Gold and ASEAN

Introduction: ASEAN Region

The launch of the ASEAN Economic Community (AEC) on 31 December 2015 was a major milestone in ASEAN’s regional economic integration agenda and the next stage of the organisation’s evolution, which began in 1967 with five-member countries. It is now collectively the 7th largest economy in the world in terms of GDP (US$2.4 trillion) and has a population of 625.5 million.

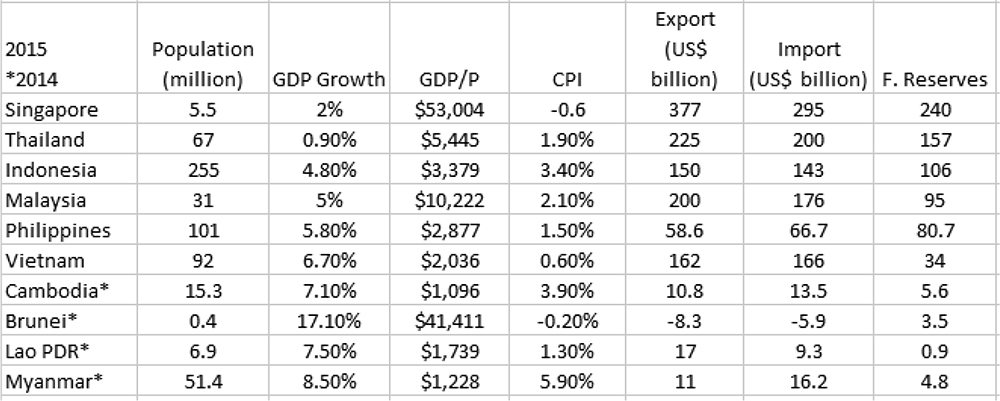

Further infrastructure development commitments made under the ASEAN Free Trade Area (AFTA), such as the East-West Economic Corridor connecting the Greater Mekong sub-region, and the North-South corridor linking China with Southeast Asia, together with development of key sea ports will increase import and export opportunities for ASEAN countries, and will allow ASEAN to become a major production and distribution hub. Besides, ASEAN itself is a huge consumer market, with a middle class that is growing along with its economy, and as a consequence wealth accumulation among this demographic will also increase (Table 1).

ASEAN’s Gold Market

Gold has played a very important role in the region and is closely connected with the life and culture of the people in the region. In some countries, gold is seen as more stable than the national currency, and people often use it as a medium of exchange and a unit of measurement. In general, people in this region like to buy gold jewellery, not only for use as accessories or gifts for cultural or religious ceremonies such as weddings, festivals and other special occasions, but also as a storage of wealth. In rural areas, people often convert their excess money into gold, and store it for a rainy day. People can re-sell the gold to jewellery shops when they need money, or visit pawn shops for short-term borrowing. Besides the demand for jewellery, political and global macroeconomic uncertainty are prompting people to invest in gold, and is pushing the demand for physical gold, such as bars or coins. Additionally, dinar coins are well-received by a couple of countries as a form of savings, and are even used as a medium of exchange.

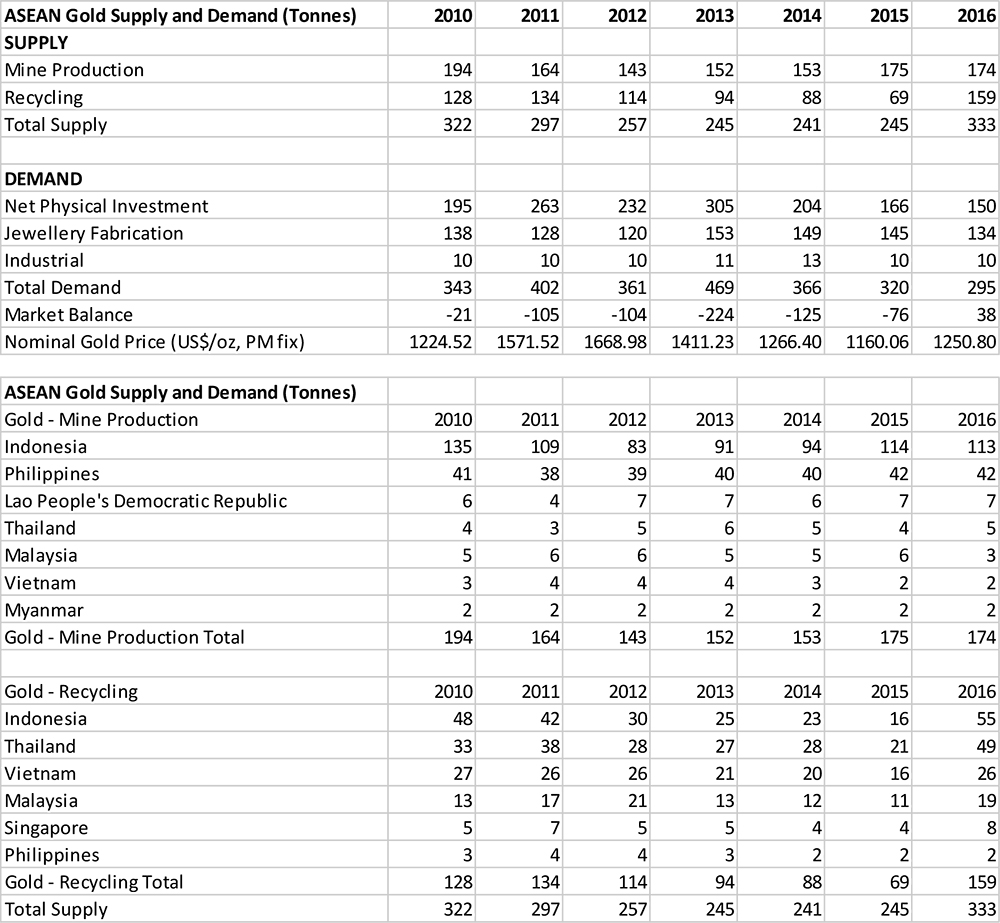

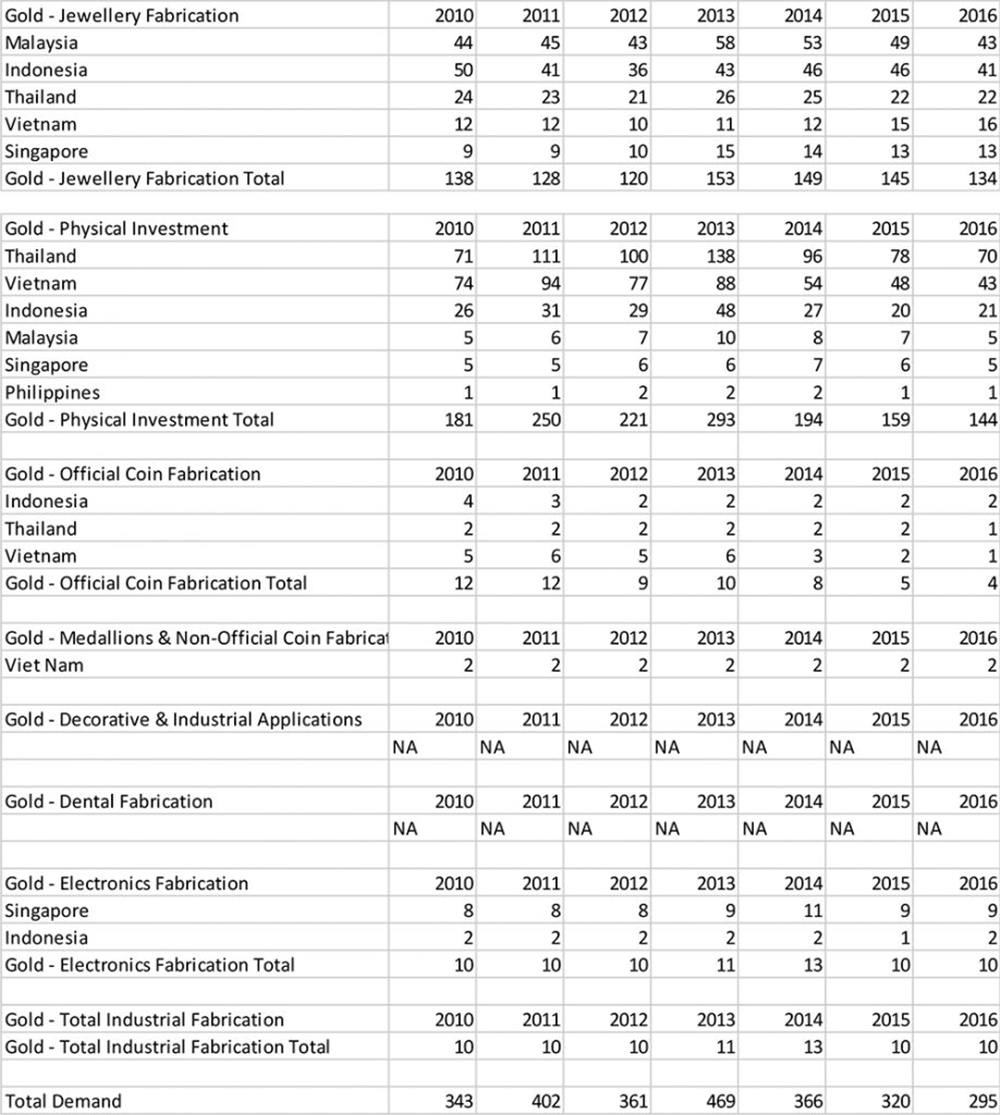

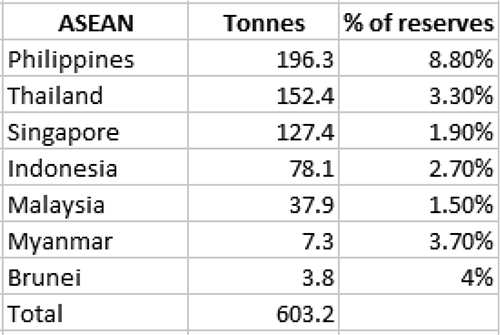

ASEAN does not only comprise gold importing nations, but also includes nations that export gold collected as scrap or from the by-product of mining, though gold mines are located only in a few countries (Table 2). According to Metal Focus, in 2016, ASEAN’s total demand for gold was 295 tonnes, and its total supply was 333 tonnes. In addition, ASEAN central banks hold gold as a part of their reserves. The official gold holding in ASEAN is 603 tonnes (Table 3).

New Demands and Participants

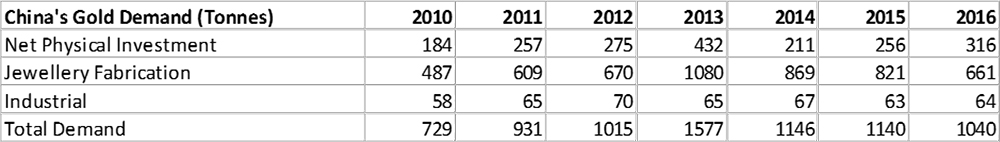

- China began liberalising gold transactions, including jewellery, in 2001, ending the state’s monopoly of the gold sector. The Shanghai Gold Exchange was established in 2002 by the People’s Bank of China (PBoC), and it is now the largest physical gold exchange in the world. PBoC also has the fastest growing official gold reserves in the world. In 2005, it developed trading infrastructure for individual investors. China’s gold demand was 1,040 tonnes in 2016 (Table 4), or about 31% of total global demand.

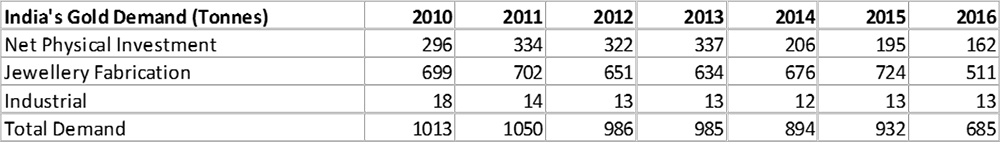

- India’s demand in 2016 was 685 tonnes (Table 5), or about 21% of total global demand.

- The introduction of Shari’ah Standard on Gold, which sets out clear guidelines for Islamic investment in gold, is expected to spur the development of new investment asset classes, and Islamic banks and other financial institutions should be able to expand their customer base with new products created under the guidance of the standard. This has the potential to make Malaysia a gateway to ASEAN for Islamic investments from the Middle East and the rest of the Islamic world. Bank Negara Malaysia, the country’s central bank, has a history of studying gold circulation in the Middle East as the region has a history of accepting gold as money.

India’s free trade agreements (FTA)

Gold jewellery imports from ASEAN to India have surged as a result of the India-ASEAN FTA, which came into effect in 2010. Gold jewellery imports under the India-ASEAN FTA face 1% import duty, as opposed to 10% under the normal trade channel.

Uncertainty of the international monetary system

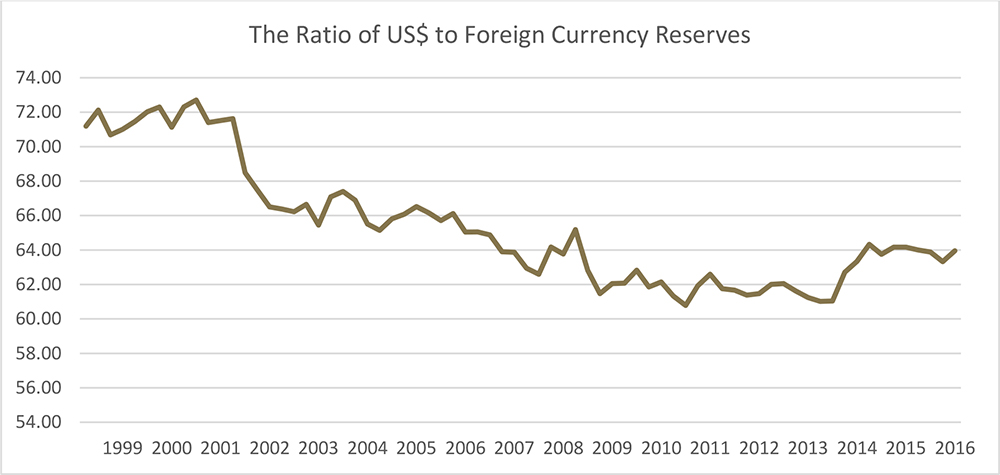

According to the International Monetary Fund (IMF), the ratio of US dollars to foreign currency reserves in each country/region at the end of March 2014 was 60.9% ($3.76 trillion of $6.18 trillion). The ratio has experienced a long-term downward trend since its peak of about 73% in June 2001 (Chart 1). The total reserves of ASEAN currently stands at US$727.5 billion (Table 1).

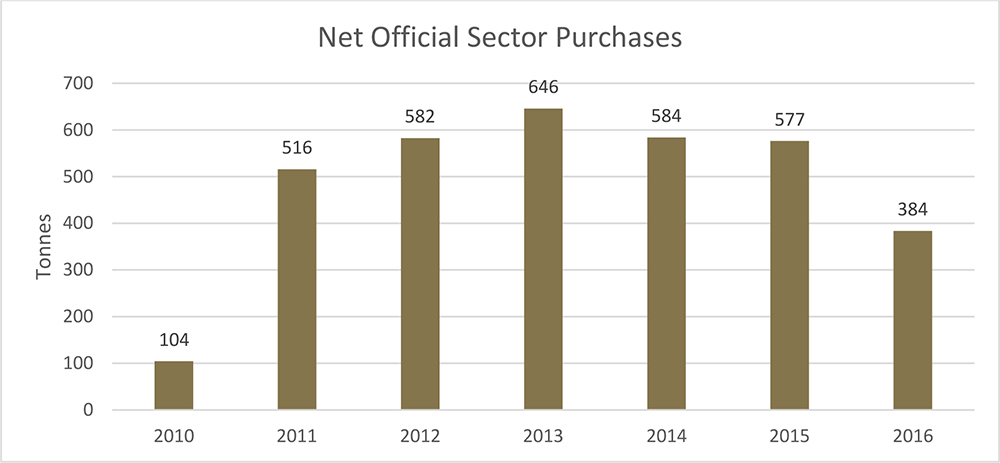

Uncertainty in the international monetary system is creating more demand for gold from central banks. Net official sector purchases have been positive since 2010 (Chart 2) and the total holding has increased by 3,393 tonnes in seven years. Additionally, the self-centred behaviour of certain developed countries is creating more uncertainty in global currency markets.

A new generation of gold investors

Gold has become more popular among the younger generation of folk who are always connected to the internet, and this is no different in Southeast Asia, where mobile phone penetration is almost 100%. Online gold trading is gaining traction among this group of investors, who see gold as an instrument to generate income and wealth.

Sovereign wealth funds and pension funds

The increasing income of the middle class is prompting the development of social security systems such as pension funds and social insurance. As a result, the diversification of such portfolios into different asset classes, including precious metals, is becoming more common.

Gold is currently not a popular asset class among institutional investors in ASEAN, except for central banks, which buy gold as a part of their reserves. However, the pension fund system in some countries, such as the Central Provident Fund in Singapore, has approved exchange traded funds (ETF) as an asset class to diversify their portfolio into gold, with a limit of 10% of the total assets.

Currently, many pension fund assets are managed and invested in their respective local markets. The total asset size of major sovereign wealth funds and pension funds in ASEAN was US$1,111 billion (Table 6).

Summary

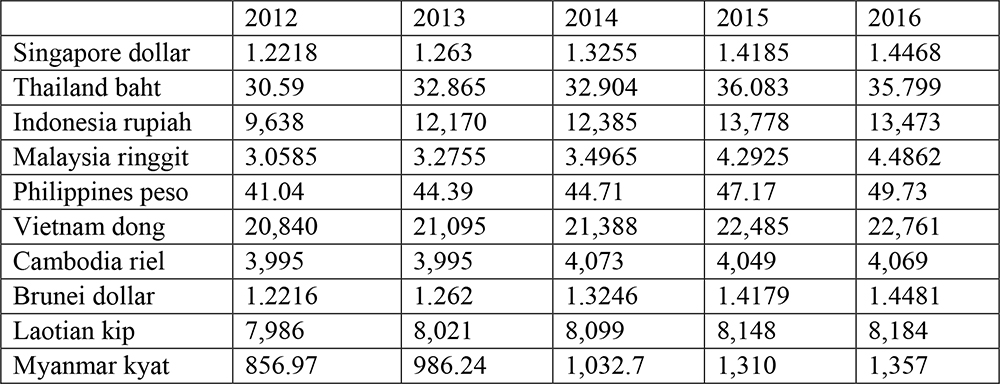

Growing demand from Southeast Asia is moving physical gold from West to East. Increasing wealth and disposable income among the growing middle-class population in ASEAN is also creating a huge consumer market for lifestyle products and consumer goods, which extends to jewellery, gold and financial products like insurance policies or investment funds. Gold is rooted in the life and culture of people in the region, and these factors, along with the introduction of Shari’ah Standard on Gold, weak local currencies (Table 7), and uncertainty over international currency markets should increase the total demand for gold going forward. Additionally, the growth of pension funds and sovereign wealth funds, and the need to diversify assets will lead to the growth of gold as an important asset class in these funds.

Notes

- http://www.gic.com.sg/report/report-2015-2016/investment-report.html

- https://www.cpf.gov.sg/Assets/common/Documents/ViewAnnualReport2015inPDF.pdf

- http://www.temasekreview.com.sg/overview/portfolio-highlights.html#sector

- http://www.kwsp.gov.my/portal/ms/web/kwsp/home

- http://www.thestar.com.my/business/business-news/2016/11/26/a-giant-awakens/

- https://www.pwc.com/gx/en/deals/sovereign-wealth-investment-funds/assets/sovereign-wealth-investment-funds-league-table.pdf

- http://www.khazanah.com.my/Our-Performance/Finance-Highlights

- http://www.kwap.gov.my/EN/OurPerformance/Pages/FinancialHighlights.aspx

- http://www.sso.go.th/uploads/eng/files/SSF_01%2010Q4_Eng.pdf

- https://www.gpf.or.th/eng/invest_growth.asp

- http://www.bpjsketenagakerjaan.go.id/assets/uploads/tiny_mce/Annual%20Report/16012017_093528_IR%20BPJS%20Ketenagakerjaan%202015.pdf

- http://www.taspen.co.id/?page_id=422

- https://www.malaysiakini.com/news/328312

- http://www.asabri.co.id/asset/images/media/large/annual_report_2015.pdf