transforming India Gold Market

By Sameer Patil, Head – Business Development, BSE

- Canada’s Mining Finance Ecosystem a Model for Late-Cycle Precious Metals Capacity Expansion

By Bart Melek , Director and Global Head of Commodity Strategy, TD Securities

- Bridging Gold and Cryptocurrency

By Richard Melbourne, Head of Member Services, Kinesis Money

- SBMA News

By Albert Cheng, CEO, SBMA

Article List

- Asia, Australia and Gold

By Nicholas Frappell, General Manager, ABC Bullion

- LMEprecious – New Opportunities for the Asia Pacific Precious Metals Market

By David Mears, Assistant Vice-President, Precious Metals Market Development, London Metal Exchange

- Building a Belt and Road Gold Corridor in Asia

By The Chinese Gold & Silver Exchange Society

- Working Together to Achieve the Mutual Benefits in the Golden Era

By Wang Zhenying, President, Shanghai Gold Exchange

- INTL FCStone – Supporting the Bullion Market’s Growth in Asia

Feature: INTL FCStone

- Transforming India Gold Market

By Sameer Patil, Head – Business Development, BSE

- Canada’s Mining Finance Ecosystem a Model for Late-Cycle Precious Metals Capacity Expansion

By Bart Melek , Director and Global Head of Commodity Strategy, TD Securities

- Bridging Gold and Cryptocurrency

By Richard Melbourne, Head of Member Services, Kinesis Money

- SBMA News

By Albert Cheng, CEO, SBMA

LMEprecious – New Opportunities for the Asia Pacific Precious Metals Market

By David Mears, Assistant Vice-President, Precious Metals Market Development, London Metal Exchange

Published on June 4, 2018

David Mears provides an update on London Metal Exchange’s LMEprecious one year after its launch, and explains what he sees as opportunities for the Asian market as volumes grow.

London Metal Exchange (LME) launched LMEprecious, which offers loco London spot pricing, together with daily and monthly futures for both gold and silver, in July 2017 in response to market demand and in close consultation with key precious metals stakeholders. This suite of exchange-traded and centrally cleared precious metals products delivers greater choice for market participants and modernises the gold and silver markets to better reflect the needs of global players in precious metals markets.

To develop LMEprecious, LME worked with a group of leading industry participants who were committed to providing a London based centre of liquidity, reinvigorate the market, and remove barriers to trading based on counterparty credit lines and establish transparency in a forward curve that stretches out to five years.

For many banks in particular, this provides significant capital savings, operational efficiencies and streamlined trade reporting.

Volume and Open Interest

LMEprecious launched on 10 July 2017 and by the end of 2017, the LME Gold contract had seen 1,989 tonnes of gold traded, making LME the fourth-largest global gold futures exchange for that period. Silver also saw strong volumes with 14,870 tonnes traded in 2017.

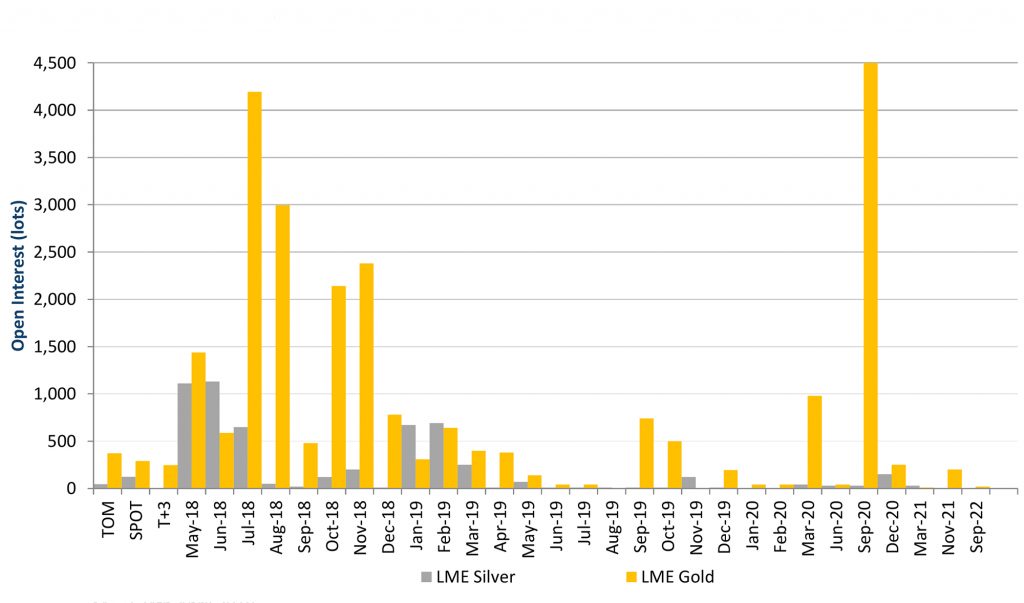

The growth of open interest (OI) has been an equally impressive story, with LME Gold and LME Silver at 30,000 lots and 5,000 lots (93t and 777t) respectively in the first four months of 2018 (Figure 1). The ability to trade liquid on-screen monthly contracts across the curve has seen considerable longer-dated open interest OI develop, with approximately 80% of OI beyond the first monthly date and significant OI out as far as 3.5 years forward.

The rapid establishment of trading volume and open interest serves to validate the drivers behind the contracts and demonstrates the commitment of the market to trade on-exchange and clear centrally.

Figure 1: LMEprecious open interest

Opportunities for the Asian market as LMEprecious volumes grow

Loco London gold remains an integral part of global physical bullion trading. Most loco swaps are priced relative to loco London (loco London +/- USD per ounce) and many end users utilise loco London accounts to manage their bullion trading and hedging.

LMEprecious provides an additional deep source of liquidity to hedge outright loco London risk. On-screen spot liquidity is impressive with at least 100 lots of spot gold both sides and top of book consistently 20c wide. There is also a 60% margin offset between gold and silver for those who have exposures in both metals.

The benefits of trading on-exchange and clearing centrally, as outlined earlier, translate into deep liquidity on-screen right out to five years forward. This creates a vital source of liquidity for market participants looking at curve dynamics and opportunities further out. Indeed we have seen trades executed on-screen out to 3.5 years forward.

LMEprecious also offers a closing price curve each day based on trading activity on LMEselect, providing a transparent forward curve for the market. Feedback from a range of precious metals market participants across the value chain – including producers, refiners, banks and financial institutions – has been very positive.

Another key benefit for the Asian market is the increased transparency that LMEprecious provides. Real-time prices are available via the major market data vendors, and from this summer the data will be freely available on LMElive – LME’s own market data platform. This means anyone around the world will be able to have free access to real-time spot order book data and a streaming forward curve out to five years on their desktop or mobile device!

This is hugely valuable to market participants whether they are traders, producers or consumers looking to hedge, roll positions and manage risks.

The increasing internationalisation of the gold market also provides trading opportunities for market participants looking to manage basis risk or take a view on regional supply and demand dynamics. To this end LMEprecious provides a transparent, liquid, on-screen solution to trade in combination with other exchanges across the globe. Some brokers are already offering margin offset against gold positions traded on other major exchanges.

A golden era for global bullion trading

In response to client demand from Asia, in June 2018, LME will launch a liquidity provider programme to cover the period from 1 00 a.m. to 8:00 a.m. London time. Increasing liquidity during this crucial period crystallises many of the benefits described above for the Asian market; indeed most other exchanges see a significant share of trading during this time window.

Further ahead this year, LME will be looking to improve access for registered intermediating brokers (RIBs), notably offering system access so they can broker trades for clients and members on an anonymous basis and enter trade details.

Next on the agenda this year is trade-at-settlement functionality. This will constitute separate order books to allow buyers and sellers to match and trade at (or at a number of ticks above or below) a yet to be defined LME settlement or reference price. After this, LME is expected to launch gold and silver options, and then platinum and palladium futures in 2019.

David Mears is an Assistant Vice-President in the Precious Metals Market Development team at the London Metal exchange. He previously worked as an Associate Director in Commodities Sales at Standard Chartered Bank covering the precious metals clients globally. He has a BA in Chinese and Economics from London School of Oriental and African Studies (SOAS).

Alex Shaw is responsible for the development of the LMEprecious product suite and the LBMA Platinum and Palladium Price Discovery Process. Prior to joining the LME, he was a Strategy Consultant at Monitor Deloitte, where he led projects across financial services. Alex started his career with Accenture and Korn Ferry. He holds an MBA from INSEAD and an MA (hons) from the University of Cambridge.